Owners of properties in Kolkata, are liable to pay the Kolkata Municipal Corporation (KMC) Property Tax every year. The municipality uses the funds collected as KMC Kolkata Property Tax, to provide important civic facilities and services. In this guide, we will talk in detail about the meaning of the KMC Property Tax, calculation of the KMC Property Tax 2025, online and offline payment, status check and waiver scheme, NOC, LOI etc.

KMC Property Tax 2025: Quick facts

| Authority | Kolkata Municipal Corporation (KMC) |

| Last date to pay KMC Property Tax | July 2025 |

| Properties that have to pay KMC Property Tax | Industrial, institutional, residential, commercial, vacant land, mixed-use, government |

| Mode of payment | Online payment through debit card, RTGS, UPI etc.

Offline payment through the KMC offices, authorised banks, Common Service Centers(CSCs) |

| Rebates | Available for categories such as senior mcitizens, physically challenged individuals |

KMC Property Tax to be hiked by 10% every 5 years

From April 1, 2025, the KMC put into effect the five yearly 10% hike in property tax, following a bill passed by the state government last year. This is an interim measure until a new assessment list of properties is finalised by the urban local bodies.

How is the KMC Property Tax calculated?

The KMC Property Tax is calculated on the basis of Unit Area Assessment (UAA). Using this, owners can calculate their tax themselves, thereby, removing any subjectivity or ambiguity that existed under the earlier Annual Rateable Value (ARV) system.

Key highlights of Unit Area Assessment

- Under the UAA scheme, the city has been divided into 293 blocks and seven categories – A to G. The division is on the basis of market value of the properties, facilities and infrastructure.

- Each category has been assigned an annual value per sqft, also known as the Base Unit Area Value (BUAV) where category A has the highest while category G has the lowest BUAV.

- All slum areas in the city are categorised as ‘G’, irrespective of the location, to reduce the tax liability on the economically weaker classes. Similarly, all Refugee Rehabilitation colonies and government schemes for the economically weaker section are categorised as ‘E’, regardless of their geographical location.

- The system covers around six lakh property tax payers in Kolkata. The UAA calculation method is expected to bring parity in the tax system, so that all the properties under the block are taxed uniformly.

- In contrast to the ARV system, a flat tax rate percentage within min-max limit of 6% to 20% is applied in the UAA system. According to the KMC, tax rate for developed bustee is fixed at 8% under this system. Also, the rate of tax of individual flat does not depend on cumulative AV of all flats in the premises concerned.

KMC Kolkata Property Tax calculation formula

The annual property tax under the UAA system is calculated, using the following formula:

Annual tax = BUAV x Covered space/Land area x Location MF value x Usage MF value x Age MF value x Structure MF value x Occupancy MF value x Rate of tax (including HB tax)

(Note: HB tax refers to Howrah Bridge tax, which is applicable on properties lying in specific wards.)

Ensure that your record in the system is updated and no outstanding amounts are shown against your account. If there are any errors, have them corrected immediately.

KMC Kolkata Property Tax 2025: Base unit area calculation

| Base Unit Area Values for covered space of building or land comprising building or vacant land | |

| Block Category | Base Unit Area Value per sq ft (in Rs) |

| A | 74 |

| B | 56 |

| C | 42 |

| D | 32 |

| E | 24 |

| F | 18 |

| G | 13 |

See also: Property Tax Guide: Importance, Calculation and Online Payment

To simplify property tax assessment even further, ‘bustee’/slum/’thika’-tenanted areas are categorised as ‘G’, irrespective of their geographical location under any block. Additionally, all recognised RR colonies*, including settlements under government-notified EWS and BSUP (Basic Services for Urban Poor) Schemes, are categorised as ‘E’, irrespective of their geographical location under any block, unless they belong to a block that is categorised lower than ‘E’.

(* RR Colonies refer to refugee rehabilitation colonies, including slum settlements that are spread all across the city.)

Check out price trends in Kolkata

Multiplicative factors impacting KMC Property Tax

The Kolkata Municipal Corporation Property Tax calculation also utilises the concept of multiplicative factors (MFs), to calculate the critical differences in houses within the same block. The multiplicative factors would account for variations such as

- the purpose of use

- location of the property within the block

- the age of the property

- nature of occupancy

- type of structure.

These factors are clearly notified and they are used to increase or decrease the base unit area value of different properties.

| Location of the property | Multiplicative factor |

| Property abutted by roads having width ≤ 2.5m | 0.6 |

| Property abutted by roads having width >2.5 m but ≤ 3.5 m | 0.8 |

| Property abutted by roads having width >3.5 m but ≤ 12 m | 1 |

| Property abutted by roads having width >12 m | 1.2 |

| Age of building | Multiplicative factor |

| Age of premises 20 years or less | 1 |

| Age of premises more than 20 years but less than 50 years | 0.9 |

| Age of premises more than 50 years | 0.8 |

| Type of property | Tax Rate |

| Un-developed bustee | 6% |

| Developed bustee | 8% |

| Government properties under KMC Act, 1980 | 10% |

| Properties having annual value <Rs 30,000 | 15% |

| Others | 20% |

| Occupancy Status | Multiplicative factor |

| Property under occupation of tenant, where the tenancy ≤ 20 years old and is used for non residential purpose | 4 |

| Property under occupation of tenant, where the tenancy ≤ 20 years old and is used for residential purpose | 1.5 |

| Fee/ Commercial Car Parking Space/ garage | 4 |

| Property under occupation of tenant where (a)the tenancy > 20 years old but ≤ 50 years old and, (b) the tenant is not protected under West Bengal Premises | 1.2 |

| Property under occupation of tenant, where (a) the tenancy > 20 years old but ≤ 50 years old and, (b) the tenant is protected under West Bengal Premises Tenancy Act 1997 | 1 |

| Property (or portion thereof) under occupation of tenant(s), where the tenancy > 50 years old | 1 |

| Property (or portion thereof) under occupation of owner or his/her “family” as defined in the scheme | 1 |

| Structure of Building | Multiplicative factor |

| Residential Building (not being an apartment) on a plot size > 10 cottah | 1.5 |

| Apartments belonging to such “Special Projects” as earmarked by IG Registration (excluding apartments identified/ notified as MIG / LIG by any Government/ statutory body) or, Apartments having “covered space (excluding car parking space)” > 2000 sq. ft. | 1.5 |

| All Pucca properties and such other properties not falling under any of the other categories | 1 |

| All Car Parking Spaces (open and covered) and Garage | 0.8 |

| Semi-Pucca | 0.6 |

| Proportionate Common Area | 0.5 |

| Kuchcha | 0.5 |

| Usage Types | Multiplicative factor |

| Water Body | 0.5 |

| Residential Use | 1 |

| Industrial/manufacturing, Shop<250 Sq.Ft., Restaurant | 2 |

| Health, Edu – Inst, Single Screen Cinema, Hotel < 3 star, Bar | 3 |

| Hotels 3 star and 4 star, Ceremonial House | 4 |

| Office, bank, Hotel 5 star or more | 5 |

| Commercial shops(not in U3) , mall, Multiplex | 6 |

| Offsite ATM, Tower, Hoarding, Night Club | 7 |

| Vacant Land upto 5 cottah not falling under above categories | 2 |

| Vacant Land more than 5 cottah | 8 |

What is assessee number? How to search it to pay KMC Property Tax ?

An Assessee is a person who is liable to pay the KMC Property Tax. An assessee number is the unique number that each assessee has on the basis of which the KMC Kolkata Property Tax is paid.

- Log on to https://www.kmcgov.in/KMCPortal/HomeAction.do

- Click on Online Services from the left menu and select Assessment-Collection.

- You will be redirected to a new page where you can find the ‘Assessee Information Search’ option.

- Click on that and you will reach

- Enter ward no, street, premise no and click on search. You will access the assessee number.

