State governments in India fix a rate, below which properties cannot be registered in a particular location at the time of title transfer. This rate is known by various names, including guideline value, circle rate, ready reckoner rate, etc. In Tamil Nadu, the usage of guideline value (GV) is more common. The TNREGINET portal allows you to check the guideline value in Chennai and other cities in Tamil Nadu. It is the official portal of the Tamil Nadu Registration Department.

Prospective buyers must know all about the GV before they make up their mind to buy a property in Tamil Nadu. To help such buyers, we provide a step-by-step process on how to find the guideline value for a property in Tamil Nadu, based on which the stamp duty on property transactions is calculated.

The Tamil Nadu government recently increased guideline values for land by up to 10% in Chennai and some old corporations, reverting to March 2023 values. The new guideline values will be effective from July 1, 2024. The property guideline values in key locations such as Coimbatore, Trichy, Salem and Vellore significantly increased while those in other areas remained unchanged.

What is Guideline value?

Guideline value is the minimum value of a property, as fixed by the state government, at which property can be registered. If the sale of a property takes place at a value higher than the guideline value, the registration will be based on the higher value. However, if you buy a property below the guideline value, you will be required to pay stamp duty and registration charges based on this minimum value.

What is TNREGINET?

TNREGINET, or the Inspector General of Registration (IGRS), is the official website of the Tamil Nadu state Revenue Department. The TNREGINET portal provides various property-related services, which includes:

- Guideline value of property

- Stamp duty valuation

- Encumbrance certificate application

- Checking building value

The portal also provides various other e-services such as application status check, registration of marriage, registration of death, etc.

Significance of guideline values

Helps in estimating property purchase costs

The payment of stamp duty and registration charges adds up to the overall costs for a homebuyer. When buying a property, it is essential to know the latest guidelines and values as they enable a homebuyer to estimate and calculate the cost of their property purchase. The stamp duty and registration charges will be paid on the guideline value or the actual transaction value as specified in the agreement, whichever is higher.

Helps detect property undervaluation, frauds and black money transactions

Knowing the guideline value helps the authorities and buyers to understand and detect undervaluation of properties. It is also a good index that helps buyers understand land value as to price their properties competitively.

It also helps keep property-related frauds in check. Those who try to avoid paying the registration charges can be tracked, and therefore, this gets rid of corruption and scams with regard to land-related deals to an extent.

In cases where the property guideline value is lower than the property’s market value, the possibility of black money dealings increases. In such cases, buyers and sellers agree to a deal where the guideline value is specified on the sale document, and the remaining payment is done in cash.

A lower guideline value compared to the property market value will imply revenue loss for the state government.

Income tax implications

If the sale of a property done at a value less than the guideline value, in such case the seller and buyer would incur a loss. This impact is due to the provision of Section 56 (2) (vii) (b) under the Income Tax Act. If the guideline value is higher than the purchase consideration by over Rs 50,000, the difference amount is considered as ‘income from other sources’ under the act. This provision applies in case the assessee obtains the property as Capital Asset and not as stock in trade.

Guideline values vs Market value

| Parameter | Guideline value | Market value |

| Definition | Guideline value is the estimated market value of a property as per the government records. | Market value refers to the price based on which the actual property transaction between seller and buyer takes place. |

| Determined by | It is determined by the state government. | This value is typically determined by sellers. |

| Factors influencing the value | Factors such as property location is mainly considered when determining the guideline value. The specific features of the property may not be taken into account. | Factors such as market conditions, location, demand and supply dynamics, etc. The specific features of the property (renovation costs, amenities, etc.) are taken into account. |

| Revision of the value | The guideline values are revised periodically but not as frequently as market values can fluctuate. | Market values can fluctuate constantly due to several factors. |

In an ideal scenario, it should be the same as the property’s true value in the market. However, guideline values are lower than the market value in most cases. There are some exceptional cases where one may find the guideline value to be more than market value. There are several land valuation systems to arrive at the true value of land. Nowadays, one can easily estimate the value of a property or land using property value calculator online.

Impact of guideline value increase

Registration charges and stamp duty are usually based on the guideline value. The Tamil Nadu government recently increased the property guideline values across Chennai and key locations. This implies that buying a house in these areas will become costlier. According to some industry players, this increase could also result in an increase in the premium floor space index (FSI).

See also: How to obtain Patta Chitta online in Tamil Nadu

How to find TNREGINET guideline value online?

So far, the guideline value/ guidance value for 2.19 lakh streets and 4.46 crore survey numbers / subdivision numbers is available on the department’s website.

Also read all about IGRS market value in Andhra Pradesh (AP)

- Go to the the Registration Department’s TNREGINET portal at https://tnreginet.gov.in/portal/

- The content is available in both Tamil and English. You can change the language as per your preference.

- Click on Guideline Value option from the menu bar.

- On the next page, click on the relevant link to search for the latest TNREGINET guideline value 2025.

- Users have the option to search for guideline value by street name, survey number or composite value.

Guideline value by street name

- Users can search for guideline value by street name through two options – village wise and category wise.

Guideline value by survey number

Users can search for guideline value by survey number through two options – category wise and survey number wise.

Guideline value by composite value

Users can search for guideline value by composite value village wise option only.

- Provide details such as Zone, Sub-registrar office, registration village, etc.

- Click on Search button to view the guideline value.

- The guideline values for different areas will appear, click on the link to view the details.

- Click on the link to calculate the value of stamp duty based on the document.

See also: All about guideline value in Coimbatore

Guideline Value for land in Tamil Nadu

Guideline value for land in Tamil Nadu refers to the estimated market value of land, according to government records. Typically, the guideline value for land in Tamil Nadu is lower than the market value. If you are investing in a plot of land anywhere in Tamil Nadu, make sure to check the guideline value. The stamp duty and property registration charges are calculated based on the guideline value or the actual transaction value, whichever is higher. One can check the latest guideline value for land on the official portal of Tamilnadu Registration Department TNREGINET website.

Impact of guideline value on home loans

Majority of homebuyers rely on home loans to finance their house purchase. Banks and financial institutions sanction home loans based on the cost of the property, which is referred to as the loan-to-value (LTV) ratio. The guideline value of a property (the term used in Tamil Nadu) has an impact on the home loan in different ways:

- Home loan amount: The lender will offer a specified percentage of the property’s value, up to a maximum of 80%. Hence, a lower valuation will imply a lower amount of home loan.

- Stamp duty and registration fee: The guideline value of a property is referred when calculating the property registration charges.

- Taxation: The guideline value of a property ensures fair taxation. Purchasing a property below the guideline value results in additional taxes for the homebuyer.

- Financial issues: If one purchases a property at a price lower than the guideline value in the area, it can also lead to financial issues for the buyer.

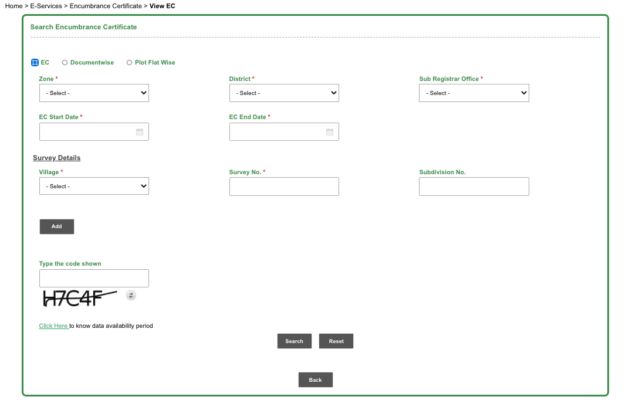

How to view encumbrance certificate on TNREGINET?

On the official TNREGINET website, click on the ‘E-Services’ tab and go to ‘View EC’. Input the details, either document-wise or plot/flat-wise and add details of the zone, district, EC start date, its end date, survey details, verification code and then click on submit, to view the encumbrance certificate.

How is guideline value calculated?

To arrive at the value of property based on the Guideline Value, which is the minimum value of a property in Tamil Nadu at which a property can be registered, the following formula applies:

Property Value = Guideline value (in Rs per sq metre) X Built-up area in sqm

The guideline value can be determined based on the property location and type. The market value of a property is calculated by taking its built-up area and Guideline value into consideration.

For example, property area = 800 sqm

Guideline value = Rs 10,000 per sqm

The property value = 10,000 X 800 = Rs 80 lakh

Factors that influence guideline value in Tamil Nadu

The state government calculates the TN guidelines values for land and other properties by taking into consideration several factors, including:

- Location: This is the primary factor that influences guideline values in a state. The value is likely to be higher for properties in expensive localities compared to other localities in the same city.

- Property usage: The guideline values may vary based on the type of property. That is, property rates may be lower for residential properties compared to commercial properties.

- Amenities: The availability of various amenities and infrastructure can significantly influence the property values in an area.

- Property age: The government also considers the age of buildings when determining the guideline values.

How to check jurisdiction for guideline value?

- Go to the TNREGINET portal at https://tnreginet.gov.in/portal/

- Click the ‘Help’ tab on the homepage and click ‘Web Home Application Services’.

- Click on ‘Know Your Jurisdiction’ option.

- Enter the field office search ‘Street Name’ or ‘Village Name’, and click ‘Search’.

- The details related to the jurisdiction, such as the district name, zone, name and address of the Sub Registrar’s Office (SRO) and the Sub Registrar’s email address will be displayed.

Know about: Hosur

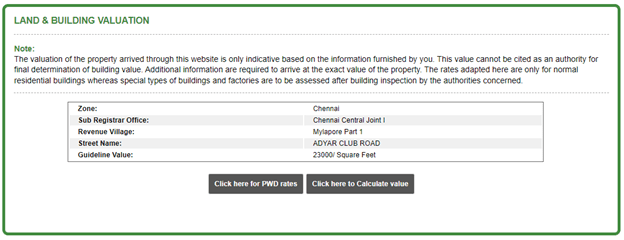

How to calculate building value on TNREGINET?

- Go to the TNREGINET portal at https://tnreginet.gov.in/portal/

- Click the ‘Calculation of Building Value’ option.

- Select the building classification and enter the details, such as building type, zone/region, building age, calculation period, unit, etc., Click ‘Submit’.

Know about: Tirunelveli (Tamil Nadu)

Property or land registration fees in Tamil Nadu

| Document type | Stamp duty in Tamilnadu | Registration charges in Tamilnadu |

| Conveyance (Sale) | 7% of the market value of the property | 4% of the market value of the property |

| Gift | 7% of the market value of the property | 4% of the market value of the property |

| Exchange | 7% of the market value on the property that has the greater value | 4% of the market value on the property that has the greater value |

| Simple mortgage | 1% on the loan amount, subject to a maximum of Rs 40,000 | 1% on the loan amount, subject to a maximum of Rs 10,000 |

| Mortgage with possession | 4% of the loan amount | 1%, subject to a maximum of Rs 2,00,000 |

| Agreement to sale | Rs 200 | 1% on the money advanced (1% on total consideration if possession is given) |

| Agreement relating to construction of building | 1% on the cost of the proposed construction or the value of construction or the consideration specified in the agreement, whichever is higher | 1% on the cost of the proposed construction or the value of construction or the consideration specified in the agreement, whichever is higher |

| Cancellation | Rs 1000 | Rs 50 |

| Partition among family members | 1% on the market value of the property, subject to a maximum of Rs 40,000 for each share | 1%, subject to a maximum of Rs 10,000 for each share |

| Partition among non-family members | 4% on the market value of the property for separated shares | 1% on the market value of the property for separated shares |

| i) General Power of Attorney to sell the immovable property | Rs 100 | Rs 10,000 |

| ii) General Power of Attorney to sell the immovable property (Power is given to a family member) | Rs 100 | Rs 1,000 |

| iii) General Power of Attorney to sell the movable property and for other purposes | Rs 100 | Rs 50 |

| iv) General Power of Attorney given for consideration | 4% on the consideration | 1% on the consideration or Rs 10,000, whichever is higher |

| Settlement in favour of family members | 1% on the market value of the property but not exceeding Rs 40,000 | 1% on the market value of the property, subject to a maximum of Rs 10,000 |

| Settlement in other cases | 7% on the market value of the property | 4% on the market value of the property |

| Partnership deed where the capital does not exceed Rs 500 | Rs 50 | 1% on the capital invested |

| Partnership deed (other cases) | Rs 1000 | 1% on the capital invested |

| Memorandum of Deposit of Title Deeds (MODT) | 0.5% on loan amount, subject to a maximum of Rs 30,000 | 1% on loan amount, subject to a maximum of Rs 6,000 |

| i) Release among family members (coparceners) | 1% on the market value of the property but not exceeding Rs 40,000 | 1% on the market value of the property, subject to a maximum of Rs 10,000 |

| ii) Release among non-family members (co-owner and benami release) | 7% on the market value of the property | 1% on the market value of the property |

| Lease below 30 years | 1% on the total amount of rent, premium, fine, etc. | 1%, subject to a maximum of Rs 20,000 |

| Lease up to 99 years | 4% on the total amount of rent, premium, fine, etc. | 1%, subject to a maximum of Rs 20,000 |

| Lease above 99 years or perpetual leave | 7% on the total amount of rent, fine, premium of advance, if any, payable. | 1%, subject to a maximum of Rs 20,000 |

| Declaration of trust (if property is there, it would be considered as sale) | Rs 180 | 1% on the amount |

| Articles of Association | Rs 500 for every 10 lakh on authorised capital; maximum Rs 5 lakh | |

| Copy or Extract | Rs 100 | |

| Counterpart or Duplicate | Rs 500 | |

| POA | Rs 500

Rs 500 Rs 1,000 Rs 1,000 |

|

| POA to sell immovable property for consideration | 4% on market value | |

| POA to sell immovable

property in favour of family member |

1000 | |

| POA to sell immovable property in favour of person who is not a family member | 1% on market value of property | |

| Reconveyance of Mortgaged Property | Rs 1,000 | |

| Security Bond | Rs 500 | |

| Revocation of Settlement | Rs 1,000 | |

| Surrender of lease | Rs 1,000 | |

| Transfer between Trustee to Trustee or Beneficiary

of same Trust |

Rs 1,000 | |

| Declaration of Trust | Rs 1,000 | |

| Revocation of Trust | Rs 1,000 |

Source: Registration Department, TN

Know about: Apartments for rent in chennai

What is draft guideline value (DGV)?

A draft guideline value (DGV) is a draft of a minimum value for a property determined by the state government. The government releases draft guideline values inviting feedback and comments from the public.

In Tamil Nadu, one can check the draft guideline values by visiting the TNREGINET portal.

- Click on guideline values on the top menu bar of the TNREGINET portal home page.

- Click on the link to check draft guideline values.

- Choose the relevant search criteria – Land Classifiation or Composite

- Select options from the dropdown, including Zone, Sub-registrar office and registration village

TNREGINET portal contact details

Citizens can reach out on the following contact details for any queries regarding the TNREGINET portal:

Helpline number: 044-24640160

Email: helpdesk@tnreginet.net

Housing.com News Viewpoint

The TNREGINET portal has enabled citizens to access various property-related services online, including checking the guideline value in Tamil Nadu. This helps them get a fair idea of the property rates in their city and plan their property purchase. Moreover, it also provides clarity on the stamp duty and registration charges they will have to pay to the state government. The portal makes various government services available online, eliminating the need to visit the sub-registrar office.

FAQs

When was the Guideline Value in Tamil Nadu last revised?

Guidance Value for properties in Tamil Nadu was last revised in 2017.

What is the impact of guideline value revision on property buyers?

It is believed that any cut in guideline value will bring down property prices. However, property value is also determined by other factors, such as registration charges.

Where can I address queries regarding Guideline Value in Chennai?

You can call on 18001025174 or write to helpdesk@tnreginet.net