The Karnataka Stamps and Registration Department developed the Karnataka Valuation and E-registration – Kaveri 2.0 portal to enable online registration of properties and land without having to visit the sub-registrar’s office (SRO). The Kaveri 2.0 online services portal also allows users to download property registration documents free of cost. This guide details how you can make use of the online services on Kaveri 2.0. Read on.

Kaveri 2.0 Online: Main facts

| Name of the portal | Kaveri Online Services |

| Owned by | Department of Stamps and Registration, Government of Karnataka |

| Maintained by | C-DAC |

| Objective | To act as a virtual storage unit for data pertaining to records of rights, tenancy and crops (RTC). |

| Developed in | 2018 |

| Website address | https://kaveri.karnataka.gov.in/landing-page |

| Primary users | Karnataka citizens |

| Revenue generated by Kaveri 2.0 | Rs 3,862 crore generated from stamp duty and registration |

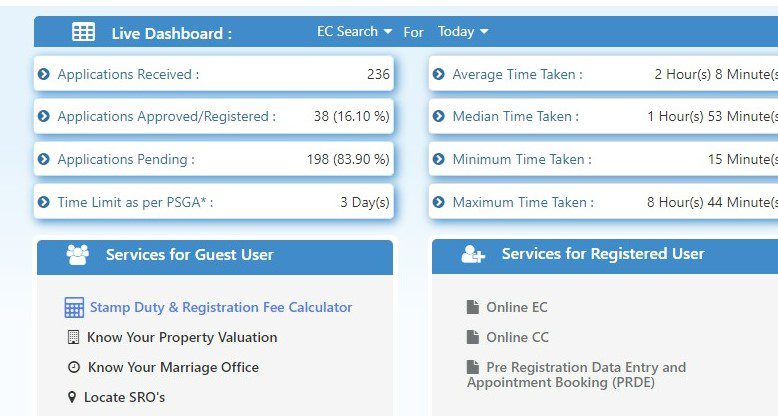

| Services | For guest users:

For registered users:

|

| Security features | Safe document storage and digital authentication |

| Benefits | Transparent, eliminates middlemen, saves time |

| Fee payment | Debit card, credit card online or net banking |

| Languages | English, Kannada |

| Access | 24 hours access |

What services can registered users access on Kaveri 2.0 portal?

- Property registration and stamp duty payment: Under the existing laws, property documents like sale deed, mortgage deed, lease deed, deposit of title deed, reconveyance deed, partition deed, release deed, gift deed, exchange deed, settlement deed, agreement, power of attorney, etc. in Karnataka must be registered with the state registration department. These services are offered online in Karnataka through Kaveri 2.0 portal.

- Encumbrance certificate (EC): An encumbrance certificate is a record showing registered transactions over a property. For obtaining an EC, the user must submit Application Form No. 22.

- Certified copy (CC): These are registered documents relating to immovable properties to verify the legality of the transaction of property effected through it. Banks and non-banking financial companies (NBFCs) refer to certified copies of registered sale deeds before giving a loan on a mortgaged property to verify the ownership. The income tax department may also refer to a certified copy to ascertain the value of the transaction and assess the income of the property buyer or seller.

- Online appointments: Pre-registration data entry and appointment booking (PRDE provides online booking of time slots for registration of property).

See also: Stamp duty and registration charges in Karnataka

Karnataka doubles registration property charges from August 31, 2025

Effective August 31, 2025, the property registration in Karnataka increased from 1% to 2%. This was issued by a Karnataka state government notification on August 29, 2025. This increase will also be applicable on lease agreements, conveyance deeds, exchange deeds, gift deeds, advance registration charges, bank registration charges, etc.

This decision has been taken to achieve the Karnataka government’s additional revenue of around Rs 3,000 crore from August 31 to March 31, 2026.

Note that for all property documents that are already submitted with the SRO for document verification, the registration charges will be recalculated based on the revised registration charge.

Impact of double the property registration charge in Karnataka

| Tax | Charges till August 30, 2025 | Charges from August 31, 2025 |

| Stamp duty in Karnataka | 5% | 5% |

| Registration charge | 1% | 2% |

| Cess | 0.6% | 0.6% |

| Total | 6.6% | 7.6% |

Stamp duty and registration charges make up a significant amount of the property cost. These charges depend on the guidance value Karnataka. For instance, if a property’s value in Bangalore, Karnataka is around Rs 2 crore, then the registration cost after this change will be 2% amounting to Rs 4 lakh. Earlier, people would pay only Rs 2 lakh (1%). Registration charges were last hiked in the state in 2003.

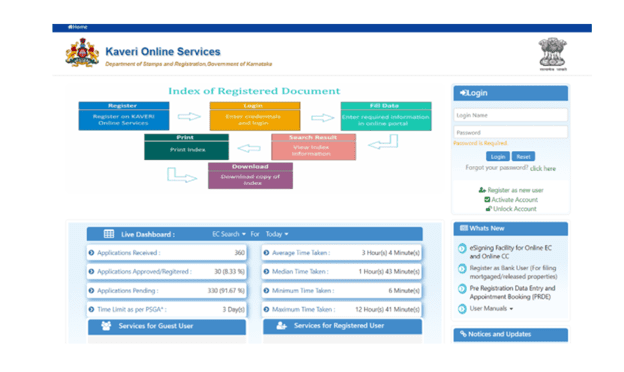

How to register on Kaveri 2.0?

Only users who are registered can avail of extensive services on Kaveri 2.0 online services portal.

- On the Kaveri 2.0 official page, click on ‘Register’ on the right-hand side of the page and fill in your details. A username and password will be sent to you by SMS and you will be redirected to the main page. Note that if you are an NRI trying to register on the Kaveri portal, you may need to have an Indian mobile number. Overseas mobile number cannot be used to register on the Kaveri Portal.

Kaveri online services: How to activate the process?

- Complete the Kaveri 2.0 registration.

- Verify the mobile number.

- Upload valid proof of identity

- You will get activation confirmation through email

How to download EC from Kaveri 2.0 online portal?

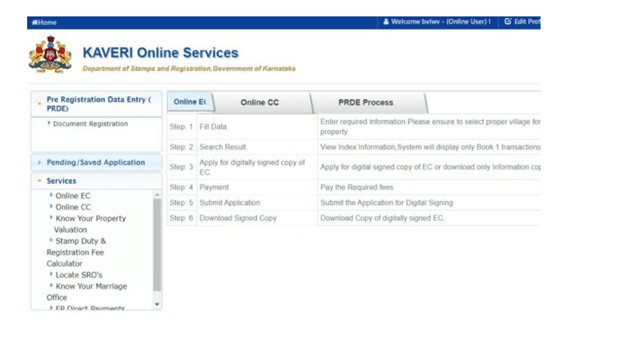

To get an encumbrance certificate online at Kaveri 2.0 Online, login into the Kaveri online services portal.

- After logging in, select the ‘Online EC’ option from the ‘Services’ menu.

- Select the duration of the property registration and fill other details before your click on the ‘Send OTP to View Document’ option.

- The OTPs are delivered promptly by email but there can be a lag in receiving OTP by SMS. So, always check your email inbox also for the OTP. Note that the Kaveri portal OTP is valid for 10 minutes.

- Enter the OTP sent to your mobile and click on ‘View Document’ to view or download the property EC.

- To download the EC, select the ‘Check to apply for digitally signed EC’ checkbox and tap on ‘View Document’. You can download the PDF of the EC after paying applicable charges.

Know about: Udupi (Karnataka)

Kaveri 2.0: Encumbrance Certificate fee

| Particulars | Fee |

| General Search for First year | Rs 35 |

| For every other year | Rs 10 |

Source: IGRS Karnataka

How to verify EC on Kaveri 2.0 online portal?

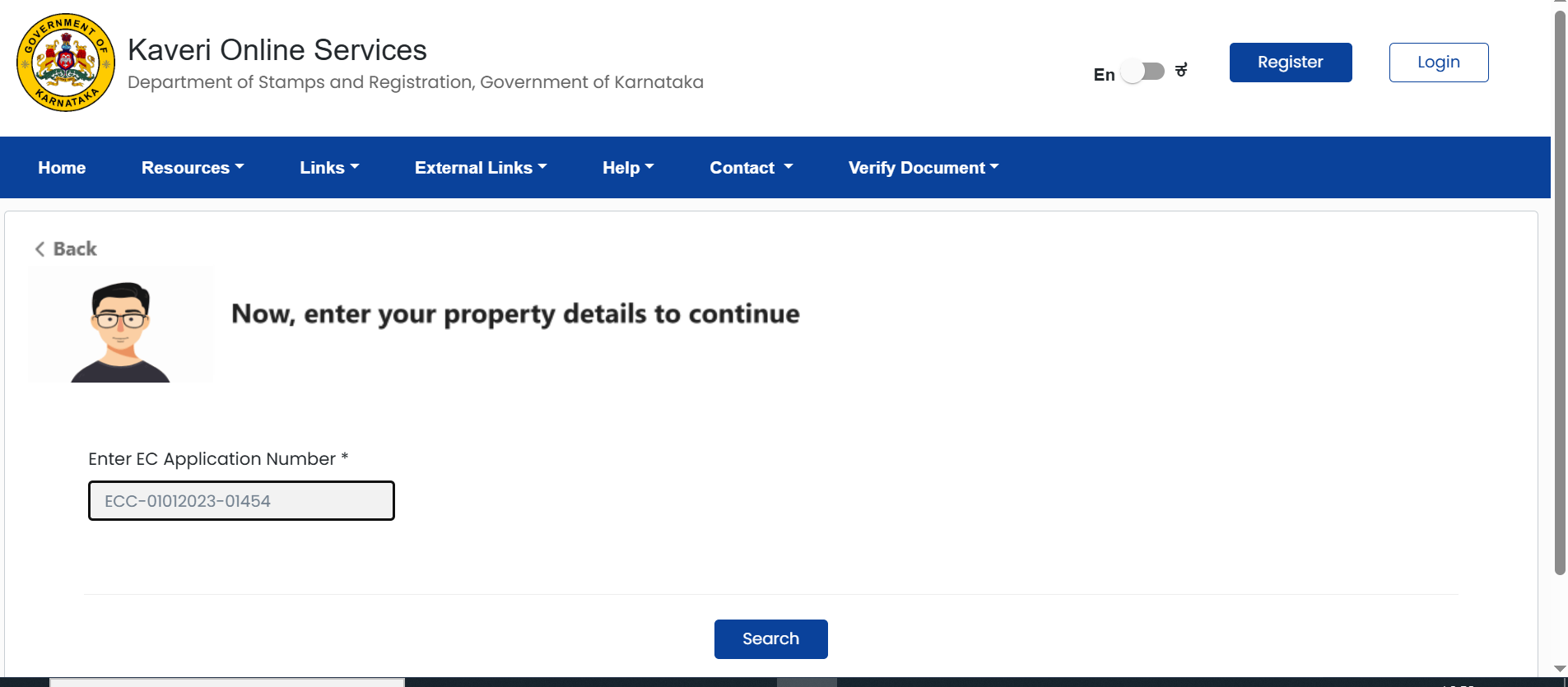

- To verify an encumbrance certificate online at Kaveri 2.0 Online, select verify EC document under the Verify document on the Kaveri online services portal.

- Enter the EC application number and click on search.

How to update Karnataka EC?

In case there is any information that is incorrect on the Karnataka EC portal, then you can update the same by invoking a rectification deed and submitting it in the SRO. Note that with the help of rectification deed, only clerical errors can be corrected and changes cannot be made.

How long does it take to get digitally signed EC?

For getting a digitally signed EC for the period from April 1, 2004 to today, it will take 3 working days. Before April 1, 2004, up to 13 years, it will take 10 working days and for more than 13 years, it will take 10 days plus 1 extra day for every additional 10 years.

Note that payment for EC is non-refundable, so one should check the draft EC details carefully before paying.

How to view and download CC on Kaveri 2.0 online?

CC or certified copies of registered documents relating to immovable properties is used to verify the legality of the transaction of property effected through it. Agencies like banks refer to certified copies of registered sale deeds before giving a loan on a mortgaged property to verify the ownership. The Income Tax department may also refer to a certified copy to ascertain the value of the transaction and assess the income of the property buyer or seller. Buyers in Karnataka can view and download certified copies (CC) of documents on the Kaveri Online portal by following some simple steps.

Prerequisite to apply for a signed Certified copy

1.District name

2. SRO name

3. Financial year

4. Document number of registration need

5. e-Signing is mandatory to avail of a certified copy of the document searched. Hence Aadhaar number is mandatory.

6. It is recommended to have details of net banking, UPI or credit card/Debit card to make payment based on total document pages.

7. Adobe Reader 10 is required to view the downloaded document

Steps to apply for CC on Kaveri 2.0 online portal

- After logging in, select the certified copy option on the home page. Click on the ‘Certified Copy’ option.

- Fill in the required details in the respective fields.

- Make payment to proceed.

- Click on the E-Sign option.

- Provide all the details and click on ‘Submit’.

- This is an E-signed Form 22. You can download or print the document.

- Click on ‘Go To Dashboard’.

- Your application is now sent to the SRO.

- Download the digitally signed CC.

- Click on ‘Download Signed CC’.

Kaveri 2.0 Certified Copy fee

| Particulars | Fee |

| Particulars | Fee |

| Single search fee | Rs 25 |

| Copying fee for every 100 words | Rs 5 |

| For Computer registered Docs for every page | Rs 10 |

Source: IGRS Karnataka

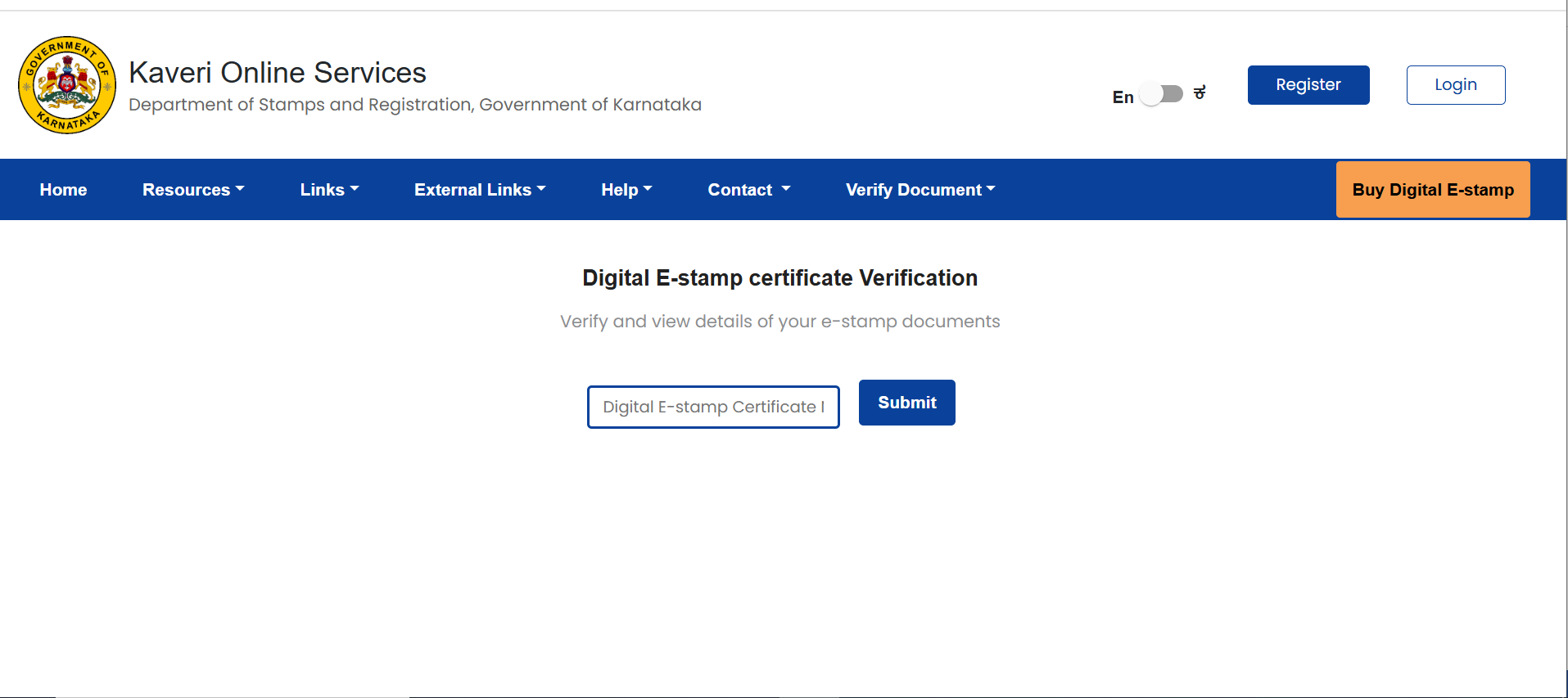

How to verify digital e-stamp?

- To verify digital e-stamp log on to https://kaveri.karnataka.gov.in/verify-E-Stamp.

- Enter digital e-stamp certificate verification and click on submit.

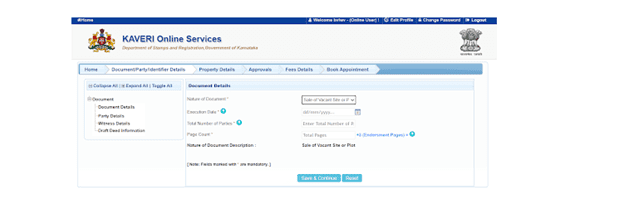

How to register property on Kaveri 2.0?

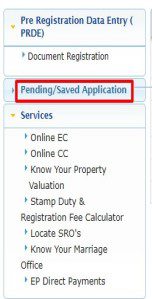

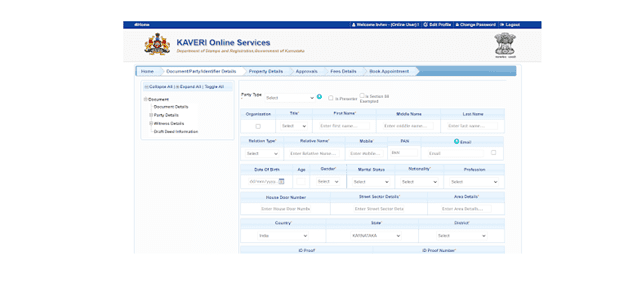

- Since only registered users can perform this action on the Kaveri Online Services portal, the user must first register himself, using his credentials. Once the registration is complete, you can click on the ‘Pre-Registration Data Entry and Appointment Booking (PRDE)’ option. On the page that opens, click on the ‘document registration’ option as shown in the image below.

- On your screen, you will now have to select various options from the drop-down menu to initiate the document registration process. These details include the nature of the document, execution date, the number of shares, total number of parties, page count and number of document description. After entering all the details, hit the ‘save and continue’ button at the bottom.

