The Income Tax (I-T) Department on March 4, 2024, said it was in process of sending notices to some taxpayers for income tax returns (ITRs) filed for assessment year (AY) 2021-22 (FY2020-21). Communication will be sent to those taxpayers whose ITR information has a mismatch with the information received by the department through various sources.

“In some cases of ITRs filed for AY 2021-22, a ‘mismatch’ has been identified, between the information filed in the ITR vis-à-vis information of specified financial transactions, as available with the department… Accordingly, as part of the e-Verification Scheme-2021, the department is in the process of sending communication(s) to the taxpayers for the mismatch in information pertaining to AY 2021-22 (FY 2020-21),” the ministry of finance said in a statement.

The Income Tax Department receives information of specified financial transactions of taxpayers from various sources. To increase transparency and to promote voluntary tax compliance, this information is reflected in the Annual Information Statement (AIS) module and is available to the taxpayer for viewing.

What is an Annual Information Statement?

An Annual Information Statement is a detailed form containing all tax payment-related details about an income taxpayer in India. The income tax department in India maintains taxpayers’ information in a set format for specific financial years. Known as the Annual Information Statement (AIS), this data is provided to taxpayers through Form 26AS. The AIS contains all the information about the taxpayer’s income, spending, investments, tax applicability, etc. It also provides taxpayers the option to give feedback on the reported transactions.

See also: What is income tax?

What is the objective of the AIS?

The AIS displays complete information to the taxpayer with a facility to capture online feedback. It promotes voluntary compliance and enables seamless pre-filling of income returns. The statement is also meant to deter non-compliance by taxpayers.

What is the difference between AIS and Form 26AS?

The AIS is an extension of Form 26AS. While Form 26AS shows details of high-value investments like property purchases and TDS/TCS transactions, the AIS shows savings account interest, dividends, rent received, purchase and sale transactions of securities/immovable properties, foreign remittances, interest on deposits, GST turnover, etc.

Information displayed in the AIS

- PAN

- Masked Aadhaar number

- Name of the taxpayer

- Date of birth

- Incorporation

- Formation

- Mobile number

- E-mail address

- Residential address

- TDS/TCS information

- Statement of Financial transaction (SFT)

- SFT code

- Payment of taxes under different heads like advance tax and self-assessment tax

- Demand

- Refund

- Demand raised

- Refund initiated during a financial year

- Details of the information received from the other sources

- Data about Annexure II salary

- Interest on refund

- Outward foreign remittance

- Purchase of foreign currency, etc.

How to view Annual Information Statement?

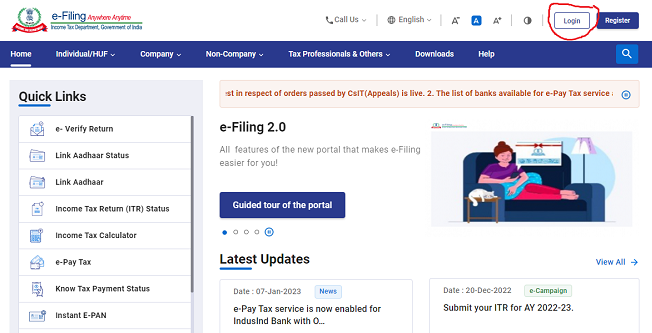

Step 1: Copy and paste the following URL into your browser.

Step 2: Log into the e-filing portal.

Step 3: Click on the Annual Information Statement (AIS) option under the ‘Services’ tab.

Step 4: Click on the AIS tab on the homepage.

Step 5: Select the relevant financial year and click on the ‘AIS’ tile to view the Annual Information Statement.

In what formats can I download the AIS?

You can download the Annual Information Statement (AIS) in PDF, JSON and CSV file formats.

How do I submit feedback on AIS?

Step 1: To submit feedback on active information displayed under TDS/TCS information, SFT information or other information, click on the ‘Optional’ button in the feedback column for relevant information. You will be directed to the ‘Add Feedback’ screen.

Step 2: Choose the relevant feedback option. Enter the feedback details.

Step 3: Click on the ‘Submit’ option.

Can you modify the feedback?

Yes, you can modify your feedback on the AIS. Also, there is no limit on the number of times you can modify previous feedback.

FAQs

In which form is the Annual Information Statement of a taxpayer in India displayed?

The Annual Information Statement is displayed in Form 26AS.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]