Tiruchirappalli also known as Trichy located in Tamil Nadu comes under the jurisdiction of the Tiruchirappalli City Municipal Corporation (TCMC). Divided into four administrative zones — Abhishekapuram, Ariyamangalam, Golden Rock and Srirangam — there are 65 wards in Trichy. Property owners in Trichy should pay the property tax twice a year. Money collected by the TCMC is used in managing the civic amenities in the city. In this guide, we will share steps to pay property tax online and offline in Trichy.

Check Stamp duty and registration charges in Tamil Nadu 2024

What is the property tax rate in Trichy in 2024?

The property tax rate in Trichy was revised in 2018.

| Zone | Property type | Property tax rate (Rs /sqft) |

| A | Residential | Rs 2 |

| B | Residential | Rs 1.80 |

| C | Residential | Rs 1.50 |

How to pay Trichy property tax online?

- Under services, select property tax and click on ‘click here’.

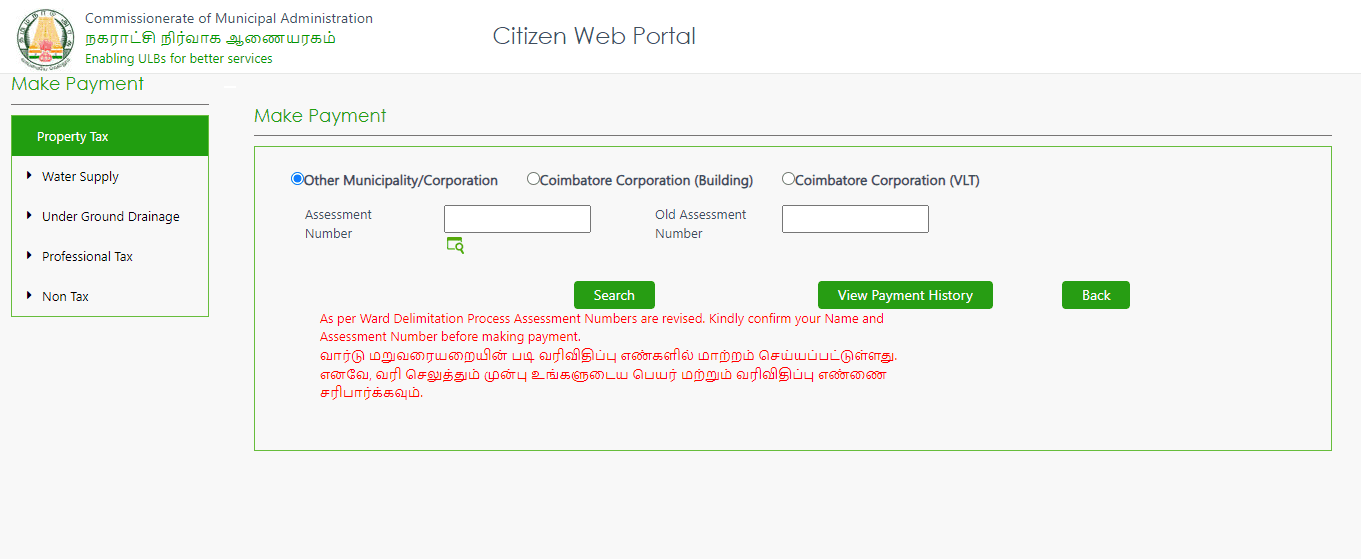

- You will reach the following page.

- Select ‘other municipality/corporation’.

- Enter assessment number, old assessment number, and click on ‘search’.

- To check payment history, click on ‘View Payment History’.

How to pay property tax offline?

- You can pay property tax offline by identifying the zone and the ward where your property falls.

- Fill in details in the property tax form and submit.

- Proceed to make payment with card, cash, or cheque.

- When done, get an acknowledgement slip in the form of receipt.

How is property tax Trichy calculated?

Trichy property tax is calculated based on the property’s Annual Rental Value (AVR) and Budget Variance Report (BVR).

- Total AVR = AVR of covered space + AVR of uncovered space.

- AVR of uncovered space = 12 x (½) x BVR x uncovered area in square foot.

- Area of the covered space can be defined by the multiplication of the relatable value, including the addition of 12.

- Property tax of an apartment building, or flat is calculated based on the basement floor area.

- The rate varies depending on the location of the property.

- The usage of the property helps in calculation too, as tax rates for residential and commercial properties differ.

- The occupancy type and total period of the building existence are additional factors for the tax calculation.

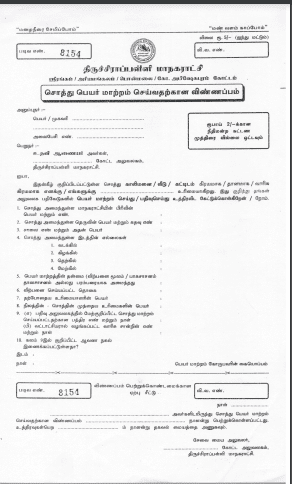

How to change names in Trichy property tax documents?

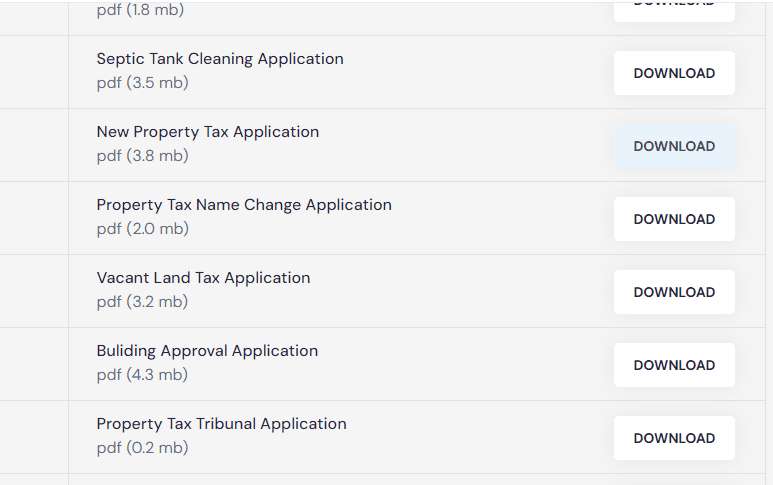

- Log on to Smart Trichy website at https://smarttrichy.com/forms.

- Click on ‘Property Tax Name Change Application’ and download the form.

- Fill in the form and submit it to the nearest municipality office.

How to register new property for property tax?

On the Smart Trichy website, click on ‘new property tax application’. Download the form, fill in details and submit it to the nearest municipality.

How to file a complaint?

On the Smart Trichy website, click on ‘property tax tribunal application’. Download the form, fill in details and submit it to the nearest municipality.

What is the last date for payment of Trichy property tax?

For Trichy property tax 2024-25, between April 2024 and March 2025, Housing.com recommends the payment of the property tax by April 30, 2024. Municipal corporations offer rebates for advance tax payments, around 5%-10% that one can avail of and save money. For instance, the TCMC had announced a 5% waiver incentive of upto Rs 5,000 for app property tax payments made till April 30, 2023 for FY2023-24.

FAQs

What happens if you do not pay property tax Trichy?

If you do not pay property tax Trichy, you will have to pay a penalty of 2% per month. Repeated offenders may also run into risk of their properties being attached by the municipal corporation.

How many times do property owners in Trichy should pay property tax?

Property tax can be paid in two different installments every six months. For the April to September period, it should be paid by July and for the October to March period by December.

Is property tax applicable on all properties?

Yes, property tax is applicable for residential, commercial, and industrial properties. There are exemptions if the property is used for religious or educational purposes. Check with the respective municipal corporations to know more.

What is an assessment number in property tax?

Every property has a unique identification number known as an assessment number. This is important for property tax calculation.

On what basis is the property tax Trichy calculated?

Trichy property tax is calculated based on its Annual Rental Value (AVR) and Budget Variance Report (BVR).

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]