Stamp duty is the legal fee that a buyer pays to the sub-registrar of the area to get a property registered in government records. How much money you will have to pay as stamp duty and registration charge in 2024 if you are buying a property in Bangalore?

Stamp duty for men in Bangalore/ Karnataka 2024

| Property cost | Stamp duty for men |

| Property above Rs 45 lakh | 5% |

| Property between Rs 21 lakh and Rs 45 lakh | 3% |

| Property up to Rs 20 lakh | 2% |

Stamp duty for women in Bangalore/Karnataka 2024

| Case | Stamp duty rate in Karnataka |

Registration charges in Bangalore/ Karnataka |

| When a man, woman or joint owners (regardless of gender) buy the property | 3% on properties of up to Rs 45 lakh

2% on properties less than Rs 20 lakh |

1% of the property value |

Registration charges for men/women in Bangalore/ Karnataka 2024

| Property cost | Registration charge |

| Property above Rs 45 lakh | 1% |

| Property between Rs 21 lakh and Rs 45 lakh | 1% |

| Property up to Rs 20 lakh | 1% |

See also: All about gift deed stamp duty

Surcharge on stamp duty in Bangalore

Besides stamp duty in Karnataka, you will have to reserve a budget for the cess and surcharge as part of the property registration charges in Bangalore and other cities within the state. For properties priced above Rs 35 lakh, a cess of 10% and a surcharge of 2% are applicable. This is in the case of urban areas. So, effectively, you will be paying 5.6% as stamp duty. In the case of rural areas, a home buyer pays 5.65% as the stamp duty, because the surcharge is 3%.

See also: All you need to know about Kaveri Online Services

Stamp duty on other legal instruments in Bangalore, Karnataka

In a move that would substantially increase the cost of document registration in the state, the Karnataka government on December 11, 2023, passed a bill to hike stamp duties on various instruments of property transfer. After being tabled in the State Assembly on December 7, the Karnataka Stamp (Amendment) Bill, 2023, which aims to hike stamp duty in the state was passed on December 11.

Stamp duty in Karnataka after December 11, 2023, revision

Adoption deed

Now, stamp duty on adoption deeds will go up from Rs 500 to Rs 1,000.

Affidavits

Stamp duty on affidavits will rise from Rs 20 and up to Rs 100.

Powers of attorney

Stamp duty on powers of attorney hiked from Rs 100 to Rs 500. When more than five but not more than 10 people are authorised by the PoA, stamp duty will be Rs 1,000 in place of the earlier Rs 200.

Divorce papers

Stamp duty on divorce papers will go up from Rs 100 to Rs 500.

Certified copies

For certified copies, stamp duty will increase from Rs 5 to Rs 20.

Trusts

Stamp duty on registering trusts will be increased to Rs 2,000 from the existing Rs 1,000.

Conveyance deed of amalgamation of companies

For conveyance deeds involving amalgamation of companies, stamp duty has been hiked to 5% from 3%.

Property partitions converted for non-agricultural purposes

Stamp duty for property partitions converted for non-agricultural purposes will increase from Rs 1,000 per share to Rs 5,000 per share in urban areas.

Stamp duty for property partitions converted for non-agricultural purposes will increase from Rs 500 per share to Rs 3,000 per share in gram panchayats.

Stamp duty for agriculture property partition will increase from Rs 250 per share to Rs 1,000 per share in gram panchayats.

Stamp duty on commercial property in Bangalore

To register commercial property —which includes business establishments and office spaces, including hospitals/private schools and colleges—the following stamp duty must be paid:

Stamp duty: 5% on the market value or consideration amount whichever is higher

Cess: 10% on the stamp duty

Surcharge: If the property comes under the urban zone, 2% on stamp duty.

If the property comes under the rural zone, 3% on stamp duty.

Registration fee: 1% on the market value or consideration amount whichever is higher.

Stamp duty on industrial property in Bangalore

To register industrial property — properties used for the establishment of factories and industries—the following stamp duty must be paid:

Stamp duty: 5% on the market value or consideration amount whichever is higher.

Cess: 10% on the stamp duty.

Surcharge: 2% of stamp duty if the property comes under urban zone.

3% of the stamp duty if the property comes under the rural zone.

Registration fee: 1% on the market value or the consideration amount, whichever is higher.

