May 18, 2023: Real estate developers have acquired around 2,181, acre of land area between January 2022 and May 2023, says leading real estate advisory firm JLL India. Data available with the company show the 104 separate land deals sealed in the past 17 months are valued at over Rs 26,000 crore, with an estimated development potential of around 209 million square foot (msf).

Around 578 acre (27%) of the land of this lot was acquired in the first five months of 2023 alone, the report adds. Data indicate that developers with a brand identity have successfully closed many land transactions in leading metro cities as well as Tier-2 and Tier-3 cities.

Leading cities

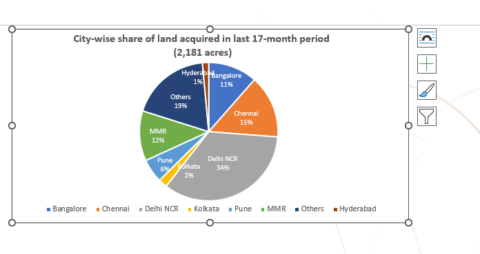

Delhi-NCR, Chennai, the Mumbai Metropolitan Region and Bengaluru lead in terms of total land area transacted, accounting for a 72% share. Around 1,576 acre of land was bought in these cities in 79 separate land deals, with a development potential of around 150 msf.

Pune, Kolkata and Hyderabad together account for 9% share. The remaining deals were closed in cities such as Surat, Ahmedabad, Jaipur, Lucknow, Nagpur, Panchkula and Kurukshetra. In Delhi-NCR, submarkets of Panipat and Gurgaon lead with a combined share of 73%.

Number of transaction

In terms of the number of transactions, the Delhi-NCR and the MMR lead with 53 transactions recorded in the last 17-month period.

Leading developers

Real estate developers that actively acquired land during the analysed period included Godrej Properties, M3M, Max Estates, Birla Estates and Mahindra Lifespaces, etc.

Note: NCR includes NCT of Delhi, Gurgaon, Noida, Ghaziabad, Faridabad, Bahadurgarh, Sonipat, and Panipat. MMR includes Mumbai, Thane, Panvel, Palghar, and Khalapur.

Others include Surat, Sanand, Ahmedabad, Jaipur, Lucknow, Nagpur, Panchkula, and Kurukshetra

The development potential is estimated based on the permissible FAR/FSI allowed in the respective micro markets where the land has been transacted.

Sales potential is estimated considering the loading component of the development potential area and the average saleable price in the respective micro markets where the land has been transacted.

Residential segment in focus

According to the report, majority of these land acquisitions were made for proposed residential developments.

“Driven by unprecedented levels of residential sales, real estate developers are acquiring land for building relevant supply pipelines for the future. Out of the total 2,181 acre, 84% of the total land area transacted (around 1,822 acre) is for proposed residential developments,” says the report. These residential land transactions have an estimated development potential of around 165 msf, it adds. The sales potential from these residential deals is estimated to be around Rs 122,000 crore.

Land deals between January 2022 and May 2023

| Number of land deals | 104 |

| Value of transaction | Rs 26,000 crore |

| Area of land transacted | 2,181 acre |

| Estimated development potential | 209 msf |

| Area of land transacted for proposed residential developments (includes plotted developments, group housing, townships) | 1,822 acre |

| Estimated development potential for proposed residential developments | 165 msf |

| Estimated sales potential of land transactions with proposed developments | Rs 122,000 crore |

With a surge in demand for housing, developers are actively acquiring land for new housing projects.

“In 2022, residential sales registered a decadal high with 215,000 units sold across the top seven cities, which is almost like the 2010 sales of 216,762 units. Sales in 2022 increased by 68% Y-o-Y with more than 50,000 units sold in each of the four quarters. Also, residential launches during the same period stood at 247,000 units, the highest in over a decade and next to the previous high of 281,000 units in 2010,” the report added.

In January-March 2023, sales of 62,000 housing units were recorded marking the highest quarterly sales in the past 15 years despite rising interest rates and prices in the past 12 months. This growth has been fuelled by a collective effort of all stakeholders, who swiftly adapted to changing consumer preferences, it added.

“These numbers are a visible indication of the positive sentiment for the real estate sector. In 2023, we expect land transactions to remain steady with developers expanding their land banks on the back of expected moderation in interest rates, growing demand for housing and support from institutional funding agencies,” says Samantak Das, chief economist and head of research and REIS, JLL India.

Launches of new residential projects are expected to strengthen further through new land acquisitions in strategic locations and growth corridors, Das adds.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

sunita.mishra@proptiger.com