If you are a prospective home buyer, you would be familiar with the feeling of excitement, as well as indecision, especially when deciding on matters pertaining to home loans. To-be home owners are always worried about the weight of their purchase decision. Questions like how much would go towards the equated monthly installments (EMI) or should I buy or continue to live on rent continue, often confuse buyers. Let us tell you that this indecision surfaces only because, despite plenty of data, it sometimes becomes difficult to estimate the cost of buying a home.

To address this, Housing.com has launched the Home Loan EMI Calculator. Read on to know about the product and the benefits that it offers.

Home loan EMI calculator

A home loan calculator is online tool used for calculating the home loan EMI a borrowers has to pay when applying for a home loan. A home loan calculator will compute the monthly EMIs payable, basis the factors such as principal amount, interest, and the tenure. On the home loan calculator page, one has to select factors such as loan amount (rupees), tenure (years), and rate of interest (%). The page will show results, including the monthly EMIs (Equated Monthly Instalments) to be paid to the bank and the home loan EMI chart or amortization table.

Home loan EMI calculators: How do they work?

The EMI to be paid for a home loan is calculated based on the following mathematical formula:

EMI (E) = [PxRx(1+R)^N]/[(1+R)^N – 1]

Here, the value of E or EMI will vary depending on the variables, P, R, and N;

- P refer for the principal amount

- R is the interest rate decided by the lender

- N is the number of years or during for which one has availed the loan. Since EMI amount must be paid on a monthly basis, the duration of loan is calculated in the number of months.

Let us suppose, a person has applied for a loan of Rs 10 lakh with an average interest rate of 8% for a tenure of 10 years. Then, based on the above formula, the EMI to be paid will be as given below:

P = Rs 10 lakh

R = 8% p.a. i.e., 8 (12X100) per month

N = 120 months

EMI (E) = [1000000×8/(12×100) x (1+8/(12×100)^120]/[(1+8/(12×100))^120 – 1] = [6666.6667×2.2194]/ (2.2194-1)

EMI (E) = Rs 12,133

Home loan EMI calculator: Estimating your EMI

Sachin Wadhwa is keen to buy a property in Bengaluru. His monthly take-home salary is Rs 1.77 lakhs. He has an outstanding automobile loan of Rs 15,600 per month and takes care of the household in entirety – this includes expenses on food, clothing, domestic helps, rent, repairs and maintenance, etc. The monthly rent is Rs 35,000. His home loan requirement is Rs 46 lakhs. Now, Wadhwa is considering an SBI home loan and while he is still waiting to learn whether the loan will be sanctioned, he wishes to estimate his outflow on EMI. Let us see this through the EMI calculator.

See also: Home loan interest rates in top 15 banks

We have marked all the details on the calculator as seen in the picture below. At a home loan rate of 8.3%, for a loan of Rs 46 lakhs, Wadhwa’s EMI outflow over the next 20 years will be Rs 39,340 per month. The total amount that he would be paying as interest, comes to Rs 48.41 lakhs.

Housing.com EMI calculator: How to use the EMI calculator?

Step 1: Log on to Housing.com or click here

Step 2: Provide the details on this housing loan calculator page, such as the name of the bank from which you would like to take the loan, enter the loan amount, repayment tenure, rate of interest and prepayment details.

That is all you are required to do. The total interest amount, processing fees and other details will show up and you can instantly decide whether or not it suits your budget.

EMI calculator for home loan helps you make a decision to buy or rent

It is a conventional understanding that buying a home is a better option than living on rent. While the security of owning a house adds to your asset portfolio, in some Indian cities, EMIs may be dearer or more expensive than rent. With Housing.com’s EMI calculator, you can understand the difference.

Case 1:

Let us take the example of Kiran Shah who has been planning to invest an amount of Rs 2 crores into a property. Currently, she pays Rs 60,000 as rent for a 2BHK in Andheri west, Mumbai. Should she go ahead and buy the property?

Let us analyse.

Property price = Rs 2 crores

Loan amount = Rs 1.60 crores

Down Payment = Rs 40 lakhs

Interest rate = 8.3%

Loan tenure = 15 years

Current rent = Rs 60,000

Shah’s monthly gross salary is Rs 1.9 lakhs and falls under the 20% income tax slab. She is interested in a ready-to-move-in property and expects a capital appreciation of 4% per year. Her investments under Section 80C, would save her Rs 1.50 lakhs per year.

Should she buy this property or continue on rent?

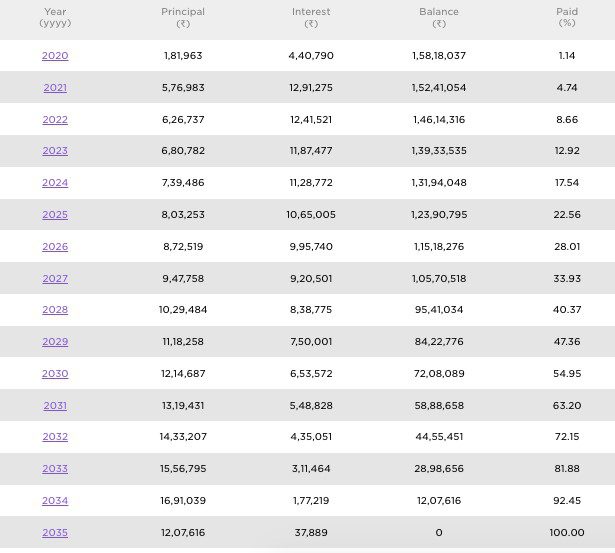

The amortization table for Shah looks like this:

If you look at it, the per month EMI comes to around Rs 1,55,688. Repaying the loan amount over 15 years will mean that Shah will be spending over Rs 2.80 crores in acquiring this property. Others charges, such as processing fees, GST and other taxes have not been included in this calculation.

On the other hand, renting costs her Rs 60,000 per month only. However, we have not included the rent hikes per year. Despite the price, renting in Shah’s case will be profitable.

See also: Pros and cons of home loan prepayment

Case 2:

In Neena Pillai’s case, the following apply:

Property price = Rs 75 lakhs

Loan amount = Rs 60 lakhs

Down Payment = Rs 15 lakhs

Interest rate = 8.3%

Loan tenure= 15 years

Current rent = Rs 41,000 per month

Simply feed in the details on the EMI calculator as explained before.

Over the next 15 years, Pillai would have spent about Rs 1.30 crores in the home-buying process. While her EMI is still higher than her monthly rent, at Rs 58,383 per month, in the long-run, buying becomes a better decision. Check the amortization schedule to understand this.

Start using the EMI calculator now and check whether your spending on real estate, is in-sync with your budget.

What is home loan EMI?

Buying a house is a wise decision since property prices have been skyrocketing. A home loan or a housing loan is a loan that one can obtain from a bank or a non-banking financial company (NBFC) to purchase a home. This type of loan provides a substantial amount to finance a house purchase and can be availed over a longer period. A specified interest rate is charged by the lending institution. The EMI one is required to pay include the principal and the interest part, which may be a fixed amount to be paid during the loan tenure.

Check out: Have info. regarding UP Baroda bank IFSC code

FAQ

Is it better to buy or rent?

The decision to buy or rent depends on a lot of factors - for example, for security, for asset building, for investment purpose, etc. You should use an online calculator, to see how the buy or rent decision affects your finances in the long run.

Can renting be profitable?

Renting may be profitable, but the scale will depend on an individual’s personal requirements.

Can I adjust home loan rate on Housing.com’s emi calculator?

Yes, all fields are editable.