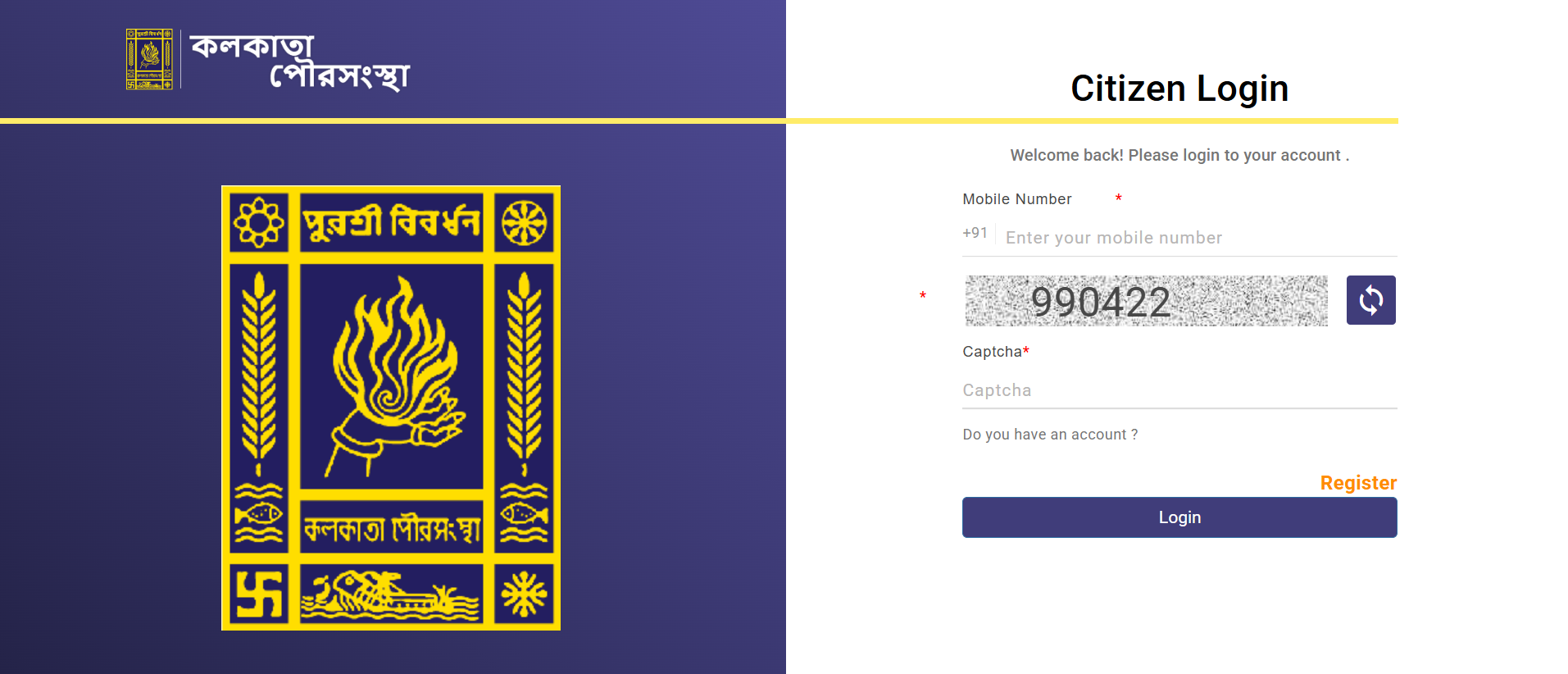

How to do citizen login in KMC to pay property tax?

- To do a citizen login, log on to https://kmc.wb.gov.in/citizen/user/login

- Enter mobile number, captcha and click on login. If you have not registered, then first register on the KMC web portal.

How to pay Kolkata municipal property tax 2025 online?

- Visit official website of Kolkata Municipal Corporation at https://www.kmcgov.in/KMCPortal/HomeAction.do

- On the right-hand side, find ‘Online Payment’ option. Select ‘Property Tax’ from the menu and you will see a drop down menu with the options:

- All bill

- Suspense

- Upto 50% interest waive LoI

- UAA online submission.

- Click on All bill. Enter assessee number, contact number and email id and click on submit.

- On the next page, you will see the details of the unpaid property tax.

- Then, enter the amount to be paid and proceed with payment.

- You can pay through credit card, debit card and net banking.

- Once the KMC Property Tax bill is paid, you will get an e-receipt as acknowledgement.

See also: Everything about West Bengal’s Banglarbhumi portal for land records

How to pay KMC Property Tax using Paytm?

Log on to https://paytm.com/municipal-payments/kolkata-municipal-corporation

Enter assesse number, mobile number and click on get tax amount. Once you see the tax amount, click on make payment and choose the online option with which you can make the payment.

How to check KMC Property Tax payment status 2025?

Property taxpayers can check the status of their KMC property tax payment through the official website. To check the payment status, access the relevant link and provide the required property details.

How to check unpaid Kolkata Municipal Corporation Property Tax bill online?

Property tax payers can easily check the pending tax dues online, on the KMC website. Follow the procedure given below, to check current and unpaid property tax bills:

What is PD Bill in KMC property tax bill?

Periodic Demand bills are issued annually, on the basis of the last decided valuation of the property.

- Visit the KMC Unpaid PD bill link at https://www.kmcgov.in/KMCPortal/jsp/PDDemandPrint.jsp

- Enter the Assessee number and click on search.

- You will see the current PD bill.

What is F/S Bill in KMC Property Tax bill?

Fresh/Supplementary bills are issued immediately after a hearing to reflect any modification to the earlier issued bills. Additionally, fresh bills are also issued after the first assessment of a property.

- To see current F/S bills, click on https://www.kmcgov.in/KMCPortal/jsp/FSDemandPrint.jsp

- Proceed by entering the Assessee No, Contact No, email if and search and proceed to pay.

- Your current unpaid will be displayed on the screen.

What is LOI in KMC property tax bill?

Letter of Intimation is issued against outstanding tax bills and may contain the following tax bills:

- All unpaid fresh and supplementary bills, which attract penalty.

- All unpaid periodic demand bills which were issued prior to the current financial year.

After clicking on the property tax button on homepage, if you select ‘outstanding (LOI)’, you will be led to https://www.kmcgov.in/KMCPortal/jsp/KMCAssessmentLoiPayment.jsp

- Enter the assessee no and search for all the unpaid property tax- all outstanding bills (LOI).

For accessing the suspense and UAA online submissions, you have to enter the site using the login id and password. If you don’t have the same, first register and then enter the KMC website to get details.

How to reprint e-receipt after KMC Kolkata Property Tax payment?

If you somehow forgot to save the e-receipt after the payment of property tax on the KMC website, here is how you can reprint it by following below given steps:

- Visit the KMC Portal at https://www.kmcgov.in/KMCPortal/jsp/KMCAssessmentCurrentPD.jsp and look for ‘Reprint e-receipt’ option in the left menu.

- Select the suitable option from the drop-down menu. You can print the e-receipt for the waiver offered, pending dues and current payment.

- Mention the requisite details such as date and assessee number. Your receipt will be generated on your screen.

See also: All about WB registration of land and property via e nathikaran

How to pay KMC Kolkata Property Tax 2025 offline?

- Visit the KMC office.

- Fill the KMC Property Tax application form with details such as asseessee number, owner name, address, property id, registered email id and mobile number.

- Submit the form, supporting documents and make the payment using cash or cheque.

What are the documents required to pay Kolkata Property Tax?

To pay the Kolkata Property Tax, following documents are needed:

- Property ownership document that can be sale deed or title deed

- Aadhaar Card

- Address proof of property for which property tax is being paid

- Previous receipts of Property Tax paid

- Measurement details of the property that will be used for calculation

- PAN card

- Utility bills such as electricity or water bill

KMC Kolkata Property Tax 2025 rebate

The Kolkata Municipal Corporation (KMC) introduced a revised property tax waiver policy from August 1, 2024. Under this, default tax payers are encouraged to pay the KMC Property Tax by offering graded waivers on penalties and interest.

This is found out by identifying the duration of the default.

- Taxpayers with defaults less than 2 years will get around 99% waiver on penalties and 50% off on interest.

- Taxpayers with defaults between 2 to 5 years will get around 75% waiver on penalties and 45% off on interest.

Taxpayers with defaults between 5 to 10 years will get around 50% waiver on penalties and 40% off on interest.

- Taxpayers with defaults of over 10 years will get around 25% waiver on penalties and 35% off on interest.

Note below the schedule of presentation/rebate dates of Kolkata Property Tax (PD) bills for the year 2025-2026

Source: KMC

How to apply for NOC on KMC website?

Citizens can download a no-objection certificate (NOC) for various purposes by accessing the KMC portal.

Some of the types of NOC that can be obtained online are:

- NOC for property sale: An NOC for property sale is required to prove that the owner has paid all property taxes and there are no outstanding dues.

- NOC for home loans: Banks and financial institutions may ask borrowers for an NOC to verify their financial position and ensure no debts to the KMC.

In addition, NOC is required for passport and visa applications and government jobs may be to prove compliance with property tax payments.

To obtain an NOC, taxpayers can send an online application process with supporting documents and payment of a nominal fee. Here’s a step-by-step guide to apply for an NOC on KMC website:

- Visit the official KMC website at https://www.kmcgov.in/

- Go to ‘Online Services’ tab and click on ‘Assessment Collection’

- In the next page, click on ‘No Outstanding Certificate (NOC)’ option

- Provide relevant details such as assessee number, property address, contact details, etc.

- Click on ‘Submit’

- The NOC will be displayed. Users can download it and save for relevant purposes. The NOC issued by the authority will be valid for one year.

NOC application offline

Taxpayers can also draft an NOC application and submit it through the offline mode by visiting the KMC office along with supporting documents.

Here’s the format of the NOC

No Objection Certificate

This is to certify that there are no outstanding dues on the property, located at [property address], bearing assessee number [assessee number].

This certificate is issued on [date] by [officer’s name] of the Kolkata Municipal Corporation.

[Signature of officer]

[Designation of officer]

How to change the name on the KMC Property Tax records?

To change the ownership offline, follow these steps.

- One can change the name of the property owner by collecting the mutation form from the municipal office.

- Fill out the form, add supporting documents and submit.

- The name transfer order will be received once done and you can get the application receipt and annual rental value (ARV) certificate from the KMC office.

Kolkata Municipal Corporation Property Tax 2025: Dos and don’ts

- Always get an estimate of the KMC Property Tax before proceeding with the payment. If you have any problem, you can complain against the property tax that you have been charged and get it verified.

- You can pay KMC Property Tax using cash or online using net banking. Credit cards can also be used to pay the KMC property tax but you may be charged around 2-3% as service charges. Also, you can pay property tax using ESCROW account.

- Certain people get tax exemptions and the criteria may be based on age etc. However, this differs from state to state.

- You can make use of the rebates that is offered by the KMC property tax for paying property tax before the deadline.

- Never skip paying property tax as this may result in heavy penalty.

Tips for reducing Kolkata Municipal Corporation Property Tax 2025

- Check your KMC property card for any difference between what is mentioned on paper and your actual asset.

- Do not make structural changes to your asset as this can result in increase in property tax.

- Make use of concessions given to super senior citizens, army personnel etc.

- Pay the property tax well before deadline to avail the rebates offered by KMC.

- In a bid to encourage people to pay the property tax online, the KMC is offering an extra rebate of 1% above the 5% rebate that people will get for making the KMC Property Tax payment before a specified time. With this, people will get a total of 6% rebate that is upto a maximum of Rs 200 per payment.

KMC Kolkata Property Tax: WhatsApp number

In a move to fast-track property tax assessment for Kolkata property owners, the Kolkata Municipal Corporation is planning to announce a WhatsApp number, where tax payers can apply for the assessment of their property. The KMC WhatsApp number will be 8335988888 and will be monitored by the municipal commissioner, to assess the requests received. If the number of requests received from a particular locality is more, the municipal corporation will set up a camp, to expedite the process.

Check out properties for sale in Kolkata

Kolkata Municipal Corporation mobile app

The Kolkata Municipal Corporation has launched a mobile app, to provide services such as building plan approvals, mutation status and tanker booking, online. The mobile app is currently available for Android users only. The app can be downloaded from the Google Play Store at https://play.google.com/store/apps/details?id=com.kmc.app&hl=en_IN&gl=US .Property tax payers can pay their pending bills via the mobile app, using credit card/debit card/NEFT. At present, UPI payment is not supported.

Kolkata Municipal Corporation: Contact details

You can reach the KMC at

The Kolkata Municipal Corporation

5, S.N.Banerjee Road,

Kolkata 700 013, India

Ph : +91 33 2286-1000

Toll Free Number: 18003453375

Timing: 10 AM and 6 PM (working days)

10 AM and 5 PM (Saturdays)

Housing.com POV

Kolkata Municipal Corporation has made paying KMC Property Tax easier. Also, the KMC offers rebate on advance payment of Kolkata Municipal Corporation Property Tax. It’s recommended that people take use of this service and pay the KMC Property Tax on time so that they are saved of paying penalties or worse losing their properties.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |