Karnataka’s capital city Bangalore is widely known as the ‘Silicon Valley of India’ or ‘IT capital of India’, as majority of technological organisations are based here. Being one of the country’s fastest-growing cities, in terms of contribution towards GDP, the IT hub witnesses many people shifting here year after year, propelling high demand for rental properties. The residential rental market is quite mature and organised in Bangalore, as compared to other cities in India. However, if you are planning to put your residential property on rent or are looking to get a property on rent, it is crucial to follow the right steps, to avoid hassles and disputes. How to go about it? You need to be aware of the rules related to rent agreements and the process involved in it, to avoid rental conflicts. There are already many cases pending in courts, either due to the absence of rent agreements or inappropriate rent agreements. Moreover, rules applicable in making a rent agreement may vary from place to place. So, it becomes important to understand the rules related to rent agreements in Bangalore.

Before getting into the process of making a rent agreement, let us first understand what a rent agreement means.

What is a rent agreement?

A rent agreement is a contract between the landlord and the tenant that specifies various terms and conditions for which both parties give mutual consent. The term rent agreement is often used interchangeably with the term lease agreement. A written rental agreement, if registered, can be used as a proof to resolve any rental dispute.

See also: Know about Section 80GG

What is the process of preparing a rent agreement in Bangalore?

The process to make a rent agreement is usually the same in most states in India. Let us check out the steps to create a rent agreement in Bangalore:

- The landlord and the tenant should list out various points that they want to include in the rent agreement. Mutual consent of both parties on each point is necessary.

- Once both parties agree on the terms and conditions, they need to get it printed on an agreement/plain paper.

- It is crucial that both the parties read the printed agreement paper once again, to verify the clauses and avoid discrepancies.

- If both the parties are satisfied with the content of the agreement, they have to sign the agreement in the presence of at least two witnesses.

Tenant and landlord rights under the Karnataka rent control act

The Karnataka Rent Control Act (KRCA) of 1999 establishes a legal framework governing the relationship between tenants and landlords in Karnataka. It outlines specific rights and responsibilities to ensure fair and transparent rental practices.

Tenant rights:

- Protection against unfair eviction: Tenants cannot be evicted without sufficient cause. Landlords must provide valid reasons and, in most cases, obtain a court order for eviction.

- Right to essential services: Landlords are prohibited from cutting off amenities such as water and electricity without sufficient cause. If such actions occur, tenants can seek intervention from the Rent Control Board.

- Fair rent: The Act provides mechanisms to ensure that rent demands are reasonable, preventing landlords from charging exorbitant rates.

- Maintenance of premises: Tenants have the right to occupy premises that are safe and habitable. Landlords are responsible for maintaining the property in good repair.

Landlord Rights:

- Right to evict with just cause: Landlords can seek eviction for legitimate reasons, such as non-payment of rent, subletting without permission, or using the premises for illegal activities.

Rent revision: Landlords have the right to revise rent, provided they follow the procedures outlined in the Act, including giving appropriate notice to tenants. - Security deposit: The Act allows landlords to collect a security deposit, typically equivalent to a specified number of months’ rent, to cover potential damages or unpaid dues.

- Maintenance responsibilities: While landlords must maintain the property, tenants are expected to use the premises responsibly and report any damages or necessary repairs promptly.

Dispute resolution:

The KRCA establishes the Rent Control Board to adjudicate disputes between tenants and landlords, ensuring a fair and efficient resolution process.

Recent developments:

The Karnataka Model Tenancy Act has been introduced to address current rental market dynamics, offering a modernized framework for rental agreements. It emphasizes transparency, standardized agreements, and streamlined dispute resolution, benefiting both tenants and landlords.

Is there a legal cap on rent increase in Bangalore?

Contrary to popular belief, Bangalore does not have a fixed legal cap on rent increases. The Karnataka Rent Control Act does not mandate a standard hike like 10% annually — any revision must be mutually agreed upon by both landlord and tenant and clearly stated in the rent agreement.

However, under the Model Tenancy Act (2021), which Karnataka has partially adopted for newer agreements:

- Landlords must provide at least 3 months’ prior notice before revising rent.

- Rent hikes must align with terms outlined in the written agreement.

- Arbitrary increases without notice or mutual consent can be challenged.

Why rent agreement is for 11 months?

The 11-month agreement is a general trend in most of the cities across India. You must be wondering, why? The answer lies in the Registration Act, 1908. According to this Act, it is mandatory to register a rent/lease agreement if the rental period is more than 12 months. So, people generally make a rent agreement for 11 months, to avoid the registration process. It allows them to save stamp duty and registration cost. However, in some cities and states, it is mandatory to register the rent agreement, irrespective of the rent tenure.

See also: Stamp duty and registration charges in Bangalore

Is it mandatory to register a rent agreement in Bangalore?

As far as rent agreement in Bangalore is concerned, it is not mandatory to register the agreement if the agreement period is less than 12 months. However, it is highly recommended to get the agreement registered. The benefits of registering the rent agreement are as mentioned below:

- A registered rent agreement is legal binding on both the parties, who are required to comply with the agreed terms and conditions.

- A registered rent agreement is legally enforceable. Therefore, it can be used as evidence when there is a dispute between the two parties.

Here it is important to note that only a written agreement can be registered and enforceable under the law. Oral rent agreements cannot be registered under the law and so, you must avoid it.

Know about: House for rent in Bangalore

How to register a rent agreement in Bangalore?

A properly-drafted rent agreement helps in building a cordial relationship between the landlord and the tenant. First, you need to get the rent agreement printed on a stamp paper of appropriate value. Thereafter, you can visit the local sub-registrar’s office (SRO), along with two witnesses, to get it registered. The landlord and the tenant need to visit the SRO to sign the documents. However, if one of them or both the parties are not present, their power of attorney-holders can sign the document on their behalf. The two witnesses also need to sign the document, before the process is completed.

Know about: Apartments in Bangalore

Documents required for registering a rent agreement in Bangalore

Before going to register a rent agreement in Bangalore, keep the following documents handy with you:

- Documents as proof of ownership: Original / photocopy of the title deed.

- Other documents: Tax receipt or Index II.

- Address proof of both the landlord and the tenant: Photocopy of passport, Aadhaar, driving licence, etc.

- Identity proof: Copy of PAN card or Aadhaar card.

- Photograph: Two passport-size photographs of each party.

Check out properties for rent in Bangalore

Can NRIs rent property in Bangalore? What are the rules?

Yes, Non-Resident Indians (NRIs) can rent out their property in Bangalore, but there are specific legal and tax implications they must comply with. Since many NRI landlords reside abroad and cannot be physically present for rental formalities, they typically appoint someone in India using a registered Power of Attorney (POA) to manage the rental process.

The rent agreement must clearly specify:

- The name and Indian address of the POA holder acting on behalf of the NRI landlord.

- The NRI landlord’s overseas correspondence address for legal and tax purposes.

- Payment terms including bank details (preferably NRO account) for rent transfers.

Under the Income Tax Act, if the tenant knows that the landlord is an NRI, they are required to deduct TDS at 30% on the rent amount each month and deposit it with the Income Tax Department under Section 195. Failing to do so can result in penalties for the tenant.

Additionally, NRI landlords must declare the rental income under Income from House Property when filing their Indian tax returns. It’s also advisable to consult a tax advisor for compliance under FEMA regulations, especially if the rent is being repatriated abroad.

How to get e-stamping done in Bangalore

In Bangalore, e-stamping is the legally accepted mode for paying stamp duty on rent agreements, as per state regulations. Traditional non-judicial stamp papers are no longer permitted for property-related transactions, including rental agreements.

Where to get e-stamping:

- Visit an authorised Stock Holding Corporation of India Ltd. (SHCIL) branch or approved vendor.

- Alternatively, you can locate an SHCIL-authorised e-stamp centre on www.shcilestamp.com.

Common denominations:

- For rent agreements, typical e-stamp values include ₹100, ₹200, and ₹500, depending on rent, deposit, and duration.

- The exact value is calculated as per Karnataka Stamp Act rates, e.g., 0.5% of (annual rent + deposit), subject to a cap of ₹500 for agreements under 10 years.

Documents required:

- Draft copy of the rent agreement

- Identity proof of the tenant and landlord (Aadhaar/PAN)

- Address of the property being rented

Turnaround time:

- E-stamp certificates are usually issued instantly at the counter.

- For bulk requests or legal firm intermediaries, it may take up to 24 working hours.

Note: Always ensure franking or e-stamping is completed before signing the rent agreement to maintain legal validity.

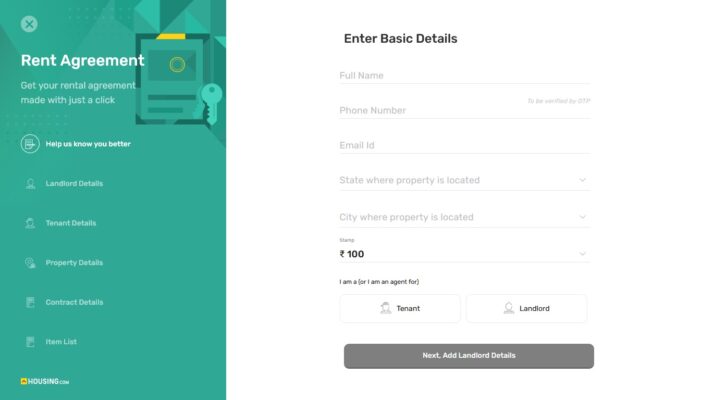

Online rent agreement facility by Housing.com

The online rent agreement facility at Housing.com provides landlords and tenants with a user-friendly platform. The users can complete the entire process through the online platform. Housing.com offers an entirely contact-less procedure, which is easy and convenient for users. Once the process is completed, the agreement is directly sent to the parties. The online rent agreement facility by Housing.com is currently available in 250+ cities across India.

Benefits of online registration of rent agreement in Bangalore

When the rent agreement registration process is available online, there is no reason to waste time on offline registration. Some of the benefits of online rent agreement include reliability, transparency and cost-effectiveness. It saves the trouble of having to go out for buying an agreement paper, getting it printed and registering it with charges involved. The online method saves time and money. Many companies provide the facility to get a rent agreement done online. Their services are cost-effective and hassle-free.

Know about: Flats for rent in Bangalore

How much does a rent agreement cost in Bangalore?

Making a rent agreement in Bangalore usually includes three costs, i.e., stamp duty charges, registration fee, and legal consultancy charges, if the parties involved in agreement hire a legal expert.

Stamp duty charges on rent agreement in Bangalore are as mentioned below:

- For rent agreement of less than one year: 0.5% of the annual rent plus deposit, or Rs 500, whichever is lower.

- For rent agreement of up to 10 years: 1% of the annual rent plus deposit, or Rs 500, whichever is lower.

- For rent agreement of above 10 years and up to 20 years: 2% of the annual rent plus deposit, or Rs 500, whichever is lower.

Non-judicial stamp paper or e-stamping/franking procedure can be used to pay the stamp duty. The registration charge is minimum of Rs 200 and ranges from 0.5% to 1%. If you hire a legal advisor, it may cost you an additional fee as consultancy charges.

See also: All about Rent agreement in Chennai

Points to keep in mind while making a rent agreement

Other points to be kept in mind while making a rent agreement are as follow:

- Do not sign the document before franking is done, as it may not be allowed by the bank.

- Do not forget to include the rent increment clause while making the agreement.

- Notice period details should be clearly mentioned in the agreement.

- Rent receipts should be given to the tenant within the time period mentioned in the agreement.

- Details of all the fittings and fixtures in the apartment should be clearly mentioned in the rent agreement.

Subletting, guests, and co-living: What your agreement should include

In Bangalore’s fast-growing rental ecosystem—particularly in tech corridors and student hubs—subletting and co-living are common, but often not addressed in rent agreements. To avoid legal or financial disputes, your agreement should clearly spell out the following:

- Subletting: Mention whether the tenant is allowed to sublet the premises or any part of it. Most agreements prohibit this without explicit written consent from the landlord.

- Co-living or sharing: If the property will be shared by multiple tenants (e.g., flatmates), list all occupants by name or define a clause that requires landlord approval for new co-tenants.

- Guests: Clarify rules around short-term visitors—such as whether overnight guests are permitted and for how many days. Some landlords restrict long stays or frequent visitors.

Tax liabilities for landlords: Reporting rental income and applicable deductions

As a landlord, understanding your tax obligations is crucial to staying compliant with the law while optimizing your tax liabilities. Here’s a detailed overview of how rental income is taxed under the Income Tax Act, 1961, and the deductions available to landlords.

1. Reporting rental income

Rental income is categorized under the head ‘Income from House Property’ in the Income Tax Act. Here’s how landlords are required to report it:

- Annual rental value: The rental income is calculated based on the actual rent received or the deemed rent (expected rental value), whichever is higher.

- Vacancy period: If the property remains vacant for part of the year, the rent for that period is not included in the taxable income.