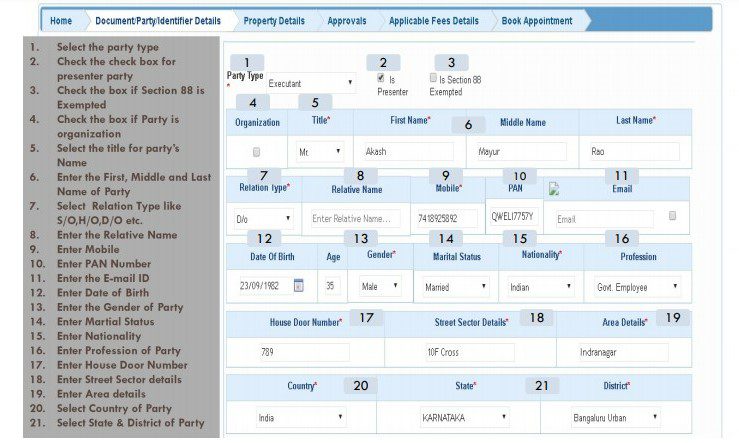

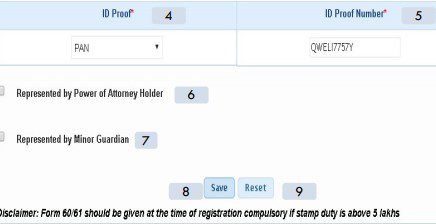

- On the next page, enter all details as shown in the grey box.

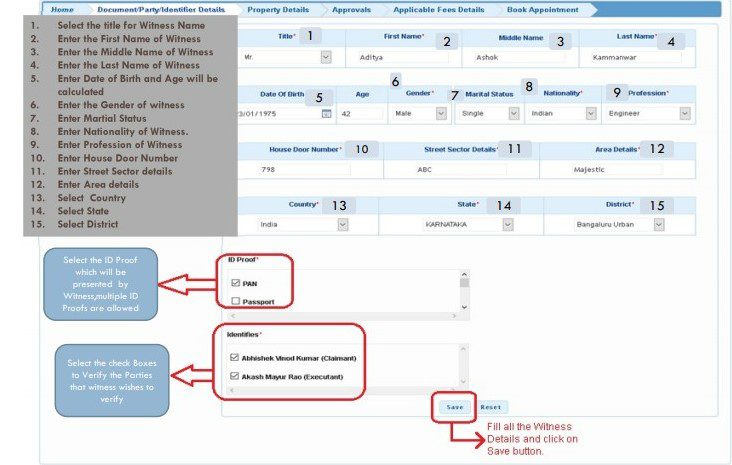

- Now, select the title for the witness name and enter the first, middle and last name of the witness. Enter the date of birth, gender, marital status, nationality, profession and address of the witness. Also select the ID proof to be produced by the witness. Now, select the check boxes to verify the parties that the witness wishes to verify. Now, hit the ‘save’ button.

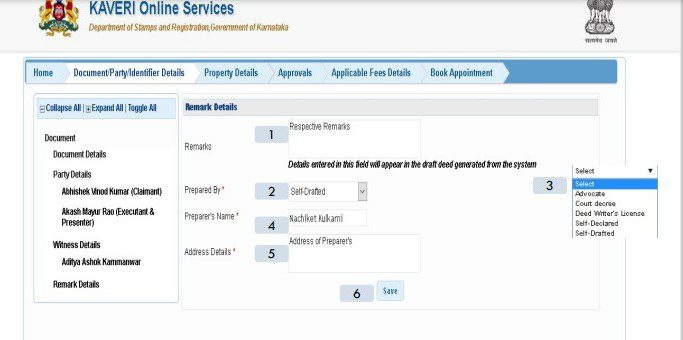

- On the next page, you have to key in the details of the deed creator.

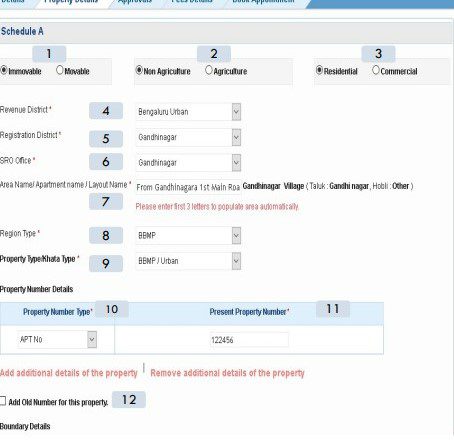

- Next, provide all details about the property and hit save.

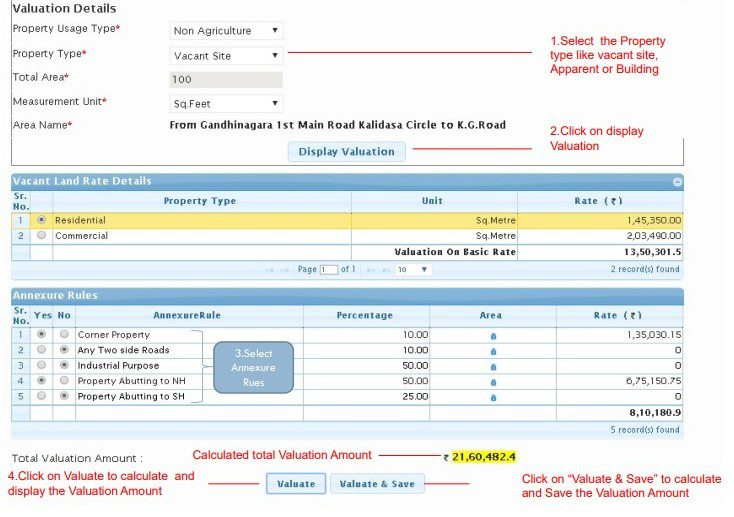

- Then enter valuation details and save.

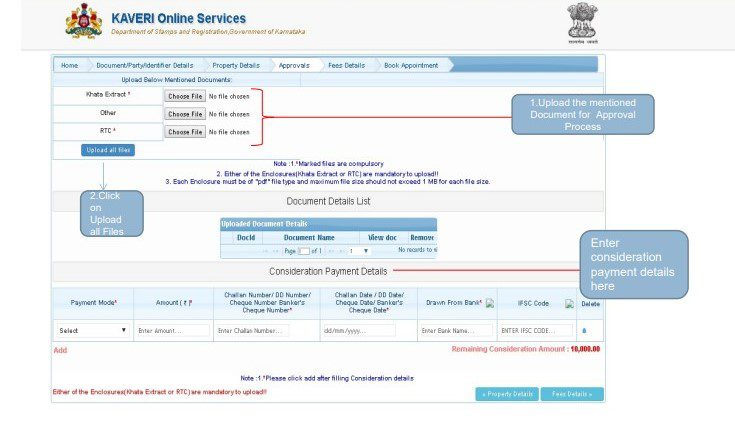

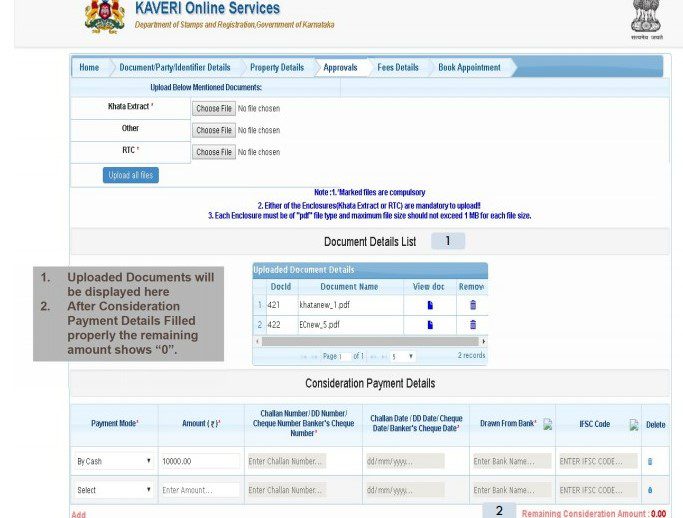

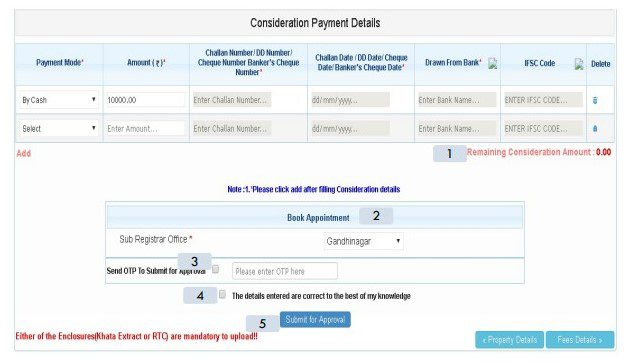

- Upload the documents needed for the registration. It will also ask you to fill in the transaction payment details.

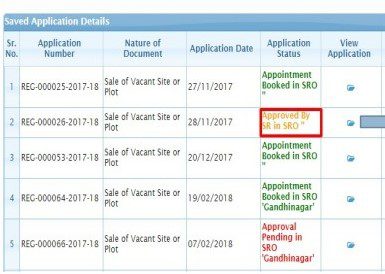

- Your application is now saved, which you can view by clicking on the ‘pending/saved application’ option as shown in the image below.

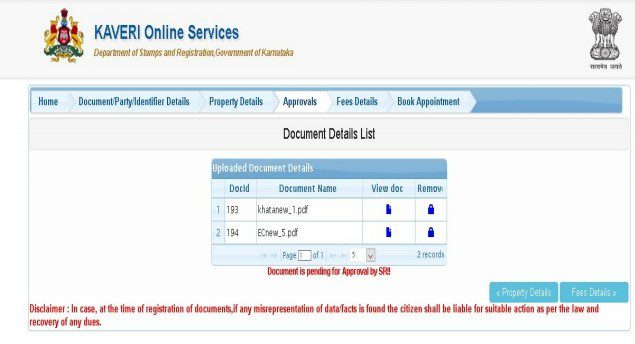

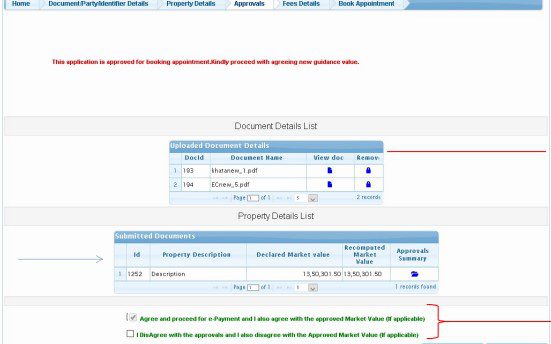

Once the sub-registrar office approves your application, the status of your application changes to ‘approved by SR’. After this you can proceed to book the appointment for the property registration.

- To proceed with the booking, click on the ‘view’ option on your approved application.

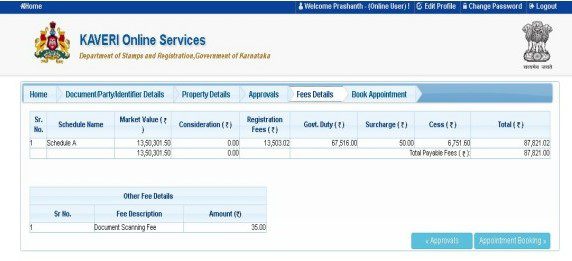

- You now have to pay the fee for online appointment booking.

- Now proceed to book the appointment.

How to make payment for property registration on Kaveri online?

- Once your application is approved by the sub-registrar, your application status will show ‘Pending for Payment’ on your home page. There will also be a call to action to ‘Make Payment’.

- You need to click on the ‘Make Payment’ option, you will see the following screen:

1. If you click on ‘Normal’, you agree with the sub-registrar’s calculations.

2. If you click on ‘Undervaluation’, you do not agree with the sub-registrar’s market valuation.

3. If you click on ‘Impound’, you do not agree with the sub-registrar’s stamp duty calculation.

- Now, select the ‘Normal’ option and click on ‘Continue and Make Payment’.

- You will be redirected to the payment page.

- Select the mode of payment from the list, cash, cheque/draft, net-banking, NEFT RTGS, debit card/credit card.

- Then select the ‘Type of Payment‘. Enter the Captcha.

- Click on ‘Submit’. Once the payment is done, you will get an e-acknowledgment/transaction receipt. If the payment is successful, you will get a transaction receipt like below:

- You can print the challan receipt by clicking on ‘Print Challan Receipt’.

- To return to the application dashboard click on ‘Return to Application’.

- After the payment is successful your application status will change to ‘Pending to Book Appointment’.

How to schedule online appointment on Kaveri online?

- On paying the valuation fee, return to the home page. Here, you can schedule an appointment by clicking the button ‘Schedule’. You can also view your transaction by clicking the View button.

- Now click on Schedule.

- You can schedule your appointment with sub-registrar’s office selected by you in the application.

- Select the date and time for the appointment.

- When you click on a particular date, you will be notified of available time slots for that day.

- Once you click on ‘Book Slot’, you will be notified of the following information. You will also get an SMS with appointment schedule details.

- Your appointment for property registration is now booked on the Kaveri Online Services portal.

- All the parties and witnesses involved in the transaction must appear 15 minutes before the scheduled time before the sub-registrar along with all the uploaded original documents.

- Now, your application status will be Application Submitted Online.

How to calculate stamp duty and registration fee online?

