If you are buying any immovable property including flat, land or building in Andhra Pradesh, you need to pay stamp duty, registration charges and also transfer duty (specified under Andhra Pradesh Gram Panchayats Act, 1964 and the Andhra Pradesh Municipalities Act, 1965). According to section 17 of the Indian Registration Act 1908, the AP stamps and registration deed details of every immovable property sold should be registered in the sub-registrar’s office (SRO) within six months of deed execution.

What is stamp duty in Andhra Pradesh?

Stamp duty in Andhra Pradesh is the compulsory tax that is levied by the Andhra Pradesh state government on legal documents to validate transactions related to property and other financial agreements. IGRS AP deed details help in preserving the ownership title and act as proof in case the property documents are lost. It is calculated on the basis of the Andhra Pradesh Market Value. The stamp duty in Andhra Pradesh comes under the purview of IGRS AP, the registration and stamps department in Andhra Pradesh.

Stamp duty charges in Andhra Pradesh in 2025

| Gender | Stamp duty | Registration charges | Transfer duty fee |

| Men | 5% | 1% | 1.5% |

| Women | 5% | 1% | 1.5% |

In Andhra Pradesh, there is no rebate provided on the basis of gender. The stamp duty charges are 5%, registration fee is 1% and the transfer duty fee is 1.5% in the state.

Stamp duty charges on different transactions in AP in 2025

| Type of transaction | Stamp duty charges |

| Sale of property | 5% |

| Gift deed | 0.5% |

| Affidavit | Rs 10 |

| Development agreement-cum-general power of attorney | 5% |

| Construction agreement | 5% |

| Exchange deed | 4% on consideration or M.V. of the property of greater value, whichever is higher |

| Lease agreements of less than 10 years | 2% on A.A.R |

| Lease agreements of more than 10 years but less than 20 years | 6% on A.A.R |

| Will | Nil |

| Indemnity Bond | 3% subject to a maximum of Rs. 100/- |

| Special power of Attorney | Rs 20 |

Note: These fees are based on market value or transactional value of the property (whichever is lower).

AP stamps and registration deed details 2025: Types of conveyance deeds

| Purpose | Type of Conveyance Deed |

| Inheritance | Entries in revenue records and predecessor’s title |

| Partition | Deed of Partition |

| Gift | Gift deed |

| Settlement | Settlement deed |

| Grant | Grant order |

| Release | Release deed |

| Mulegeni | Deed of Mulgeni or permanent lease |

Factors on which stamp duty Andhra Pradesh is based on

Age of the buyer: Age plays an important role in determining stamp duty. Senior citizens get a rebate on stamp duty.

Age of the property: A new property may command more stamp duty in Andhra Pradesh as compared to an old property that are charged lesser stamp duties. Also, some like historic or heritage buildings are exempted from paying stamp duty.

Usage of property: Usage of property- residential, commercial or industrial plays an important role in calculating stamp duty of the property.

Location of the property: The stamp duty depends on whether the property is located in a rural area or an urban area. The properties that are located near the central or prime area will command more stamp duty as compared to a property located in the periphery. The property located within the municipal corporation limits have to pay higher stamp duty as compared to a property located in the development authority area.

Property type: The different types of property – residential, commercial, agricultural, industrial and open plots each command different stamp duty.

Amenities: The presence of amenities in the project and infrastructural development, connectivity etc. influence the price of the property and thus the stamp duty.

How to get duty fee and registration fee details on IGRS AP?

- Log on to IGRS AP website.

- On the right side, under duty fee and registration details, select the transaction type.

- You will get the stamp fee as 2% of the market value, registration fee as 0.5% and user charges as Rs 100 if value less or equal to Rs 50,000 and Rs 200 is value more than Rs 50,000.

How to calculate the stamp duty charges in Andhra Pradesh?

To calculate the stamp duty charges in Andhra Pradesh one has to determine the following:

- Property value: Can be determined using market value or the government- assessed rate, whatever is higher.

- Stamp duty: Based on the various factors, multiply the applicable stamp duty to the value of the property.

- Add registration charge and transfer fee: Add the registration charges and transfer fee to the stamp duty and get the final amount that has to be paid.

Example of stamp duty calculation in Andhra Pradesh

-

- Ram has purchased a flat for Rs 70 lakh

- The applicable stamp duty is 5%, registration charge is 1% and transfer fee is 1.5%.

- Thus, Ram will pay stamp duty of 70,00,000 * 5/100= Rs 3,50,000.

- Registration charge for AP deed details will be = Rs 70, 00,000*1/100= Rs 70,000

- Transfer duty fee for AP deed details will be = Rs 70,00,000*1.5/100 = Rs 1,05,000

- Thus, Ram will have to pay a total AP stamps and registration cost of Rs 5, 25,000 or Rs 5.25 lakh.

- Taking into consideration all these charges, the total cost of the property purchased by Ram is

- Rs 70 lakh + Rs 5.25 lakh = Rs 75.25 lakh.

- The buyer and the seller must go to the SRO office where the property is located and proceed with the AP stamps and registration process. Also, present should be two witnesses for the AP stamps and registration of deed details.

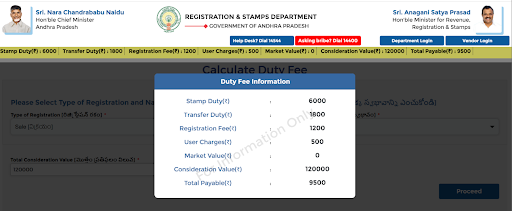

Stamp duty calculator on IGRS AP

You can also use the stamp duty calculator on the IGRS AP website to calculate the stamp duty and registration charges.

- To calculate using the IGRS AP stamp duty calculator, log on to https://registration.ap.gov.in/igrs

- Under online services, click on Duty Fee Calculator

- You will reach https://registration.ap.gov.in/igrs/DutyFeeCalculator/Property

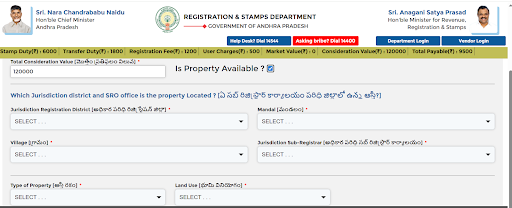

- Select type of registration, nature of document and total consideration value and click on proceed. ( In case you have not checked on is property available?)

- You will see the duty fee information that will include stamp duty, transfer duty, registration fee, user charges, market value, consideration value and total payable.

- In case the property is available, select the jurisdiction registration district, mandal, village, jurisdiction sub-registrar, type of property, land use and click on proceed. You may have to fill property details subsequently

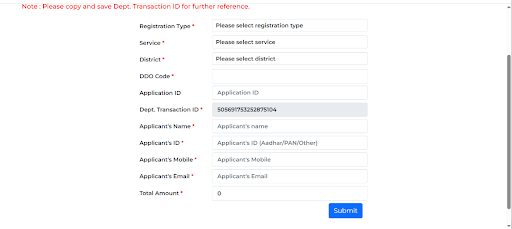

How to pay stamp duty in Andhra Pradesh online?

- To pay the stamp duty in Andhra Pradesh online, log on to the IGRS AP website and under online services, select payment.

- Enter details such as registration type, service, district, DDO code, application ID, Applicant’s name, ID, mobile number, email id and total amount and click on submit.

- Make the payment using the preferred payment mode like debit card, credit card, internet banking or e-wallet.

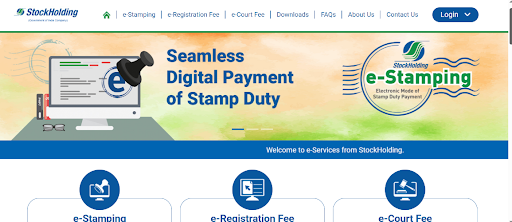

How to pay Andhra Pradesh stamp duty online using SHCIL?

- Log on to official portal of SHCIL at https://www.shcilestamp.com/.

-

- Select Andhra Pradesh from the drop-down box.

- Login with your username and password.

- Enter the property details and proceed to make payment using NEFT, debit card, credit card, etc.

- Save receipt

How to pay the Andhra Pradesh stamp duty charges offline?

For people who want to pay the stamp duty offline, there are a few options- they can pay through the sub-registrar offices, authorised banks or stamp vendors. To pay the stamp duty at the SRO, follow these steps.

- Visit the SRO

- Fill the stamp duty form

- Attach supporting documents

- Make the payment by means of DD, cash or cheque

- Collect the stamp duty certificate from the SRO

What is Andhra Pradesh registration charges?

To register your property in Andhra Pradesh in the legal book of records, a registration fee has to be paid to the Andhra Pradesh state government. The registration charges in Andhra Pradesh is 1% of the value of the property.

AP registration charges 2025 for different transactions

| Description of instrument/document | Registration fee |

| Sale deed | 1 % |

| Gift | 0.5% (minimum Rs 1,000 and maximum Rs 10,000) |

| Agreement of sale-cum-general power of attorney | Rs 2,000 |

| Development agreement-cum-general power of attorney | 0.5% (capped at Rs 20,000) |

| Power of attorney to sell / construct / develop / transfer immovable property | 0.5% (minimum Rs 1,000, capped at Rs 20,000) |

| Conveyance deed | 0.5% |

| Lease deed | 0.1% |

| Licence deed | 0.1% |

| Mortgage | 0.1% |

List of documents required to register property in Andhra Pradesh

- Passport-size photo of seller and buyer

- Voter ID, Aadhaar card, passport

- Registered copy of original sales deed

- Property card from city survey department

- Utility bills

- Documents that specifies sufficient stamp duty payment

How to register your property online in Andhra Pradesh?

- Log on to the IGRS AP website and click on online services.

- From the list of authorised vendors, select the vendor for registration services.

- Click on proceed and proceed to district property registration.

- Fill details on the application form.

- The stamp duty and registration fees will be calculated.

- Pay using one of the online modes and upload all supporting documents that are asked.

- Take an appointment with the SRO for verification of document and visit the SRO.

- Collect the registered document from the SRO. You can also download it from IGRS AP portal.

AP anywhere land registration 2025

Home buyers will now be able to register AP their property document in any sub-registrar office of the district. As per the new directives from the state government, all sub-registrar offices falling in the same district will have concurrent jurisdiction and can register any property deed details situated in the district. This means that a property buyer can approach the SRO that is nearest to his residence or office and get the IGRS AP deed details registered. Presently, there are 38 districts where you can register AP your deed details of property or land.

Stamps and registration AP receipt 2025

For each and every property for which land registration charges in AP has been paid, for each Power of Attorney presented for authentication and for each sealed cover deposited and for every fee or fine levied by a registering officer, a receipt shall be granted by the AP land registration department. This receipt for the registration AP document/ IGRS deed details will be handed over to the person who is presenting the document or his nominee, after getting signature of the person present there. If the receipt for the paid land registration charges in AP is lost for some reason, the person who is needed to produce it can sign a declaration of loss and request for making another registration AP document receipt that can be obtained by signing the counterfoil.

Stamp duty refund in Andhra Pradesh

While payment of stamp duty for Andhra Pradesh property is compulsory, there are also times when the buyer should be legally allowed to get a refund on stamp duty.

Who is eligible for stamp duty refund in Andhra Pradesh?

All home buyers who have paid

-

- Excess or incorrect stamp duty

- For invalid or cancelled documents

- For a duplicate document

- On unregistered documents

are eligible for stamp duty refund in Andhra Pradesh.

How to claim stamp duty refund in Andhra Pradesh?

A home buyer can claim stamp duty refund within six months from the date of the issuance of the challan. Mentioned are steps to follow to claim stamp duty refund.

- Write an application to the SRO with reason on stamp duty refund.

- Attach supporting documents such as original challan, proof of excess payment, sale dead cancellation deed etc.

- The SRO should verify the claim raised by the homebuyer and issue stamp duty refund after deducing 10% fee as penalty.

- The stamp duty refund process will take close to 15-30 days.

FAQs

What is the land registration process under Stamps and registration AP department in Andhra Pradesh?

For land registration under Stamps and registration AP department, keep all the documents listed above handy, including the property card.

How do I find the link documents for property in AP?

You have to apply for all these services offline, through the municipal office.

What is the land registration fee in Andhra Pradesh?

Depending upon the deed details, land registration fee under stamps and registration AP department may vary.

Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com