- Advance rent and security deposits:

- Advance rent: Any advance rent received is taxable in the year of receipt.

- Refundable security deposits: These are not taxable. However, if a portion is adjusted towards rent or other expenses, it becomes taxable.

2. Tax deductions available to landlords

The Income Tax Act provides several deductions to reduce the taxable rental income:

- Standard deduction (Section 24(a)):

A standard deduction of 30% of the net annual value (Gross Annual Value minus Municipal Taxes) is allowed for repairs, maintenance, and other expenses. This deduction is fixed, irrespective of actual expenses incurred. - Interest on home loan (Section 24(b)):

Landlords can claim a deduction for the interest paid on a home loan taken for purchasing, constructing, or renovating the rented property.- Self-occupied property: Up to ₹2 lakh per year.

- Rented property: No upper limit on the interest amount.

- Municipal taxes paid:

Municipal taxes, such as property tax, are deductible if paid by the landlord during the financial year. - Pre-construction interest:

Interest paid on a home loan before the property’s construction is completed can be claimed in five equal installments, starting from the year of property completion.

3. Tax treatment of co-owned properties

- If the property is jointly owned, the rental income and deductions are proportionally divided based on each owner’s share in the property.

4. Tax implications of vacant properties

If a property is not rented out but available for rent, the deemed rental value is taxable. However, one self-occupied property can be declared as exempt from rental income tax.

5. Filing requirements

Landlords must declare rental income while filing their Income Tax Return (ITR) under the relevant ITR form (ITR-2 or ITR-3). Failure to disclose rental income can lead to penalties and legal consequences.

See about: Flats for sale in Bangalore

Karnataka model tenancy act (MTA) 2021

The Model Tenancy Act, introduced by the central government in 2021, aims to create a more balanced and transparent framework for rental housing across India. Its primary objectives include:

- Establishing a rent authority: The Act proposes the creation of a Rent Authority to regulate renting of premises and to protect the interests of landlords and tenants.

- Balancing rights and responsibilities: It delineates clear rights and obligations for both landlords and tenants to minimize disputes.

- Speedy dispute resolution: The Act provides for establishing Rent Courts and Rent Tribunals to ensure fast-track resolution of rental disputes.

Key provisions of the model tenancy act

- Written agreement mandatory: All new tenancies must be formalized through written agreements, ensuring clarity on terms and conditions.

- Security deposit cap: For residential properties, the security deposit is capped at two months’ rent, while for commercial properties, it is capped at six months’ rent.

- Rent revision: Landlords must provide a three-month notice before increasing rent, and the increment must be in accordance with the terms set in the tenancy agreement.

- Subletting: Tenants are prohibited from subletting the premises without the landlord’s prior consent.

- Eviction grounds: The Act specifies conditions under which a landlord can evict a tenant, such as non-payment of rent, misuse of premises, or the landlord’s own need for the property.

Implications for Karnataka

The adoption of the Model Tenancy Act in Karnataka could bring about significant changes:

- Standardised security deposits: Currently, landlords in Karnataka often demand security deposits ranging from 5 to 10 months’ rent. Implementing the MTA would standardise this to a maximum of two months’ rent for residential properties, alleviating the financial burden on tenants.

- Efficient dispute resolution: Establishing dedicated Rent Courts and Tribunals could lead to faster resolution of disputes, benefiting both landlords and tenants.

- Enhanced transparency: Mandatory written agreements and clear guidelines on rent revisions and eviction processes would promote transparency and reduce ambiguities in rental transactions.

Housing.com POV

Creating a rent agreement in Bangalore requires careful attention to legalities, documentation, and financial considerations. By understanding the processes and rights outlined under the Karnataka Rent Control Act, tenants and landlords can foster transparent and harmonious rental relationships. Whether opting for traditional methods or leveraging online platforms for convenience, adhering to these guidelines ensures compliance and minimizes conflicts. As the city’s rental market grows, staying informed empowers you to navigate the system confidently and effectively.

FAQs

What is power of attorney?

Power of attorney (POA) is an authority granted by the principal or grantor to a person who is acting as his/her agent, to take any action on his/her behalf. Such an agent can be allowed, with a limited or absolute authority, to make financial, property-related decisions, etc.

How many months’ deposit is required while making a rent agreement in Bangalore?

The usual practice in Bangalore is to give around three to six months’ rent amount as a deposit. However, one can convince the landlord to reduce the deposit amount further.