Since no registration is required to use the stamp duty and registration fee calculator, a user can proceed as a guest to know about these charges on various transactions.

- To do this, click on the ‘Stamp duty & registration fee calculator’ on the Kaveri portal’s homepage, as shown in the image below.

- On doing this, a new page will open that would ask you to select from various options the ‘nature of document’. Once you select your option from the drop-down menu, hit on the ‘show details’ button.

- After doing this, the page will ask you to fill in additional details like the region of the property, the market value of the property and the consideration amount. After keying in all this information, hit the ‘calculate’ button. The stamp duty and registration charges for the property transaction would be visible on your screen as shown in the picture below.

See also: All about IGRS Karnataka

How to register sale deed on Kaveri 2.0 online?

The process to register a sale deed on Kaveri Online Services is quite simple and straightforward. Here are a few steps involved in the registration of sale deed on Kaveri 2.0 online services:

- Visit the Kaveri Online Services site and register yourself as a ‘user’.

- After registration, log into the portal with your credentials. After that, click the ‘Document Registration’ tab which will be under ‘Pre-Registration Data Entry’ tab.

- Then enter details like type of document, that is, sale deed, execution date, the number of transacting parties and the page count of your sale deed.

- Fill in the details of the parties involved, that is, the buyer and the seller details as mentioned on their IDs. Fill in the details of the witnesses as mentioned on their IDs. Then fill in all the property details like whether it is agricultural land or non-agricultural land or residential or commercial land. Also, mention location details of the property including name of the revenue district where the property is located, the district where you are needed to register it and the closest SRO office.

- Then calculate stamp duty charges by filling in details like property type, the total area of the property, measurement unit and the locality name.

- Then upload documents like the sale deed, the no-objection certificate, address proof of property buyer and seller and ID proof of buyer, seller and witnesses.

- After this you will be asked to make the payment.

Kaveri 2.0: Various monetary values to be filled at the time of property registration

Total Consideration Amount: The value agreed between both parties.

Total Market Value: The value calculated based on the rates and annexure rules selected.

Government Duty: The stamp duty calculated based on the market value and considerable amount.

Government Duty after exemption: The stamp duty calculated based on the market value and consideration amount deducting the exemptions.

Surcharge Value: A surcharge is an additional charge you are required to pay. This is based on stamp duty. For urban property, it is 2% on stamp duty and for rural property, it is 3% on stamp duty.

Cess Value: An additional charge you are required to pay. This is based on stamp duty. For all properties, it is 10% on stamp duty.

Duplicate stamp duty: The value calculated when you enter a number of duplicate copies. The charge is Rs 500 per duplicate copy.

Total amount of previously paid stamp duty: Stamp duty paid in earlier transactions.

Registration Fee: This is calculated as the percentage of stamp duty.

Duplicate registration fee: The value calculated when you enter a number of duplicate copies. The charge is Rs 200 per duplicate copy.

Mutation Fee: A fixed amount declared by the government, charged in the case of agricultural land to transfer ownership in the land revenue department records (Bhoomi). The mutation fee is zero for non-agriculture properties.

Scanning Fee: The fee for scanning the pages of the documents to be registered and preserving the scanned registered documents.

Private attendance fee: If any party requires the sub-registrar to attend them privately (e.g., at home or hospital), a letter or medical certificate must be attached, the presenter has to attach an appropriate letter or medical certificate. The sub-registrar for taking thumb impression and photo and a fee of Rs 1,000 will be charged for one visit.

Consenting witness: If any of the parties is a consenting witness, a fee shall be levied of Rs 100 per consenting witness.

Memo fees: If two properties of the same owner but coming under different SROs involved in the transaction a memo fee of Rs 100 will be levied.

Can sub-registrar change the market value of the document?

Sub Registrars are authorised to fix the correct market value for the property based on the guidance value published by the Karnataka Government. In case of a wrong selection made by the applicant to determine market value, the sub registrar is allowed to select the correct market value field and send it back to the presenter for resubmission.

Can sub-registrar suggest modification to contents of document submitted online?

Sub-registrars have no powers to suggest any modification in the contents of the documents submitted for online registration of property. It is illegal for documents to be rejected and sent back to the presenter suggesting any modification in the version made in the document.

Kaveri 2.0: List of documents for which stamp duty payment is must

| Document Type | Description |

| Agreement | A contract that is signed between two parties after agreement of the points. |

| Memorandum of Agreement | Official record of agreement |

| Power of Attorney | Giving responsibility to someone to act on behalf of another person |

| Valuation or Assessment | Set the value of property or asset |

| Deed of Transfer | Legal rights transfer |

| Deed of Cancellation | Suspension of agreement or contract |

| Sale Deed Cancellation | Making sale process invalid |

| Certificate or Other Documents | Certificates that are issued for verification purposes |

| List of Withdrawals | List of assets or properties |

| Conveyance Deed | Property merger documents |

| Registration of Vehicle | Documents for vehicle registration |

| Property Exchange | Documents related to property transactions |

| Lease Agreement | Land or buildings’ agreement of lease |

| Loan Agreement | Signed contract for loans |

| Power of Attorney | Giving legal rights to someone |

| Release Deed | Relinquishing rights documents |

| Settlement Deed | Property distribution documents |

| Surrender of Lease | Termination of lease documents |

What services can guest users access on Kaveri 2.0 portal?

- Generate challan

- Verify challan payment status

- Stamp duty and registration fee calculator

- Calculate guidance value

- Property valuation.

- Marriage office

- Locate SROs

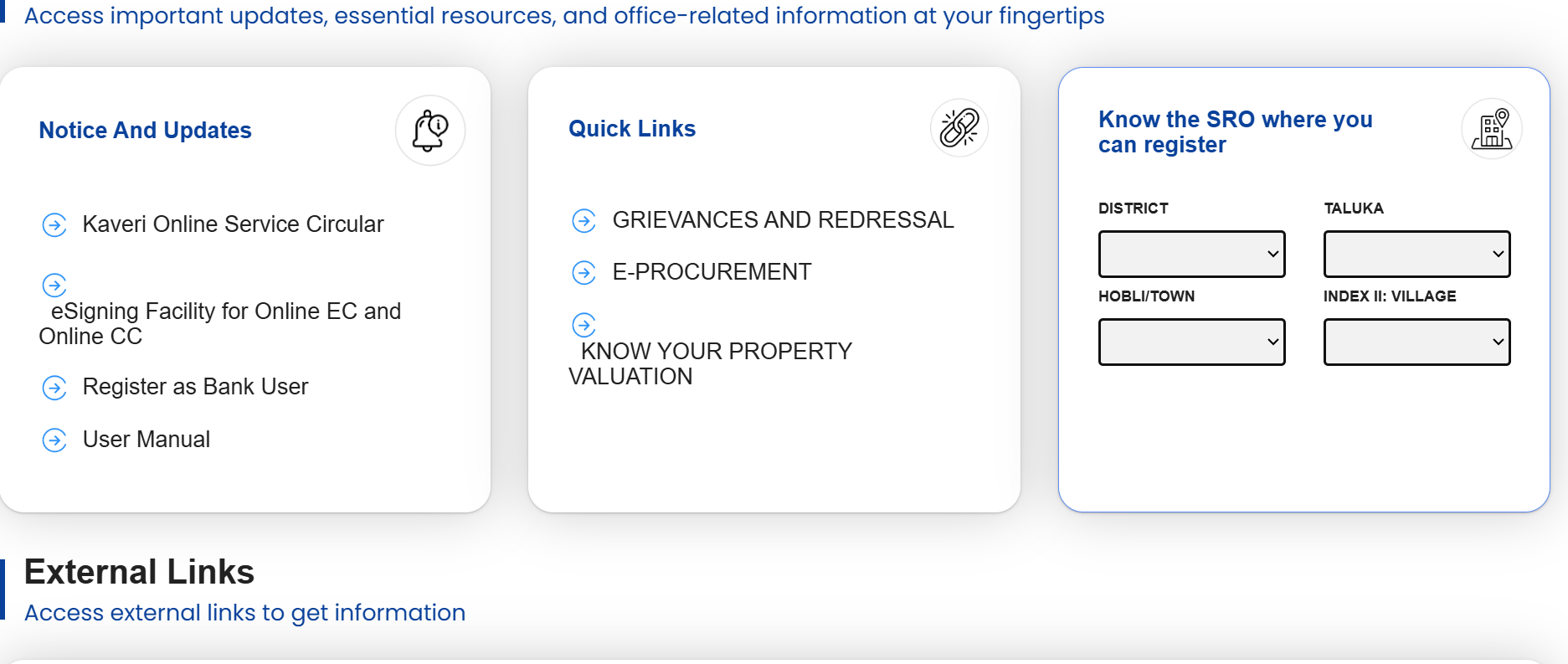

How to calculate guidance value online on Kaveri 2.0?

- To find the guidance value on Kaveri online, click on ‘know your property valuation’ under online services.

- Enter details such as district, location, kind of property, how it will be used, the surface area, unit of measurement etc. and click on display valuation.

- You will view the appropriate valuation of the property.

- Choose the property type again to get a final approximate amount for your property based on the guidance value.

How to generate challan online on Kaveri 2.0?

This facility can be used by a guest user by following these simple steps:

- On the Kaveri Online homepage, you will find the option ‘Generate Challan’ towards the lower end of the page.

- Once you click on that option, a long form will open, in which you will have to fill several details.

- Fill all the details, enter the security code and click on the Submit button to generate the challan.

Know about: Bangalore rent

How to check challan payment status on Kaveri 2.0 online?

Once you have generated a challan on Kaveri online, you can also check the challan payment status. This facility too can be used by guest users by following the below-mentioned steps:

- On the Kaveri Online homepage, find the ‘Verify Challan Payment Status’ option.

- Enter application number to proceed with your search.

How to locate the sub-registrar office through Kaveri Online Services?

- On the homepage, locate the Know the SRO where you can register.

- Select district, taluka, Hobli/town and Index II: Village

- You will get the SRO office name and its address with whom you can register.

See also: How to register property online in Bengaluru

Kaveri 2.0 mobile app

While there is Bhoomi Karnataka official app, there is no Kaveri 2.0 mobile app available on Google Playstore. Users should be wary of downloading fraudulent apps that may result in unwanted activities.

What are the benefits of Kaveri 2.0 online services portal?

- The Kaveri Services portal is available 24X7.

- The portal is secure and user-friendly. The registration process is simple involving basic information.

- The Kaveri online portal facilitates electronic signature tool for generating encumbrance certificates.

- There is a user manual available on the Kaveri online portal to assist users in navigating the website in English and Kannada.

- To maintain system integrity, Kaveri 2.0 does not support use of multiple tabs in a browser.

Common issues faced on Kaveri portal

- Issues related to login, payment and processing: To ensure smooth transaction, use a supported browser, check the transaction history, track application status etc.

- Customer support: Use the Kaveri portal’s email id or helpline for assistance.

-

“Multiple active session is detected. Do you want to clear all your previous active session(s)?” error message – Most users are getting this message. According to a reddit user zencitizen, this usually means you closed the Kaveri portal tab without logging out and are now trying to log in again, or you are attempting to log in on one device while still logged in on another. Just click OK. You may need to repeat this a couple of times until you receive the OTP and can log in.

-

Known unresolved issues: According to a redditor with the name Data__Sorceress, when selecting the checkbox “Can’t locate your property”, the system prompts you to enter a document reference number from the Sale Deed. However, clicking ‘View Documents’ yields no response, leaving this functionality unusable. So, having a property identifier is important.

Tips for using Kaveri portal 2.0

- Use updated versions of browsers for easy access to Kaveri portal.

- Before proceeding with property investment, verify EC of the property using the official Kaveri portal.

- Take appointments to avoid delays.

- Keep scanned copies of all property related documents during a transaction.

Who should use the Kaveri portal?

- The Kaveri portal is helpful for investors and homebuyers for due diligence before buying a property.

- The Kaveri portal is helpful for lawyers to validate property ownership and encumbrances.

- The Kaveri portal is helpful for banks and NBFCs before approving a home loan for property.

- The Kaveri portal is helpful for real estate consultants to know all about the property.

How to file grievance on Kaveri 2.0?

- Click on grievances and redressal under Quick Links on Kaveri 2.0 page.

- You will reach https://pgportal.gov.in/

- Register on the website and submit the grievance.

- It will be assessed by authorised officials.

- Based on the complaint, redressal will be offered.

Note that grievances sent by email will not be accepted or processed. Please lodge your grievance on this portal.

Kaveri helpline email IDs

Bangalore urban zone

sd1.igro@karnataka.gov.in

Bangalore rural zone

sd2.igro@karnataka.gov.in

Gulbarga zone

sd3.igro@karnataka.gov.in

Belgaum zone

sd4.igro@karnataka.gov.in

Mysore zone

sd5.igro@karnataka.gov.in

Kaveri helpline number: 080-68265316

Land registration in Karnataka: Contact information

Office Locations & Contacts in Bangalore

Sub-Registrar Corporate Office,

Ambedkar Veedhi, Sampangi Rama Nagar,

Bengaluru, Karnataka 560009

Deputy Secretary to Govt. (Land Grants & Land Reforms)

Room No. 526, 5th Floor, Gate – 3, M S Building,

Dr. BR Ambedkar Veedhi, Bangalore, 560001.

Phone number: +91 080-22251633

Email ID: prs.revenue@gmail.com

Website: kaverionline.karnataka.gov.in

Housing.com POV

Having already simplified the property registration process in the state with Kaveri 2.0, the Karnataka government is now planning to take this process entirely online. This would do away with the formality of the buyer and the seller having to visit the sub-registrar’s office for final bio-metric verification. The Registration (Karnataka Amendment) Bill, 2024, proposes to enable technical property registration without the physical presence of both the seller and the buyer. The presence of both parties at Deputy Registrar Offices had resulted in crowding and complaints of inadequate facilities.

FAQs

HD Kumaraswamy, the former chief minister of Karnataka, launched Kaveri Online Services in 2018.

Encumbrance certificates provide information on whether there are any claims on the property title. This helps you to understand the ownership pattern on the property in question.

The Kaveri Online Services website provides many important services which are related to property like Online Commencement Certificates, Encumbrance Certificates, Stamp Duty & Registration Fee Calculation, Valuation of property and even locating Sub-Registrar Office.

The process to download online Encumbrance Certificate on Kaveri Online Services is quite simple. You will have to login to Kaveri Online Services portal with proper credentials and then click on The Saved Applications tab and then select View Application and then simply Download.

After the application form is filled and the payment is made, it only takes 7-10 days to obtain digitally signed Encumbrance Certificate.

First-time users can go to the Kaveri 2.0 website URL: https://kaveri.karnataka.gov.in/landingpage” in any of the browsers and click on the register button. Enter the citizen details which all are mandatory fields, then citizen will get the auto-generated password to your register mobile number/eMail ID. After that, you can log in to the citizen page by using your email id and generated password to avail the services.

Yes. Post login to the portal, there is an option called “Change password” by clicking profile/account which is present at the right top corner of the screen to reset the password by providing the old password and new password then click on Change. After that, you can log in to the portal with a new password.

When citizens receive a notification for payment, a citizen can pay the required amount online by selecting the payment gateway and selecting the applicable mode of payment and paying the required amount on the fly.

Debit/Credit cards which are provided by the bank to make the online payment 3. UPI (GPay/Phone Pe)– Citizens can use their UPI-enabled account to make the online payment

Yes. However, one has to wait for 24 hours to reschedule the slot.

Deeds that need registration in Karnataka include: 1. Agreement or Memorandum of agreement 2. Joint Development Agreement 3. Appraisement or valuation 4. Award 5. Bond 6. Clearance list 7. Cancellation 8. Cancellation of deed 9. Certificate of sale 10. Certificate or other document 11. Composition deed 12. Exchange of property 13. Gift deed 14. Lease of immovable property where the lease purports to be for a term exceeding twenty year and not exceeding 30 years 15. Mortgage deed 16. Power of attorney 17. Joint Development GPA 18. Settlement 19. Release deed 20. Surrender of lease 21. Trust

Cash Cheque Draft The modes of payment allowed on Kaveri 2.0 include: Net banking NEFT RTGS Debit Card Credit Card

11E sketch number is prepared by the survey or land revenue department through the tahsildar of the taluka when the portion of the survey number property is transacted, and it will give sub number or Pyki number for a divided portion of the land along with boundaries.

Among the many local land measurement units commonly used in India is Guntha. Alongside the globally accepted known measurement units, guntha is also used in several parts of northern India and Pakistan for land measurement purposes. Use of guntha is common in measuring agricultural land in rural parts of the northern states in India, along with Gujarat, Karnataka, Maharashtra, Odisha. Also known as Gunta, the unit typically used to measure comparatively smaller portions of agricultural land. Since gram panchayat land is now being widely used to build real estate projects and develop plot-based constructions, homebuyers and investors must be aware of the use of gunta and the conversion process.1 Guntha is equal to 1,089 square foot.

No, an EC only displays transactions for a specific time period if it has been registered with the Sub Registrar's Office in Book-1. Wills and Adoption Deeds registered in Book-3 and Power of Attorney registered in Book-4 are not reflected in EC.

Pending litigation on the property is not reflected in the encumbrance certificate.

Effective August 31, 2025, the revised registration charges will be 2% of the property value.

Upon Signing the document from Departmental staffs, an option to download the signed copy will appear in citizen login through which citizen can download the Signed copy.

Adobe Reader 10 is required to view downloaded document.

The application fee is Rs 10 while the search fee is Rs 30 for 1st year and Rs10 for every subsequent year.

No. It is not possible, because each login is mapped to the respective application. For example, if the application is submitted with an x login, the upload of the document should be done with the same login.

When citizens receive a notification for payment, a citizen can pay the required amount online by selecting the payment gateway and selecting the applicable mode of payment and paying the required amount on the fly.

There are multiple payment modes available for payment on Kaveri 2.0. These include net banking, debit card, credit card, and UPI (GPay/Phone Pe).

Yes. After scheduling, in any case, if it is required to reschedule the slot, we need to wait for 24 hours to reschedule the slot.

No. There are no charges for the rescheduling of the slot. When was Kaveri Online Services launched?

Why is it important to have an encumbrance certificate?

What are various services offered through Kaveri Online Services?

How is Encumbrance Certificate downloaded online through Kaveri Online Services?

How long does it take for online verification of Encumbrance Certificate?

How can first-time users register on Kaveri Online website?

Can I reset password on Kaveri Online website?

How to do online payment for registration on Kaveri online?

What payment options are there on Kaveri Online portal?

Is rescheduling possible on Kaveri portal?

Which documents need to be registered on Kaveri Online?

What are the modes of payment allowed on Kaveri 2.0?

What is 11E Sketch Number?

What is Guntha?

Do all transactions appear on EC?

Are pending court cases reflected in EC?

What is the revised registration fee in Karnataka?

How to download a digitally signed EC at Kaveri 2.0?

What is needed to view the downloaded EC at Kaveri 2.0?

How is the fee calculated for online EC at Kaveri 2.0?

Can I upload document for property registration on Kaveri 2.0 using the login ID of a third person?

How can I do online payment for property registration on Kaveri 2.0?

What are the modes of payment available on Kaveri 2.0?

Is rescheduling after appointment for property registration on Kaveri 2.0 possible?

Are there any charges for rescheduling?

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |