If you are purchasing a property in Madhya Pradesh, then the stamp duty and registration charges in MP are the additional costs you must consider. This is the money that a buyer has to pay to the state government along with registration charges to legally register the property in the government records. It is mandatory to pay these charges to avoid disputes and illegal activities on the buyer’s property. Note that any immovable property – gift, sale deed, exchange deed, partition deed etc., requires a stamp duty to be paid and subsequently registered in the new owner’s name.

In this guide, know what is the stamp duty in Madhya Pradesh, the registration charges commanded in the state, the stamp duty charges for different document types and the payment of stamp duty in Madhya Pradesh.

What is stamp duty in Madhya Pradesh?

The stamp duty and registration charges in Madhya Pradesh are governed by the Registration and Stamps Department of Madhya Pradesh also known as Inspector General of Registration (MPIGR). These charges are fixed by the government based on the circle rates of the property.

In Madhya Pradesh, you must pay stamp duty of 7.5% and and registration charges of 3% of property’s value. These charges are applicable for transfer of ownership of properties too.

Stamp duty waiver in Madhya Pradesh

The stamp duty charges in Madhya Pradesh was 9.5 percent of the property value before 2020. However, to encourage more people to invest in property, the state government reduced the Madhya Pradesh stamp duty by 2%- from 9.5% to 7.5%.

Factors that impact stamp duty in MP 2025

- Usage and property type: Stamp duty charges are different for commercial and residential property. A commercial property’s stamp duty is more than a residential property.

- Location: These are higher in urban areas of a municipal body.

- Amenities: A property with state-of-the-art amenities will command higher stamp duty.

- Age of property: Newer properties command more stamp duty than older properties.

See also: What is stamp duty? How does it affect a homebuyer?

Stamp Duty 2025 in Madhya Pradesh

| Stamp duty in MP for male | 7.5% |

| Stamp duty in MP for female | 7.5% |

| Joint (Male+ Male)

(Male+Female) (Female+Female) |

7.5%

7.5% 7.5% |

Registration charges in Madhya Pradesh 2025

| Registry charges in MP | |

| Male | 3% |

| Female | 3% |

| Joint

(Male+ Male) (Male+Female) (Female+Female)

|

3% 3% 3% |

The total registration charges include municipal fees and panchayat fees if applicable.

Principal stamp duty: 5-2% cess

Municipal stamp duty: 3%

District stamp duty: 1 %

Upkar stamp duty: 0.5%

See also: How to do Khasra number check MP

Stamp duty in MP 2025 on different documents

Stamp duty in MP 2025 on different documents

| Document type | Stamp duty |

| Stamp duty on lease deed | 8% of total rent and deposit |

| Stamp duty on gift deed to family members | 1% of the market value of a property that must exceed Rs 1,000 |

| Stamp duty on gift deed to others | 5% of a property’s market value |

| Stamp deed on sale deed | 7.5% |

See also: All about laws of property registration in India

How to calculate stamp duty and registration charges in MP in 2025?

If the market value of your property is Rs 5,00,000, and the ready reckoner rate is Rs 45,00,000, then the stamp duty will be calculated on the basis of the market value.

Thus, current stamp duty is 7.5% of Rs 5,00,000 that is equal to Rs 3, 75,000.

Registration charges are 3% of the property cost.

Thus, the registration charge is 3% of Rs 5,00,000 that is equal to Rs 1,50,000.

How to check stamp duty charges on IGR Madhya Pradesh?

- Go to the official website https://www.mpigr.gov.in/ and login using your credentials.

- Click on Stamp Duty and Registration Fee Chart.

- You will reach the following PDF where you can check the chart https://www.mpigr.gov.in/igrs_cms_api/api/website/download?filePath=docs/Stamp_Duty_and_Registration_Fee_Chart.pdf

Is GST included in stamp duty and registration charges in MP?

