August 16, 2023: As per an order issued by J&K Housing and Urban Development Department (HUDD), the last date for payment and collection of property tax in municipal corporations and other municipalities and filing of returns for the present financial year has been extended till August 31, 2023. According to the Daily Excelsior.com, a final decision on changes in formula for levy of property tax in J&K and reduction in factors will be taken shortly. The Jammu and Kashmir property tax is calculated considering nine factors. The government is working towards simplifying this and including around four factors so that the tax calculation and payment is user-friendly.

“In exercise of the powers conferred by section 143 A of the Jammu and Kashmir Municipal Corporation Act, 2000, the Government hereby directs that in proviso to rule 5 of Jammu and Kashmir Property Tax (Municipal Corporation) Rules, 2023, for the figures and words ‘July 31, 2023’ the figures and words ‘August 31, 2023’ shall be substituted,” mentioned the order issued by Prashant Goyal, principal secretary, HUDD.

“In exercise of the powers conferred by section 71A of the Jammu and Kashmir Municipal Act, 2000, the Government hereby directs that in proviso to rule 5 of Jammu and Kashmir Property Tax (Other Municipalities) Rules, 2023, for the figures and words July 31, 2023,” the figures and words ‘August 31, 2023’ shall be substituted,” a related order read.

Under Rule 5, a person who has to pay property tax has to submit all property details and tax in Form-1 by May 30 of the financial year to which the return is related. Along with this, a proof of payment in Form-2 and acknowledgment of filing of return shall be in Form-3.

This is the second time the HUDD has extended the property tax payment. Earlier, in June 2023, it had added a proviso to Rule 5 of the Jammu and Kashmir Property Tax (Municipal Corporation) Rules, 2023 and extended the date for property tax payment to July 31, 2023.

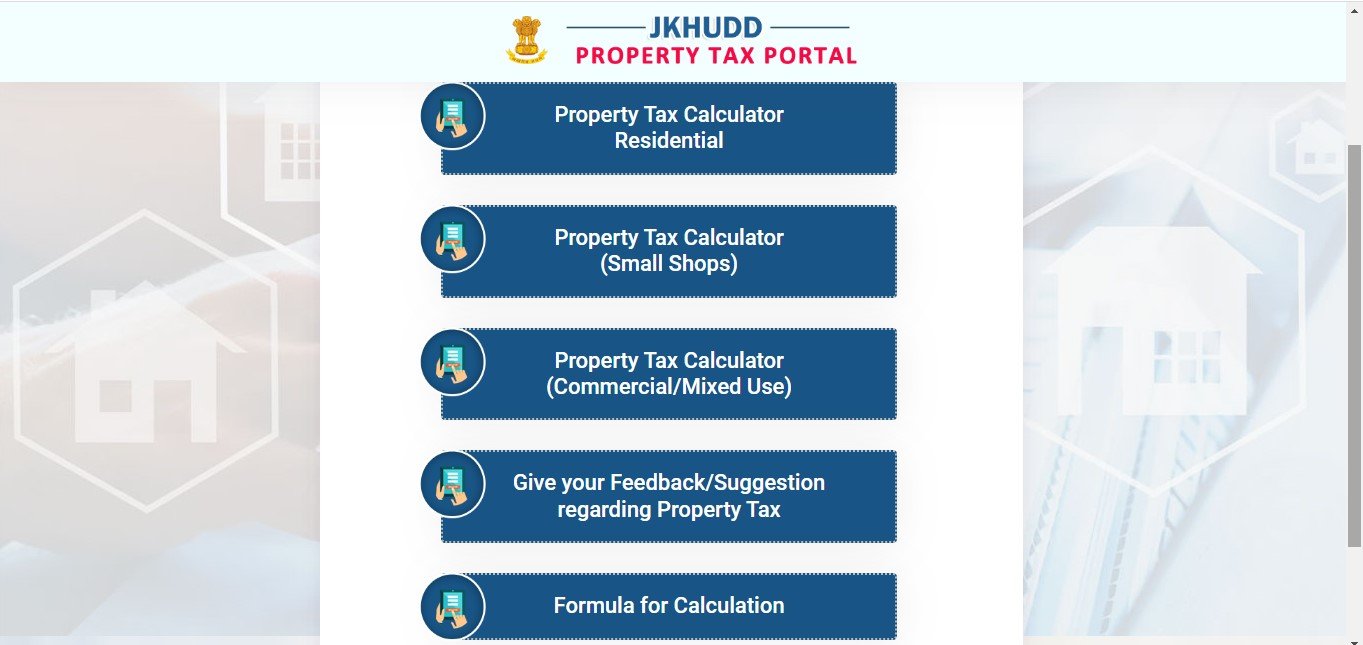

Property tax Jammu and Kashmir can be paid online by visiting https://propertytax.smcsrinagar.in/

J&K to levy property tax from April 1, 2023

The Jammu and Kashmir administration on February 21, 2023, notified imposition of property tax in municipal areas of the union territory (UT), starting April 1, 2023, on all lands and buildings.

“In exercise of the power conferred by Section 71A of the Jammu and Kashmir Municipal Act 2000, the government hereby notifies the rules for levy, assessment and collection of property tax in the municipalities and municipal councils of the Union Territory,” said H Rajesh Prasad, principal secretary, housing department in a notification.

Jammu and Kashmir property tax rates

Property tax rates for residential properties will be 5% of taxable annual value (TAV). 6% of TAV will be charged for commercial properties in the UT. A property’s TAV is decided based on factors, including municipality type, land value, floor, area, usage, age of the property, slab, usage type and occupancy.

Jammu and Kashmir property tax exemption

“As per the new tax formula, residential houses in J&K with an area of upto 1000 sqft will be exempted from paying property taxes. Residential property with built up area upto 1500 sqft are also discounted ensuring relief for LIG and MIG category residential houses,” mentioned Prasad to media persons.

There will be no property tax levied on the vacant lands, not appurtenant to a structure or building if construction on such lands is not allowed or put to agricultural use. All places of worship, cremation and burial grounds will be exempted from property tax. Also, all properties owned by the government will be exempted from paying property tax. However, they have to pay a service charge of 3% of TAV to the municipality.

The property tax will hold true for a block of three years unless a revision in calculation is introduced based on circumstances mentioned in the Act. So, the first block of property tax calculation that starts from April 1, 2023, will hold true till March 31, 2026.

People liable to pay the property tax will have to submit property details and pay the first installment by May 30, FY24. The second installment of the property tax can be paid by November 30, FY24. Also, people can avail a 10% rebate on early submission of property tax, according to the Act.

see also about: property tax faridabad

Jammu and Kashmir property tax penalty

Failure to pay property tax on time will attract a penalty of Rs 100 or 1% of the property tax. However, the maximum penalty will not be more than Rs 1,000. Note that an appeal can be made to the director of local bodies, in case of any grievance or reassessment that is required to be made.

Recall that Ministry of Home Affairs (MHA) had empowered the Jammu and Kashmir administration to impose the property tax post an amendment to the J&K Municipal Act, 2000 and J&K Municipal Corporation Act, 2000 through the J&K Reorganisation (Adaption of State Laws) order, 2020, in October 2020.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: anuradha.ramamirtham@housing.com