August 28, 2023: India’s real estate sector is expected to expand to $5.8 trillion by 2047, says a joint report by global property brokerage firm Knight Frank India and industry body Nardeco (National Real Estate Development Council). The report titled India Real Estate: Vision 2047, Knight Frank India, also says that this estimated real estate output value will contribute 15.5% to the total economic output in 2047 from an existing share of 7.3%.

By 2047, when India reaches 100 years of independence, the size of India’s economy is estimated to range between $33 trillion to $40 trillion. For study purpose, Knight Frank taken the the mean estimated growth of Indian economy to value $36.4 trillion by 2047.

“Significant expansion of the Indian economy by 2047 will be powered by real estate. A multifold economic expansion will boost demand across all the asset classes – residential, commercial, warehousing, industrial land developments etc. – will grow at a multiplier rate to accommodate the growing needs of the economy and consumption needs of the individuals,” said Naredco president Rajan Bandelkar.

Potential output growth of real estate and key assets by 2047

| 2022 | 2047 estimates | |

| Indian real estate output | $477 bn | $5,833 bn |

| Residential Real Estate Output | $299 bn | $3500 bn |

| Office Real Estate Output | $40 bn | $473 bn |

| Warehousing Real Estate Output | $2.9 bn | $34 bn |

(Source: Knight Frank Research)

PE investments in realty

Private equity (PE) investments in the Indian real estate sector have consistently grown over the past two decades. Projections for 2023 indicate that PE investments in Indian real estate are poised to reach $5.6 billion, reflecting an annual growth of 5.3%. With India’s GDP expected to reach $36.4 trillion by 2047, private equity investments within the Indian real estate sector are projected to surge to $54.3 billion by 2047, signifying a compounded annual growth rate (CAGR) of 9.5% spanning 2023 to 2047.

Investment in Reits

The report said that the combined portfolio of Indian real estate investment trusts (reits) encompasses 84.9 million square foot (msf), with 75.9 msf dedicated to office assets and 9 msf to retail assets. Additionally, there is ongoing construction of approximately 21.3 msf within the sector, projected to reach completion within 1-2 years.

Global Recognition of Indian Reits

| Office Portfolio (msf) | US | UK | Australia | Singapore | China | India |

| GDP ($ billion) | 25,460 | 3,130 | 1,606 | 591 | 18,100 | 3,390 |

| First Reit Launch Year | 1960 | 2007 | 1971 | 2002 | 2001 | 2019 |

| No of Reits | 206 | 56 | 46 | 42 | 28 | 4 |

| Reits market cap ($ billion) | 1,226.1 | 65.9 | 90.3 | 77.5 | 4.7 | 8 |

| Market cap/GDP | 4.8% | 2.1% | 5.6% | 13.1% | 0.0% | 0.2% |

(Source: Knight Frank Research)

“With the initial Reits setting a positive precedent, it is probable that in the coming years will expand into diverse sectors such as residential and warehousing, in addition to the existing office and retail segments. Inspired by global markets, developers are likely to contemplate venturing into Reits for alternative asset classes like data centers, hospitality, healthcare, education and more, in the longer term over the next 25 years,” the report said.

Estimated growth potential across RE asset classes by 2047

Residential

According to Knight Frank India, there will be an estimated 230 million units of housing requirement in India in the next 25 years. In terms of market value, the residential market has a potential to generate an output equivalent of $3.5 trillion by 2047.

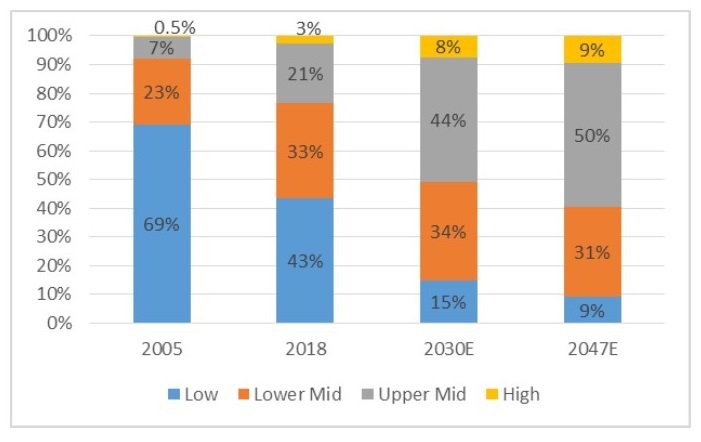

With the changing income profiles, the demand for housing will emerge across all the price categories. In the next few years, while the demand for housing will remain concentrated in affordable housing, it will gradually shift towards mid-segment and luxury housing. The share of lower income households will reduce from existing 43% currently to 9% in 2047. A significant share of the population will shift to lower-middle and upper-middle-income categories. This will enable a significant demand for mid-segment housing. Additionally, the share of hight net-worth and ultra-hight net-worth households in India which will likely increase from existing 3% to 9% in 2047 will generate a significant demand for luxury housing in India.

“The housing-for-all project will propel the sustainable demand for residential housing across the spectrum. A strong foundation for the upward cyclical growth of the real estate sector is being laid by the government and the regulatory authorities. The northbound growth in the sector is driven by the favourable domestic economic environment with economic resilience, bolstered infrastructure growth plans, alternative investment models, and domestic consumption power. Growing GDP will stimulate commercial and industrial real estate growth, attracting global investors towards Grade A assets. Emerging alternative asset classes will also play a critical role in pooling investments and boosting investors’ confidence,” said Naredco national vice-chairman Niranjan Hiranandani.

Estimation of share of households across different income groups

(Source: World Economic Forum, Knight Frank Research)

Office

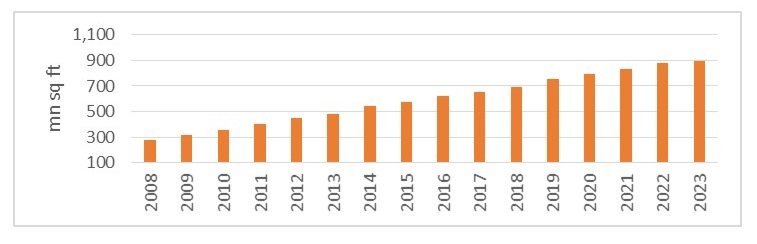

As per Knight Frank estimates, 69% of the working population will be formally employed to support the economic expansion of $36 trillion by 2047. In terms of market value, the estimated office stock is likely to generate a potential output equivalent to $473 billion in 2047. The office stock has grown significantly from 278 msf ft in 2008 to 898 msf cumulatively across the leading eight cities in India in 2022.

Office stock in India

(Source: Knight Frank Research. Note: Office stock across top 8 cities in India, 2023. Data is till June 2023)

“The next 25 years are going to witness a dramatic transformation in the Indian economy and the real estate sector. Factors like demographic advantages, improving business and investment sentiments, and government policy push towards high-value output sectors such as manufacturing, infrastructure etc. will robustly support the economic expansion of India. In the imminent future, India’s economy is expected to grow at a rapid pace, and the structural shift in the economy will be led by a major push to the growth of all sectors including real estate. For sustainable growth, it is imperative that India’s real estate sector adapts to transformations in the economy and changing technologies, making optimum use of the growing resources, especially the human capital,” says Shishir Baijal, chairman & managing director, Knight Frank India.

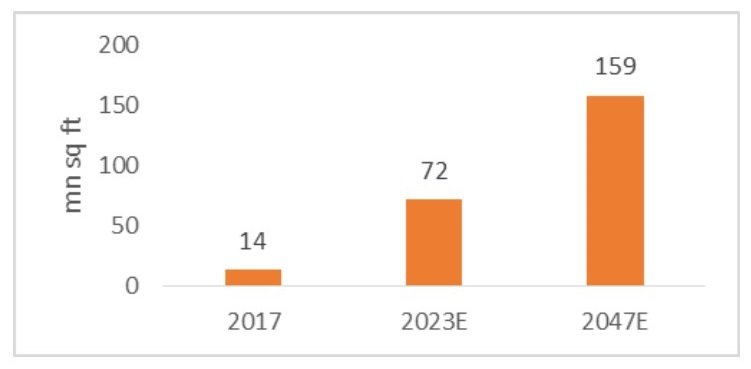

Warehousing

Spurred by the high degree of correlation between the economic growth and increase in income levels, India’s warehousing market is likely to witness a potential demand for 159 msf by 2047. India’s warehousing sector has a potential to generate an output equivalent to $34 billion in 2047.

Potential warehousing transaction volume in 2047E

(Source: Knight Frank Research)

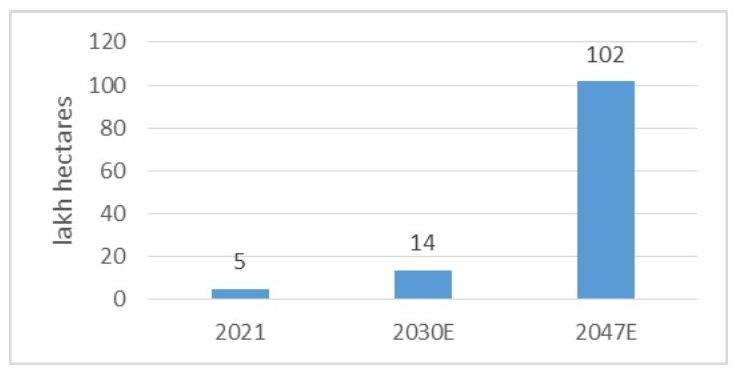

In a sperate section of the report on the impetus of manufacturing sector to industrial development, the report estimates that by 2047, at an average pace of growth India’s manufacturing sector is likely to contribute 32% to the country’s economic growth. As of 2021, 5 lakh hectare of land in India has been under usage for industrial purpose which comprises of 3,989 special economic zones, Industrial parks and estates, etc.

To cater to the manufacturing activities in the economy in the next 25 years, an estimated 102 lakh hectares of land is required for usage of industrial activities in India. The exponential growth in required industrial land has a capacity to generate a revenue equivalent to $110 billion in 2047.

Industrial land requirement in 2047

(Source: GoI, Knight Frank Research)

Retail

The report says that organised retail consumption is currently estimated to be at 4.6% of the total private consumption of individuals. This is significantly smaller when compared to developed markets such as the US, where retail consumption comprises 40% of the total private consumption of individuals. However, with growing income levels and the growing propensity of households in India to consume, the share of retail consumption is estimated to be 37% of the total private consumption by 2047, when the size of the Indian economy is estimated to be $36.4 trillion.

“This quantum of consumption boost will support the entry and expansion of retailers in India and provide an impetus to the retail real estate both for the shopping malls and the high streets,” says the report.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

Housing News Desk is the news desk of leading online real estate portal, Housing.com. Housing News Desk focuses on a variety of topics such as real estate laws, taxes, current news, property trends, home loans, rentals, décor, green homes, home improvement, etc. The main objective of the news desk, is to cover the real estate sector from the perspective of providing information that is useful to the end-user.

Facebook: https://www.facebook.com/housing.com/

Twitter: https://twitter.com/Housing

Email: [email protected]