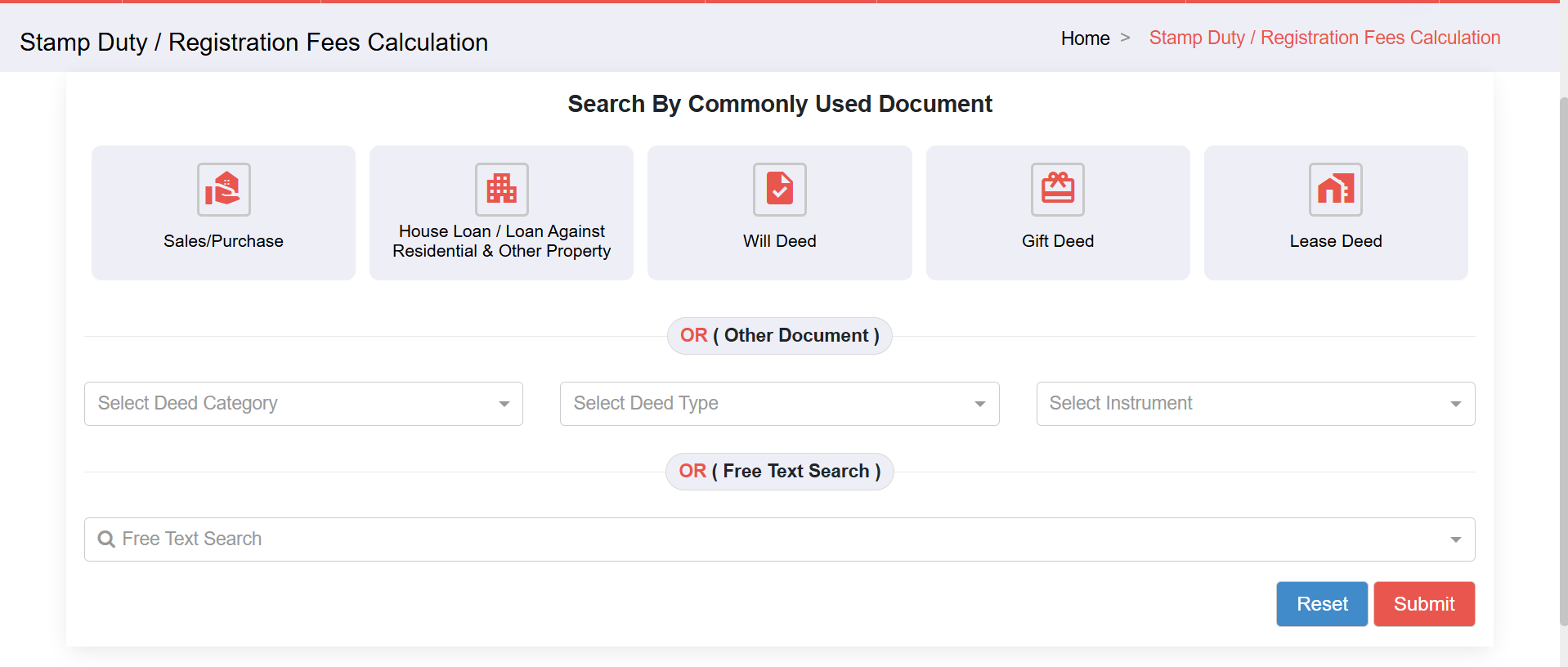

How to calculate stamp duty in Madhya Pradesh 2025 using Sampada 2.0 portal?

- Go to Sampada portal and click on stamp duty and registration charges on the page.

- Next select the deed for which you want to calculate the stamp duty and registration charges.

- Next fill in the deed category, deed type etc. and click on submit to check the stamp duty and registration charges.

What are the different ways to pay stamp duty in Madhya Pradesh?

You can choose to pay the stamp duty, either by going to the sub-registrar’s office and directly paying it in person, or via e-stamping or franking.

E-stamping in Madhya Pradesh

An online method of paying non-judicial stamp duty for a property to the government is known as E-stamping.

- In MP, you can pay the stamp and registration charges online through the – Stamps and Management of Property and Documents Application (SAMPADA).

- Prior to SAMPADA, stamping and related work was very strenuous for a layman and it took days to deliver the certified documents. Now, it is faster and much easier to access. Also, documents get saved for future reference.

- As per directions from the authorities, online payments may work only if you have chosen English as the language on the login page and details entered are in English. Also note that digital signatures are mandatory.

The Madhya Pradesh government has appointed the senior district registrar of some districts who will be responsible to issue licenses to e-stamping service providers in the state.

See also: Land and property registration online: Process and charges in India explained

Things to remember before opting for e-stamping in Madhya Pradesh

- E-stamping works if the language chosen is English

- All details for e-stamping should be filled in English

- For e-stamping, digital signatures is important

- It is advised to not click refresh button or back button until the e-stamping payment is not done

How to pay stamp duty in MP online?

Login to the official website of IGRS MP on https://www.mpigr.gov.in/indexEnglish.html .

Click on ‘e stamp verification’. First sign in by clicking on Sign In.

Once logged in, on the E-stamp details search, enter e-stamp id, enter captcha, select language and click on search.

See also: All about MP bhu naksha

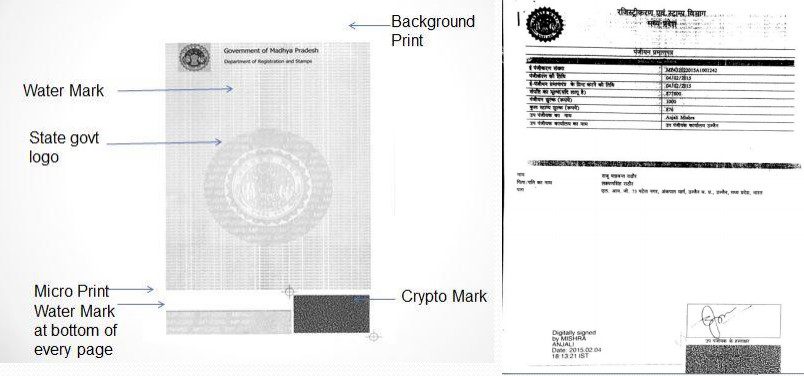

What does an e-stamped document look like?

Details on an e-stamp will include the following:

- Serial number or a unique identification number.

- Date and time of issuance.

- Amount of stamp duty paid (in words and figures).

- Name of the purchaser and the other party.

- Address of purchaser and other party.

- Description of the property or subject.

- User ID.

- Code of service provider.

- Digital signature, authorised barcode.

- Security features.

E-stamped document

Stamp duty in MP using Franking

You can also pay the stamp duty charges through the banks and post offices, approved and designated by the MP government..

See also: What are Franking charges?

What are the documents required to register property in Madhya Pradesh?

- Sale deed

- Title deed

- Encumbrance certificate

- Property tax receipts

- Khata certificate

- Sale agreement

- PAN Card

- Aadhaar Card

- Passport size photos

- No Objection Certificate

- Power of Attorney

- Stamp duty and registration fees proof

- Occupancy certificate for new buildings

- Completion certificate for under-construction buildings

How to register a property in Madhya Pradesh?

Once the stamp duty has been paid, then the buyer and the seller along with two witnesses should take an appointment and visit the Sub-Registrar’s Office. All documents mentioned above should be carried and submitted to the SRO. Once the documents are verified, the SRO will send the documents for registration. Post registration, one should collect these papers. In case the home-buyer has borrowed a home loan, then the bank will take possession of these registered property documents until the home loan has been paid off.

See also: How to link MP land records with Samagra ID?

How to apply for stamp duty refund in Madhya Pradesh?

In case of cancelled sales deed, one should apply for stamp duty refund within six months of the property registration process. In cases, where the stamp duty has been paid and the transaction is aborted, a reimbursement application should be filed to the Deputy Commissioner. On the basis of the situation, a decision will be taken in which the MP state government may levy a 10% deduction on the original stamp value. Note that the registration charges for registered properties will not be refunded.

Penalty for late payment of registration fee in Madhya Pradesh

Stamp duty and registration charges are one of the biggest sources of revenue for the Madhya Pradesh state government and hence strict penalties are imposed if these are not paid under Section 25 of the Registration (Amended) Act, 1908.

| Delay timeline | Penalty |

|---|---|

| Delay does not exceed a month | Twice the amount of property registration fee |

| Delay of more than one month but less than two months | Four times the amount of property registration fee |

| Delay of more than two months but less than three months | six times the amount of property registration fee |

| Delay of more than three months but less than four months | 10 times the amount of property registration fee |

Source- https://invest.mp.gov.in/wp-content/uploads/2021/06/Dept_of_igrs.pdf

What are the tax benefits given for stamp duty payment in MP?

Under section 80 C of the IT Act, one can get benefits of upto Rs 1.50 lakh on paying stamp duty in MP. A person can avail this benefit while filing his IT returns. However, note that this deduction can be availed only in the year of property purchase.

How to register complaints regarding stamp duty in MP 2025?

To register a complaint with respect to stamp duty in Madhya Pradesh, visit https://www.mpigr.gov.in.

Under ‘Important Links’ section, click on ‘Register Your Complaint’.

You will reach a new page where you should login with your Username and Password.

Once done, a complaint form will open under which you can write your complaint in detail and submit.

Stamp duty exemptions in Madhya Pradesh

As against other states in India where there is a difference in stamp duty between men and women, Madhya Pradesh doesn’t offer any such respite. In Madhya Pradesh, the stamp duty is the same for both male and female home buyers.

As against other states in India where there is a difference in stamp duty between men and women, Madhya Pradesh doesn’t offer any such respite. In Madhya Pradesh, the stamp duty is the same for both male and female home buyers.

However, the state does offers exemptions and concessions in stamp duty in Madhya Pradesh for commercial land owners.

- If eligible, manufacturing units are eligible for 100% stamp duty exemption

- One-time 100% reimbursement of stamp duty and registration fees for incubators on office space or land.

Housing.com POV

Payment of stamp duty and registration charges for a property that you buy in Madhya Pradesh is mandatory because you have to register the property in the legal book of records. Absence of payment will be a problem for the buyer as he won’t be able to take any legal help in case of a dispute. Also, in case the owner wants to sell the property going forward he may not be able to sell it.

The MPIGR is a very useful website when it comes to paying stamp duty and registration charges without any hassle. You can check the details and make payment anytime from anywhere, which is one of the biggest advantages. In addition to this, one can also check out other services related to stamp duty and registration in Madhya Pradesh such as access to encumbrance certificate and mutation certificates easily with just the click of a button.

FAQs

Who can give licence to service providers for e-stamping service?

The senior district registrar or district registrar of the district in Madhya Pradesh, has the power to give licences to service providers.

Is e-stamping valid in MP?

Yes, after e-stamping you can also view information regarding the amount paid, party details, particulars of the transaction, etc.

Can I pay stamp duty and registration fee through challan in MP?

Yes, you can pay stamp duty and registration fee through challan, online payment and by using the credit limit of service providers in MP.

| Got any questions or point of view on our article? We would love to hear from you.Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |