April 1, 2024: Mumbai city (area under BMC jurisdiction) in March 2024 recorded registration of 14,411 properties, contributing Rs 1,143 crore for the state government. Registrations increased by 10% year-on-year (YoY) while revenue from property registrations dipped by 7% on a YoY basis as per the Knight Frank report. The decline in stamp duty collections is attributed to extraordinarily elevated stamp duty collections last year following the central government’s decision, to limit tax deductions on capital gains earned from the sale of residential property after March 31, 2023 the report mentioned. On a month-on-month (MoM) basis, total registration and stamp duty collections increased by 20% and 29% respectively. Of the overall registered properties, residential units constitute 80%.

Mumbai property sale registration and government revenue collection

| Period | Registration (Units) |

YoY | MoM | Revenue (INR cr) |

YoY | MoM |

| Mar-23 | 13,151 | -21% | 36% | 1,226 | 6% | 10% |

| Apr-23 | 10,514 | -10% | -20% | 900 | 22% | -27% |

| May-23 | 9,823 | 0% | -7% | 833 | 15% | -7% |

| Jun-23 | 10,319 | 4% | 5% | 859 | 17% | 3% |

| Jul-23 | 10,221 | -10% | -1% | 831 | 0.3% | -3% |

| Aug-23 | 10,902 | 27% | 7% | 810 | 26% | -2% |

| Sep-23 | 10,694 | 24% | -2% | 1,127 | 54% | 39% |

| Oct-23 | 10,607 | 26% | -1% | 835 | 15% | -26% |

| Nov-23 | 9,736 | 9% | -8% | 712 | 4% | -15% |

| Dec-23 | 12,255 | 31% | 26% | 932 | 12% | 31% |

| Jan-24 | 10,967 | 22% | -11% | 760 | 10% | -19% |

| Feb-24 | 12,056 | 24% | 10% | 885 | -20% | 16% |

| Mar-24* | 14,441 | 10% | 20% | 1,093 | -7% | 29% |

Source: IGR Maharashtra

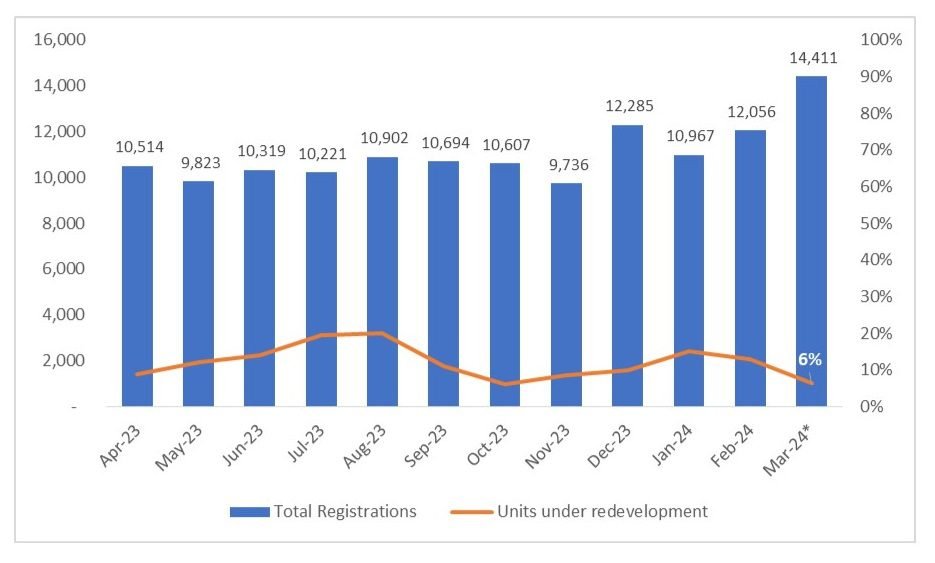

Redevelopment transactions as share of total transactions remain low

Source: Knight Frank

When purchasing any type of property, homebuyers are required to pay stamp duty and registration charges to the state government. In Mumbai, where properties fall under the jurisdiction of the BMC, the current stamp duty rates are 6% for male homebuyers and 5% for female homebuyers. Transactions below 5% encompass various types, including mortgage deeds, gift deeds, and lease deeds related to redevelopment transactions. As per Knight Frank’s analysis, the average share of deals with stamp duty rate of less than 5%, are assumed to include all the redevelopment deals which occurred during the given period.

As per the report, during FY23-24, the average share of transactions with stamp duty rate of less than 5%, which also includes mortgage deeds and gift deeds besides redevelopment deals stood at 12%.

500-1000 sqft properties continue to dominate property registrations

In March 2024, homes spanning between 500 to 1000 square foot (sqft) emerged as the favoured option among homebuyers. However, there was a decline in the proportion of apartments sized 500 sqft and below, which had seen an increase in the first two months of 2024. Conversely, the percentage of apartments exceeding 1000 sqft rose to 15%, marking the highest share for this quarter. Mumbai homebuyers have shown a clear preference for larger apartments in recent months, as evidenced by the upward trend in their share, highlighted the report.

Area wise breakup of apartment sales

| Area (sq ft) | Share in Jan

2024 |

Share Feb

2024 |

Share Mar

2024 |

| Up to 500 | 48% | 45% | 41% |

| 500 – 1,000 | 43% | 42% | 43% |

| 1,000 – 2,000 | 8% | 11% | 12% |

| over 2,000 | 1% | 3% | 3% |

Source: IGR Maharashtra

Central and Western suburbs continue to remain the most preferred location.

Preferred location of Property purchase – March 2024

| Buyer’s Property Purchase location | ||||||

| Preferred

Micro market |

Central Mumbai | Central Suburbs | South Mumbai | Western Suburbs | Out of city | |

| Central Mumbai | 42% | 1% | 3% | 7% | 2% | |

| Central Suburbs | 36% | 92% | 11% | 5% | 41% | |

| South Mumbai | 6% | 1% | 68% | 2% | 6% | |

| Western Suburbs | 16% | 6% | 18% | 86% | 51% | |

| 100% | 100% | 100% | 100% | 100% | ||

Of the total properties registered, Central and Western suburbs together constituted over 73% as these locations are a hotbed for new launches offering a wide range of modern amenities and good connectivity. 86% of Western suburb consumers and 92% of Central suburb consumers opt to purchase within their micro market. This choice is influenced by the familiarity of the location, along with the availability of products that align with their pricing and feature preferences.

Shishir Baijal, chairman & managing director, Knight Frank India, said, “The residential real estate sector in Mumbai has continued to perform exceptionally well in March 2024. The consistent increase in property sale registrations during March highlights the market’s attractiveness among homebuyers. This optimistic trend is likely to persist, especially with the strong economic growth and an amenable interest rate environment in the upcoming quarters, which will support the momentum and foster a favourable environment for prospective homebuyers.”

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]