Since the time India entered a lockdown in March 2020, due to the Coronavirus pandemic, many companies have moved to remote working for most of their employees. Consequently, there has been a lot of discussion about the future of commercial real estate in India, owing to the changing work culture and shopping patterns, trends in warehousing, etc., which indicate that a subtle transformation of commercial realty is underway. So, what is the way ahead? Will offices cease to exist or is this a temporary change, following which we will bounce back to normal again? Housing.com News analyses the scenario.

COVID-19 pandemic and its impact on office spaces

India is home to a large number of outsourcing jobs in the engineering and BPO sectors. With local English-speaking talent available at a much lower cost, a number of multi-national companies have established their presence in India. As COVID-19 has impacted almost all sectors, the commercial office space has also been hit. However, this sector may soon bounce back, according to experts.

At a webinar organised by Housing.com on the COVID-19 pandemic’s impact on commercial real estate, Vishal Mirchandani, CEO – commercial and retail, Puravankara Ltd, said: “The month of April and May 2020 were in shutdown mode, since the country was under lockdown. From June onwards, we have seen relevant conversations happening with the clients, on expansion strategies. There is positivity in the market and clients are evaluating options available immediately.”

Talking about the scope of revival, Mirchandani said that by January 2021, there might be a moderate bounce-back of the sector, as the new financial year of multi-national companies will begin and more meaningful conversations will start happening. He further added that all hopes are presently pinned on finding a COVID-19 vaccine or cure, as this will fast-track the revival.

Another panelist in the webinar, Arpit Mehrotra, managing director, south India (office spaces), Colliers International, said that business enquiries were happening from the US and European countries. “As India offers the right cost, talent and infrastructure, the office space revival will happen. The month of June has been very positive, as compared to April and May, as a number of interested clients are scouting for quality office space in India,” Mehrotra elaborated.

Impact of work-from-home on office space demand

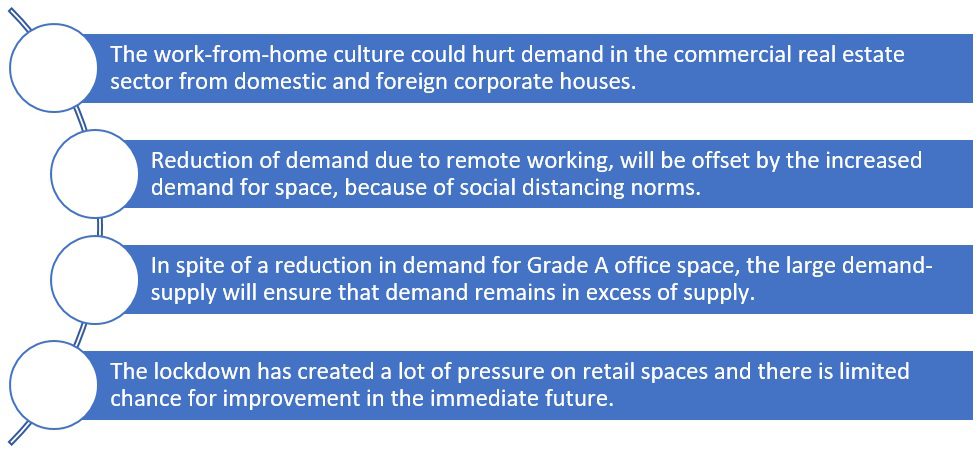

One thing that could hurt demand in the commercial real estate sector from domestic and foreign corporate houses, is the work-from-home culture that is gaining prominence, since the lockdown. A number of companies have recently announced permanent work-from-home for their employees till the end of 2020. Many may extend this, even after the pandemic ends. However, experts point out that work-from-home existed in the IT sector, even before the pandemic and that office spaces cannot be eliminated completely as it is not possible for many sectors, including banks and financial service providers.

According to Abhishek Goenka, CEO of CoWrks, “The reduction of demand due to remote working policies and distribution of offices, etc., will be offset by the increased demand for space, because of social distancing norms. Moreover, the supply of Grade A office assets in India is very limited. The gap between supply and demand is so large that even if you reduce the demand by 10%-15% due to any reason including work-from-home, it will be in excess of supply for the foreseeable three to five years.”

Incidentally, Netflix has leased 8,800 sq ft office space and Morgan Stanley has leased 1.1 million sq ft of office space in Mumbai. In the suburban market of Noida, Metlife has leased 2.95 lakh sq ft space, while in Bengaluru, Microsoft and Intel are hunting for 1 million sq ft each, to expand their engineering offices.

Future of commercial offices spaces in India

Recently, one of the leading property consultants conducted a survey, to understand the preferences of employees while working from. Interestingly, nearly 90% of the respondents said that they miss their office environment, while working from home. This could be a basis to judge that office spaces will not go out of fashion and the new normal will involve some office-going culture, which could be restricted to two days in a week.

Apart from this, the recent update of office spaces in leading cities, including Mumbai and Bengaluru, have suggested that demand is looking up but it is for more customised and modified spaces. Most of the leading technology companies have renewed their office leases, despite experimenting with a work-from-home model. Accenture, Oracle, IBM, TCS, Microsoft and many other domestic companies have renewed their lease agreements which cover over 3.5 million sq ft of office space in the top four cities, such as Bengaluru, Hyderabad, Pune and Mumbai.

“It looks like major companies are renewing their leases but most of them are neutral about the long term. Most of them are waiting and would have a flexibility clause, to add additional space, in case offices open full-time,” said Hemanth Acharya, managing director, RealCo, a real estate analytics company, based in Bengaluru.

Acharya further added that most of these companies have renewed their leases for the long term, which shows that there is a scope of revival, in terms of costing and quality talent for India’s commercial landscape. According to industry experts, around 17 million sq ft of office space deals have been finalised so far, which is expected to cross 20 million sq ft in the months to come. This is against 30-35 million sq ft annually, which is considered decent, despite the work-from-home model being tested everywhere.

Another trend, which can alter the revival of commercial spaces, is the fact that there has been no new supply of Grade A office spaces due to the Coronavirus lockdown. This is another reason why large corporates are sticking to their spaces, even if they have an effective work-from-home model.

Recent commercial space deals

| Occupier | Space acquired | Cities |

| Hong Kong TEC | 1 lakh sq ft | Mumbai, Bengaluru |

| Ola Technologies | 4.25 lakh sq ft | Bengaluru |

| Smartworks | 4 lakh sq ft | Mumbai, Bengaluru |

| Standard Chartered GBS | 1 million sq ft | Chennai |

| Amazon | 2.8 million sq ft | Bengaluru, Chennai, Mumbai |

| Apple | 4 lakh sq ft | Bengaluru |

| MUFG | 30,000 sq ft | BKC, Mumbai |

| CTS | 4.72 lakh sq ft | Chennai |

| BNY | 6.25 lakh sq ft | Chennai |

| KLA Tencor | 50,300 sq ft | Chennai |

Source: Recent media reports

Will commercial space rentals fall, because of COVID-19?

Will the pandemic bring down the prices in the sector? According to Mirchandani, clients are looking for high quality projects and prices are no more a factor, as India is already a very competitive and affordable market. Goenka adds, “There is no intense pricing pressure on Indian markets. In fact, there is room for price growth. The rent per sq ft from an MNC’s perspective is around USD 1, which puts India in a very competitive position.

COVID-19 impact on shopping and retail centres

The lockdown has created a lot of pressure on retail spaces, especially in shopping malls, where footfalls have fallen drastically. Moreover, there is limited chance for improvement in the immediate future. Apart from this, according to experts, India has a dearth of quality shopping complexes and retail spaces, which can entice high-end retailers to relook their business models in India.

See also: Post-COVID-19, warehousing segment likely to witness fastest recovery

“Retail is one of the most severely hit sectors and demand will only emerge, once a vaccine is found and people feel it is safe to go out. Footfalls may take longer to return to pre-COVID-19 levels, as there will be a lot of caution and fear among shoppers. There is a lot of uncertainty in the market and it will take a little more time for people to get out of their homes and resume leisure activities,” says Mirchandani.

According to Mehrotra, retail formats might change in the near future, which may also result in changing business models. “Many brands and developers are negotiating over the relief that can be provided and this could impact the returns for the developers,” he says.

FAQs

Which commercial real estate segment has been worst affected by the Coronavirus pandemic?

The retail segment in commercial real estate has been severely hit and demand will only return when people feel it is safe to go out.

When will the office space segment recover from COVID-19?

Vishal Mirchandani, CEO of commercial and retail, Puravankara Ltd, says that the office space segment may bounce back by January 2021.

Will office space rentals fall due to COVID-19?

Rentals for office spaces may be impacted by lower demand due to remote working policies but this may be compensated for by greater demand for space owing to social distancing norms.

Surbhi is an experienced content marketing expert for over nine years now and has contributed articles and research insights for top real estate portals. She is a journalism graduate and has keen interest in politics, urban development and infrastructure studies. Surbhi is a bookworm and delves into historical fiction and inspiring biographies when she is not sleeping.

Facebook: https://www.facebook.com/surbhi.gupta2406/

Twitter: https://twitter.com/surbhi2406

Linkedin: https://www.linkedin.com/in/surbhi-gupta-82159b63/

Quora: https://www.quora.com/profile/Surbhi-Gupta-17

about.me: about.me/surbhi.gupta/