Stamp duty in Karnataka before the December 11, 2023, revision

| Document | Stamp duty | Registration fee |

| Adoption Deed | Rs 500 | Rs 200 |

| Affidavit | Rs 20 | — |

| Agreement relating to sale of immovable property | ||

| (i) with possession | 5% on the Market Value | 1% |

| (ii) without possession | 0.1% on Market value equal to the amount of consideration Min.500, Max.20,000 |

Rs.20 |

| (iii) Joint Development Agreement | 1% Max Rs 15 lakh | 1% Max Rs 1,50,000 |

| Agreement relating to Deposit of Title Deeds (D.T.D) | 0.1% Min Rs 500, Max Rs 50,000 |

0.1% Min Rs 100 Max Rs 10,000 |

| Cancellation of Instruments

a) Cancellation of any instrument previously executed on which stamp duty has been paid as per any article of the schedule |

Same duty as on the original instrument Provided that if the original instrument is a conveyance on sale, then the stamp duty is as per article 20(1) | Rs.100 or 1% on Market value if it is cancellation of conveyance |

| b) In favour of Govt. or Local Authorities | Rs 100 | Rs 100 |

| c) In any other case | Rs 100 | Rs 100 |

| Conveyance (including flats/apartments) | 5% on the market value+ Surcharge + additional duty | 1% |

| Conveyance by BDA / KHB | 5% on Consideration shown in the document + Surcharge + Additional duty | 1% |

| Conveyance on Transferable Development Rights (TDR) | 1% on Market value or consideration whichever is higher + Surcharge + Additional duty | 1% |

| Exchange | 5% on the market value on the higher value of the two + Surcharge + Additional duty | 1% |

| Gift | ||

| (i) If Donee is not a family member of donor | 5 % on the market value+ Surcharge + Additional duty | 1% |

| (ii) If Donee is a specified family member of donor | Rs 1,000 + surcharge & Additional duty | Rs 500 fixed |

| Lease of immoveable property / License | ||

| (i) Up to 1 year residential | 0.5% on the average annual rent (AAR) + Advance + Premium + Fine. Max.500 |

100 |

| (ii) Up to 1 year commercial and industrial | 0.5% on the average annual rent (AAR) + Advance + Premium + Fine. | Rs 5 for every Rs 1,000 or part thereof Min Rs 100 |

| (iii) > 1yr < 10 years | 1% on AAR + Advance + Premium + Fine | Rs 5 for every Rs 1,000 or part thereof |

| (iv) > 10yrs < 20 years | 2% on AAR + Advance + Premium + Fine | Rs 5 for every Rs 1,000 or part thereof |

| (v) > 20yrs < 30 years | 3% on AAR + Advance + Premium + Fine | Rs 5 for every Rs 1,000 or part thereof |

| Lease Only | ||

| (vi) > 30 yrs or perpetuity or not for definite term | As per Art 20(1) on Market value or AAR+ advance + premium + deposit + fine whichever is higher | 1% |

| Lease of immoveable property between Family members | Rs 1,000 | Rs 500 |

| Mortgage | ||

| (i) If possession of property is given | 5 % on the amount + surcharge | 1% |

| (ii) If possession of property is not given | 0.5% + Surcharge | 0.5% Maximum of Rs 10,000/- |

| Partition | ||

| (a) (i) For Non Agriculture (converted) Property situated in Municipal Corp. Or Urban Dev. Authorities or Municipal Councils or Town Panchayats area |

Rs 1,000 per share | Rs 500 per share |

| ii) Other than the above | Rs 500 per share | Rs 250 per share |

| (b) Agri Land | Rs 250 per share | Rs 50 per share |

| (c) Movable property | Rs 250 per share | Rs 100 per share |

| (d)Combination of above | Maximum of above per share | Maximum of above per share |

| Power of attorney | ||

| For Regn. Of admission of execution of one or more documents | Rs 100 | Rs 100 |

| Authorizing one or more person to act in single transaction | Rs 100 | Rs 100 |

| Authorizing not more than 5 persons to act in more than one transaction or generally | Rs.100 | Rs.100 |

| Authorizing more than 5 and not more than 10 persons in more than one transaction or generally | Rs 200 | Rs 100 |

| When given for consideration and or coupled with interest and when authorising the attorney to sell any immovable property | 5% on the market value or consideration amount whichever is higher | 1% |

| When given to a promoter or developer | 1% on market value of Property or consideration whichever is higher. Max Rs 15 lakh |

1%

(Max Rs 1.5 lakh) |

| When given to persons other than father, mother, wife or husband, sons, daughters, brothers, sisters in relation to the executant, authorising such person to sell immovable property situated in Karnataka state | 5% on the market value of the property | 1% |

| In any other case | Rs 200 | Rs 100 |

| Re-conveyance of mortgage property | Rs 100 | Rs 100 |

| Release | ||

| (i) Where release is not between family members | 5% on market value or consideration whichever is higher | 1% on market value or consideration whichever is higher |

| (ii) Where release is between family members | Rs 1,000 | Rs 500 |

| Settlement | ||

| (i) If disposition of property is not among the family members | 5% on the market value + Additional duty | 1% on the market value |

| (ii) If disposition of property among the specified family members | Rs 1,000 Additional duty | Rs 500 |

| (iii) Revocation of Settlement | Rs 200 | Rs 100 |

| Surrender of Lease | Rs 100 | Rs 100 |

| Transfer of Lease | ||

| (a) Where the remaining period is less than 30 years | 5% on the consideration | 1% on the consideration |

| (b) Where the remaining period is more than 30 years | 5% on the market value | 1% on the Market value |

| Trust | ||

| (i) Declaration of Trust- Concerning any money or amount conveyed by the author to the trust as corpus | Rs 1,000 | 1% |

| (ii) Concerning any immovable property owned by the author and conveyed to the trust of which the author is the sole trustee | Rs 1,000 | 1% |

| (iii) Concerning any immovable property owned by the author and conveyed to the trust of which the author is not a trustee or one of the trustees. | 5% (under article No. 20(1)) | 1% |

| (iv) Revocation of Trust | Max Rs 200 | Rs 100 |

| Will deed | NIL | Rs 200 |

| Cancellation of Will | Rs 100 | Max Rs 200 |

| Deposit of a Sealed Cover containing a will | Nil | Rs 1,000 |

| a) Withdrawal of Sealed Cover | Nil | Rs 200 |

| b) Fee for opening sealed Cover | Nil | Rs 100 |

How to calculate Bangalore stamp duty?

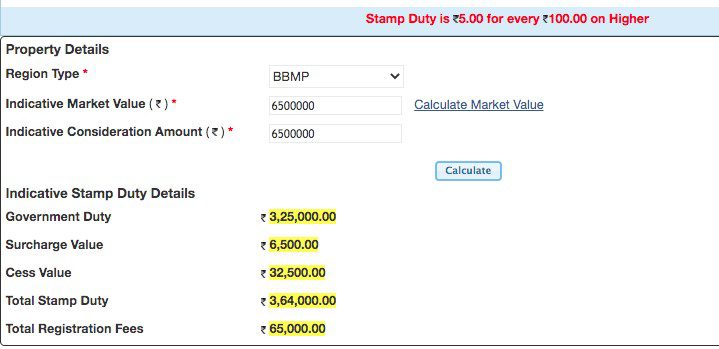

Step 1: Simply log on to the Kaveri Online Services website or click here to be directed to the page.

Step 2: The Karnataka stamp duty calculator has certain prerequisites. Fill in the nature of the document and proceed. In this case, we have selected ‘sale of flat’ as the nature of the document.

Step 3: You will be asked to fill in property details such as region type – whether BBMP, city corporation, municipal corporation, town panchayat, gram panchayat, or others. You can choose this from the drop-down menu.

Other details to be included are the indicative market value and the indicative consideration amount. What is the indicative consideration amount? To arrive at the stamp duty rates and charges, the market value is the value as worked out as per the consideration (or ready reckoner, or stamp duty) mentioned in the document, whichever is higher. If the consideration value is higher, this will be taken into account to calculate stamp duty.

If you are unaware of the market value, you can also calculate it at this stage using the calculator provided. Simply click on ‘Calculate market value’ to proceed.

Once you have filled in the details, the calculator will show you the indicative stamp duty charges, surcharge, cess, total stamp duty and total registration fees for your property.

See also: All about IGR Maharashtra online search

See also: All about Karnataka Bhoomi RTC Portal

Type of property and area taken into consideration to calculate stamp duty

| Property type | Area taken for calculation purposes |

| Multi-storey apartments | Super built-up area |

| Plots | Sq ft area of plot multiplied by current guideline value |

| Independent houses | Total constructed area |

Factors involved in stamp duty charges

| Factor | How it impacts |

| Age of the property | Older properties are cheaper |

| Age of the buyer | Senior citizens need to pay lower stamp duty |

| Gender of owner | In most states, women pay lower stamp duty. In Bangalore, rates are the same for both men and women. |

| Nature of property | Higher stamp duty for commercial properties. |

| Location of property | Properties in urban areas command higher stamp duty |

| Amenities and services | More amenities mean higher stamp duty. |

Note that there are many factors that determine stamp duty charges. These also impact the house or flat registration charges in Bangalore and other cities, which homebuyers need to consider.

Formula to calculate stamp duty

The formula to calculate the stamp duty on your property is:

Stamp duty = (Property value/100) x stamp duty rate

Depending on the property value, you have to calculate the stamp duty by taking out the applicable percentage. If the property value if Rs 50 lakh, for instance, the applicable stamp duty would be 5% of the Rs 50 lakh. This way, the buyer will have to shell out Rs 2.5 lakh stamp duty.

If the same property fell is being registered in the name of a woman, the applicable stamp duty would be 3%. Then, the buyer will have to pay Rs 1.50 lakh as stamp duty.

Housing.com viewpoint

Stamp duty and registration fee significantly increase the cost of property possession in India, especially in cities like Bangalore where property rates are already tremendously high. Because of the variation in charges depending on various factors, these duties might lead to utter confusion of homebuyers. For better planning and budgeting, having a clear understanding of these charges is an absolute must.

FAQs

Who pays stamp duty, the buyer or seller?

Starting July 1980, the buyer must pay stamp duty on the market value of the immovable property.

Which cities have high stamp duty rates?

Chennai, Kerala and Hyderabad are among cities that have a high stamp duty, in the range of 7% to 9%.

How much is the BBMP & Corporation added surcharges?

It comes to 2% on stamp duty.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]