For property transactions happening in West Bengal, the property buyer has to pay stamp duty and registration charges applicable on the sale of the property, to the West Bengal Property & Land Registration Department. A part of this property document registration process in Kolkata and other cities of West Bengal, can be done online. This includes submission of identity proofs, property details and preparation of the e-deed. Here is a step-by-step guide to property registration in West Bengal and details about the documents required for this process. Property owners in Kerala have the option to pay property tax online as well as offline. They need to physically visit the office of the respective urban local body to make the payment, on the other hand, residents of Kerala can pay the charge online on Sanchaya portal.

How to register property in West Bengal?

Step1: Visit West Bengal Property Registration Department Portal, E-Nathikaran (click here)

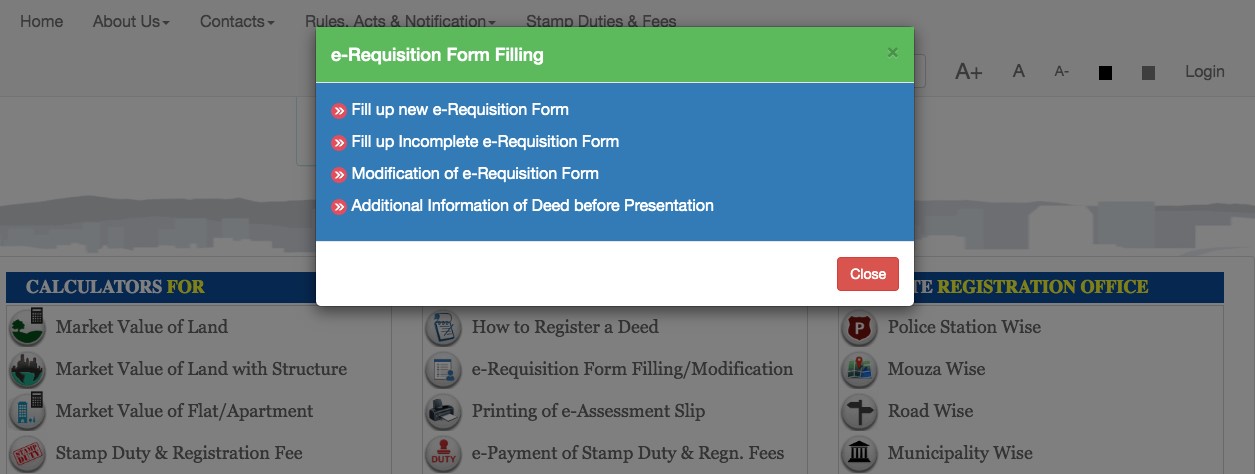

Step 2: Scroll down and click on ‘e-requisition Form Filling’. Here you need to fill a form for market value assessment, stamp and registration fee.

Step 3: All new users need to select ‘Fill up new requisition form’. If you are logging back again, you can finish your incomplete requisition form. You can also modify the e-requisition form and submit additional information about deeds, before its presentation at the sub-registrar’s office.

Step 4: All new users will be redirected to a guidelines page, where they can read the terms and conditions and rules for filling up the assessment form. Select ‘Read and Please Proceed’.

Step 5: New users need to fill three forms. The first form is ‘Applicant and Transaction’. Here, you need to feed the applicant’s details, property details and transaction-related details. The applicant could be the buyer, advocate, seller, deed writer, solicitor firm or attorney of the claimant. Save the form.

Step 6: Once you save the form, the user will be redirected to the next form – ‘Details of Seller’. Fill the details and save the form. You can also add details of more than one seller, if it is a joint property.

Step 7: Fill the details of the buyers in the next form. Add all the required details or the form will be deemed incomplete. Mention the name of all the joint buyers.

Step 8: In the last form, you need to add identifiers or witness details.

Step 9: In the next section, mention the details of the property, such as district, local body, ward number, etc.

Step 10: Once you save the form, you need to select the registration office or the place where you want to register the deed. Select the suitable office and generate your query number. This number will be used for stamp duty payment.

How to prepare and submit e-Deed?

Step 11: Now, go back to the home page and click ‘e-Registration of Deed’ and click ‘Preparation and submission of e-Deed’.

Step 12: Click ‘Read and Proceed’ and mention the query number generated in Step 10.

Step 13: Fill the requisite information, such as history of ownership, terms and conditions of purchase, which can be selected from the existing conditions, or edit it accordingly. Mention the boundary details, description of the land, common area, scribe details, memo of consideration, witness details and take a printout of the photo and the 10-fingerprint sheet, which has to be uploaded after final submission of the draft deed and before going to the sub-registrar’s office.

Step 14: Check the draft deed thoroughly and submit it for approval from the department. The applicant will get an SMS when the draft e-Deed is approved/rejected, which usually happens within 24 hours of application.

Step 15: If the e-Deed is approved, the applicant has to make the stamp duty and registration fee payment.

How to pay stamp duty and registration fee online in West Bengal?

Step 16: Go back to the home page and select ‘e-payment of Stamp Duty and registration fees’.

Step 17: Feed the query number and query year. Enter the bank details of the buyer, if there is any refund to be credited.

Step 18: You will be redirected to the payment portal. Choose ‘Payment of Taxes and Non-Taxes revenue’.

Step 19: Choose ‘Directorate of Registration and Stamp Revenue’ in department category and select ‘Payment of Stamp Duty’.

Step 20: Fill in all the details such as depositor’s name, query number, etc. Proceed with the amount and payment details. Confirm all the information and make the payment through net banking. Save the government reference number (GRN) for future purposes.

How to check status of e-Payment of stamp duty and other charges

Step 21: Now go back to the home page and click ‘status of e-Payment’ and enter the query number generated in Step 10 and GRN number generated in Step 20. Once you have verified the payment, you need to submit the approved e-Deed by e-signing it.

How is the stamp duty calculated?

The stamp duty is the legal manner in which a state collects the revenues from the buyer in case of any transactions. It can be fairly noted as a legal proof of ownership and authority. The calculation of the stamp duty can depend on a number of factors. Some of them are noted here :-

- Ready reckoner rate

- Market values

- Circle rate of consideration value of the property

Out of these, whichever amount is higher is calculated as the stamp duty.

When is the stamp duty supposed to be paid by the buyer?

This amount of money, or the revenue to the government is generally paid on the day of execution of the document. This is paid during the registration of the document itself.

How to execute the e-Deed?

Step 22: Execute the e-Deed by e-signing, using your Aadhaar card. An OTP will be sent to you on the mobile number linked with the Aadhaar card. If you do not have an Aadhaar card, you can take a printout of the execution sheet prepared by the system and present it while visiting the sub-registrar’s office.

Step 23: After executing it, submit the e-Deed for presentation and generate the acknowledgement certificate as a token of successful submission. From here on, no modification will be allowed in the sale deed.

Step 24: After final submission, upload the TI sheet, by affixing your self-attested photograph and fingerprints of the executants. The link is under the ‘e-Registration of Deed’ option. This sheet should be uploaded before you proceed to the sub-registrar’s office.

How to book e-appointment at SRO’s office

Step 25: Book the e-appointment from the home page by clicking ‘e-appointment of sale deed’ by mentioning the query number.

COVID-19: E-appointment guidelines

Property buyers who wish to register their property at the SRO office, need to follow the guidelines issued by the WB registration department, keeping in mind the ongoing COVID-19 restrictions:

- The E-appointment facility for the next week opens every Friday at 9.00 pm.

- Users can book only those dates which are available for e-appointment.

- Property buyers can check the list of offices available for e-appointment here.

Procedure to follow at the SRO office

Step 26: Present yourself at the SRO office where your documents will be verified and uploaded. Take all the original documents, along with the attested photocopies.

Step 27: Here, your deed will be scanned and fingerprint and signature will be captured, if you have not executed your e-Deed in Step 22.

Step 28: Once the application is verified, your deed will be delivered, which will be digitally signed by the registrar’s office.

Documents required for property registration

- Identity proof: Aadhaar card, Voter ID, PAN card, passport, driving licence.

- Assessment slip which has the market value, stamp duty and registration fee applicable on the property.

- PAN card or Form 60, along with identity card and address proof of both the parties.

- Stamp duty and registration fee payment acknowledgment.

- Permission from authority, if applicable.

How to download a copy of a deed in West Bengal?

Step 1: Visit E-district portal (click here)

Step 2: Register yourself, by submitting your full name, mobile number and email address.

Step 3: Once registered, you can login and download the certified copy of a deed, by submitting the deed number and other details as required.

How to get a certified copy of a deed?

Property owners can now search and download the certified copies of deeds online, by following these steps:

- Visit the E-district portal and register yourself for citizen services. Once you have registered, login again to access your account.

- You will see a list of services available. Click on ‘Apply to Services’ and search for ‘Land Records and Revenue Court Services’.

- On the next page, select ‘Apply’ button. Select the ‘Application for certified copy of deed’ radio button and then click on ‘Next’.

- Fill in the required details, such as district, registration office, year of registration, registration number, etc., to search the registered deed.

- Fill in the applicant’s details and make the payment as required. Print the acknowledgement slip and get the copy of the certified deed through AIN.

How to search legacy deed?

Property buyers can search for old deeds on the West Bengal Property Registration portal. Here is how you can do it:

Step 1: Visit WB Registration portal and click on ‘Searching of deeds’ from the right menu.

Step 2: Allow pop-ups from the search bar. Once allowed, six options will be displayed. Choose the last option ‘Legacy Deed Draft View’.

Step 3: Select the district, registration office, deed number, deed year and book.

Step 4: Click on ‘View Deed’. The result will be displayed on the screen.

Other services offered by West Bengal Property Registration Department

* West Bengal land record search: You can also search land records and property registration online on the WB Registration portal. Mention the first name and/or last name, year of property registration and district where the property was registered. The results will be displayed on the screen.

See also: All about West Bengal land record search by name on Banglarbhumi

* Calculation of stamp duty and registration fee: You can also calculate the stamp duty and registration fee to be paid for different kinds of property transactions. Select the local body and feed in the market value. This option is available on the left column under ‘Calculator Section’.

* Locate the nearest registration office: If you are not sure which the closest sub-registrar’s office is, you can search on the portal. Scroll down and click any of the available filters to search for the closest office. You can search the registration office police station-wise, road-wise or municipality-wise.

* Correction of legacy deed: If you want to make corrections in your legacy deed, you can visit the WB Registration portal and click ‘Request for Correction (Legacy Deed)’. You will be redirected to a new page, where you need to submit details pertaining to the district, sub-registrar’s office, deed number and deed year. The results will be displayed on screen and you can proceed with the request.

*Calculation of market value: You can calculate the market value of your land, property, flat/apartment through this portal. To calculate the market value, mention the following information:

- District

- Local body

- Thana

- Jurisdiction area

- Local body name

- Plot number

- Khaitan number

- Proposed land use

- Nature of land in ROR

- Encumbered status

- Purchaser details

- Litigation status

- Total area of land

Check out properties for sale in Kolkata

How to locate the nearest registration office?

Property buyers can easily locate their nearest property registration office/sub-registrar’s office using the portal.

Step 1: Visit WB Registration portal and scroll down to find ‘Locate Registration Office’ on the left menu.

Step 2: Choose any of the given options:

a) Police station-wise

b) Mouza-wise

c) Road-wise

d) Muncipality-wise

e) Gram panchayat-wise

Step 3: Select the district from the drop-down menu and the address will be displayed on your screen.

E-Nathikaran Helpdesk

Property buyers and applicants can reach out to the West Bengal Property and Land Registration Department using the following credentials:

Drop a mail at [email protected], [email protected]

You can also contact the administration on this number: 033-2225 9145

Helpline: 9932325995/9732573133

Can you sell a property without registration in West Bengal?

Without registration of the property, you have no legal right over it, even if you have cleared all your dues with the builder and there is no encumbrance. The property registration process creates ownership right over a property. Without proper property registration, a buyer has no legal right over the property and the seller cannot sell it to anyone under the Transfer of Property Act.

Can you transfer property through power of attorney in West Bengal?

As per an order issued by the Supreme Court of India in 2011, transferring property through a general power of attorney is invalid. Moreover, even an irrevocable power of attorney cannot be used for transferring title to the recipient. Therefore, GPA is not valid for the sale/purchase of a property. Transactions related to an immovable property can only be done by way of stamped and registered conveyance deed, as applicable under the West Bengal Transfer of Property Act.

Is Aadhaar mandatory for property registration in West Bengal?

Buyers should know that Aadhaar is accepted as identity proof for property registration and land mutation in West Bengal. However, no provision in the law makes it binding on the buyer to provide his unique identification number for these purposes.

E-Nathikaran mobile app

Property buyers and owners can also search for legacy deeds, land records and other important property-related documents, on the official E-Nathikaran mobile app. However, make sure you download the app from verified sources such as the official portal of the West Bengal Property Registration Department, as there are a number of phishing apps with similar names, which can steal your data.

West Bengal Property and Land Registration Grievance Redressal

To register any grievance, click on the ‘Grievance Redressal’ tab on the homepage and select ‘submission of complaint/suggestion’ from the drop-down box. You will reach https://wbregistration.gov.in/(S(5gt500xivaps1rlfcwicyoul))/Grievance.aspx?GrievanceStatus=GV1

On this page the ‘submission of complaint/suggestion’ option is checked by default. Enter all the details in the complaint form, including name, address, pin code, state, district, city, mobile number and email id and click on the appropriate radio button – whether it is your suggestion or your complaint. You can upload supporting documents to the form. Type the characters and click on submit. Note that all boxes with a red * have to be filled compulsorily for the form to be accepted.

To check the status of a complaint, check ‘Suggestion/ Complain status’ when you open the link. You can search by Grievance ID, by entering the details in the form including the Grievance ID/ year and mobile number. Type the characters and click on search.

Alternatively, you can search by Applicant Details, where you have to fill in the applicant’s name, mobile number, from date, to date and then type the characters and click on search, as shown in the image below.

For property and land registration queries you can contact on

Shri Abhijit Kumar Das

Addl IGR and Addl CSR, WB

Fortuna Tower,9th Floor,23A N.S.Road,Kolkata-700 001

033-2214 1566/9830596876

Shri Anup Kumar Mandal

ACSR eRAC

Govinda Bhavan,9th Floor, Brabourne Road,Kolkata 700 001

033-2235 0063 / 9432814120

FAQs

How can I check ownership of land in West Bengal?

You can check ownership of land in West Bengal on the Banglarbhumi portal, as mentioned in this article.

How can I download my copy of deed in West Bengal?

You can download the copy from the WB registration portal, by following the above procedure.

How can I check land value in West Bengal?

You can check land value on WB registration portal by following the procedure mentioned in this article.

Surbhi is an experienced content marketing expert for over nine years now and has contributed articles and research insights for top real estate portals. She is a journalism graduate and has keen interest in politics, urban development and infrastructure studies. Surbhi is a bookworm and delves into historical fiction and inspiring biographies when she is not sleeping.

Facebook: https://www.facebook.com/surbhi.gupta2406/

Twitter: https://twitter.com/surbhi2406

Linkedin: https://www.linkedin.com/in/surbhi-gupta-82159b63/

Quora: https://www.quora.com/profile/Surbhi-Gupta-17

about.me: about.me/surbhi.gupta/