The Khammam Municipal Corporation (KMC) oversees property tax matters in Khammam, Telangana. To streamline the payment process, the corporation has introduced a user-friendly portal. Property owners can conveniently calculate and settle their property tax obligations through this website. Timely payment entitles individuals to rebates and discounts on the total amount due. Learn how to pay property tax in Khammam online and offline.

Check how to pay Sangareddy Municipality property tax

How to calculate Khammam property tax?

Khammam property tax is the annual payment made by property owners to the municipal corporation. Residents can utilise the property tax calculator to accurately determine their tax liability. Several factors are taken into account when computing property tax in Khammam, including:

- Building permission status

- Registered title deed, patta availability or court decree

- District and Urban Local Body

- Street name

- Locality name or gram panchayat

- Total plot area (in square yards)

- Floor number

- Zone classification

- Sanctioned plinth area (in square metres)

- Building classification

- Sanctioned building usage

- Constructed building usage

- Date of construction for the building

- Occupant type

- Value of construction (in square feet)

- Sanctioned number of floors

- Constructed width (in metres)

- Constructed length (in metres)

- Plinth area (in square metres)

How to pay Khammam property tax online?

Property owners can conveniently pay their property tax in Khammam online through the official website. Follow these steps for a hassle-free payment process:

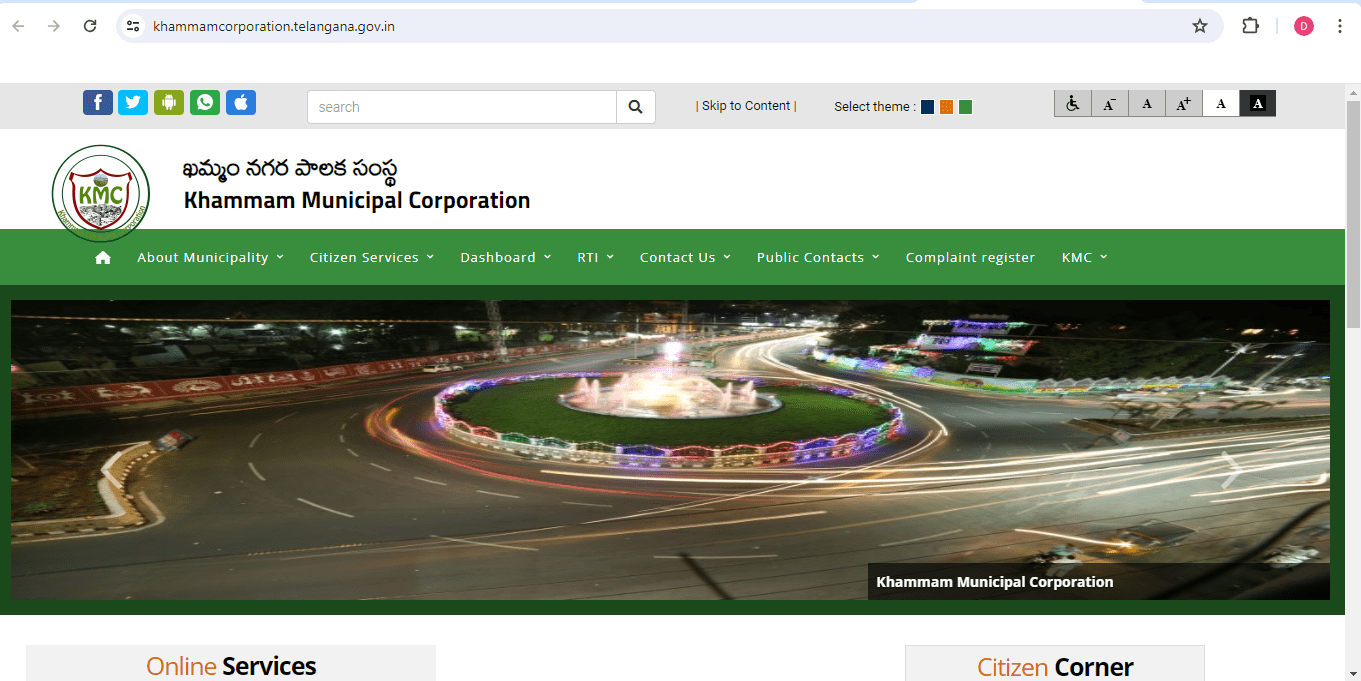

- Visit the official Khammam Municipal Corporation (KMC) website.

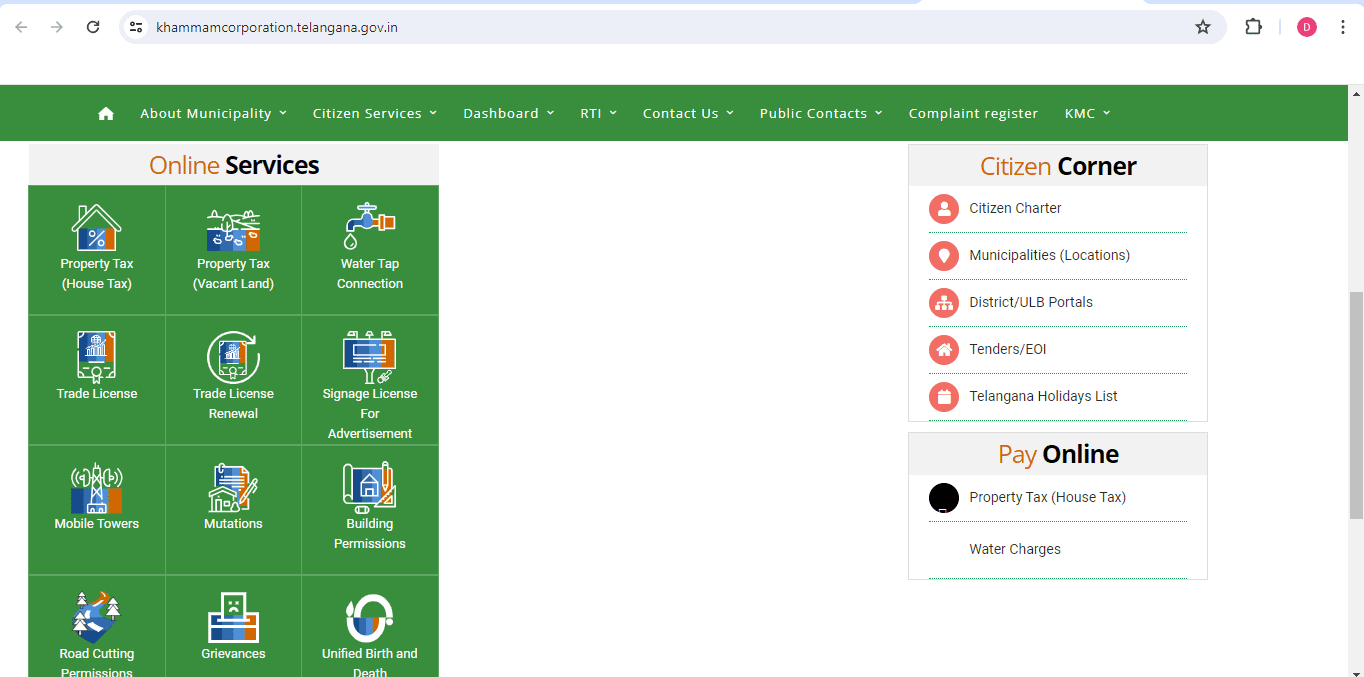

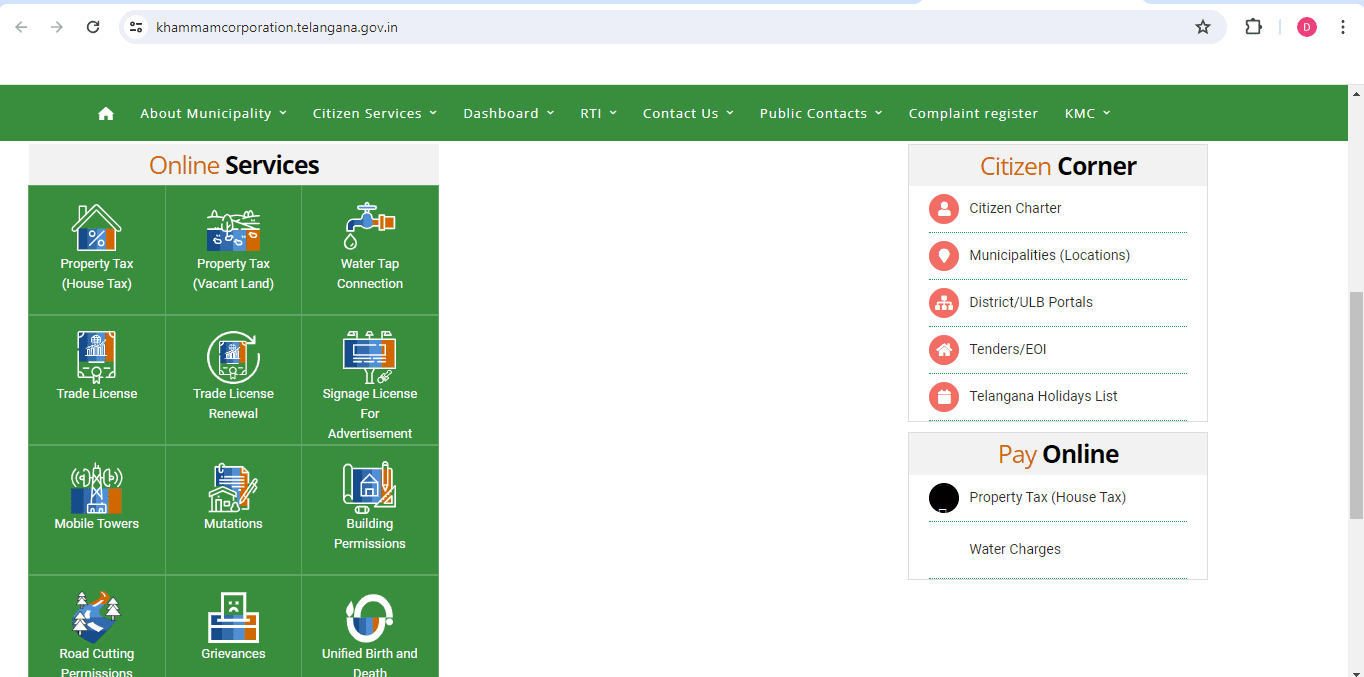

- Click on ‘Property Tax (House Tax)’ under ‘Online Services’.

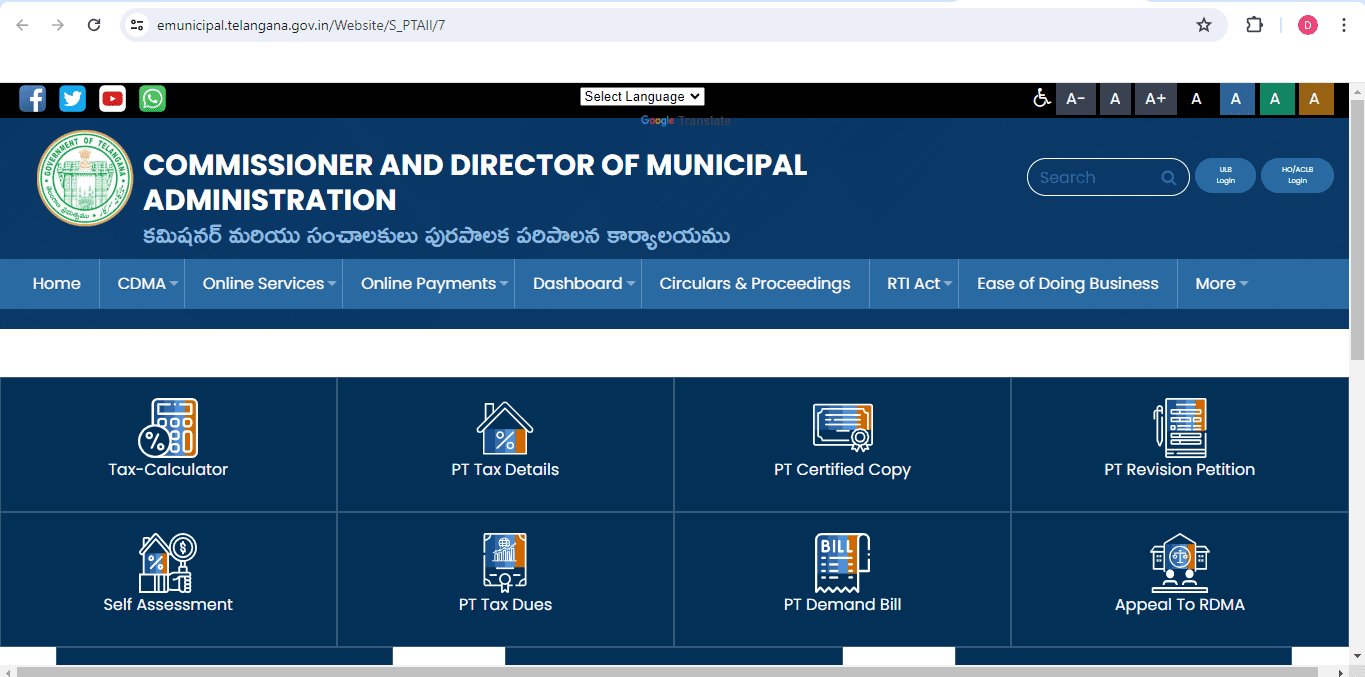

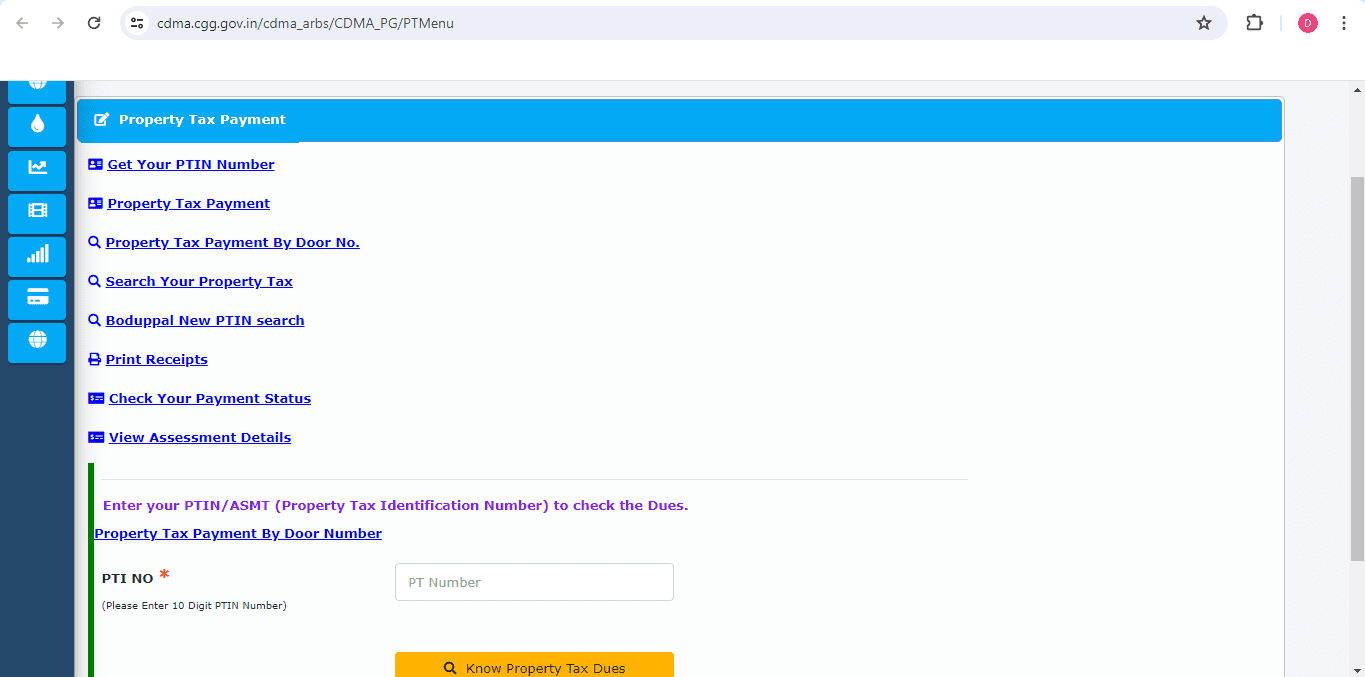

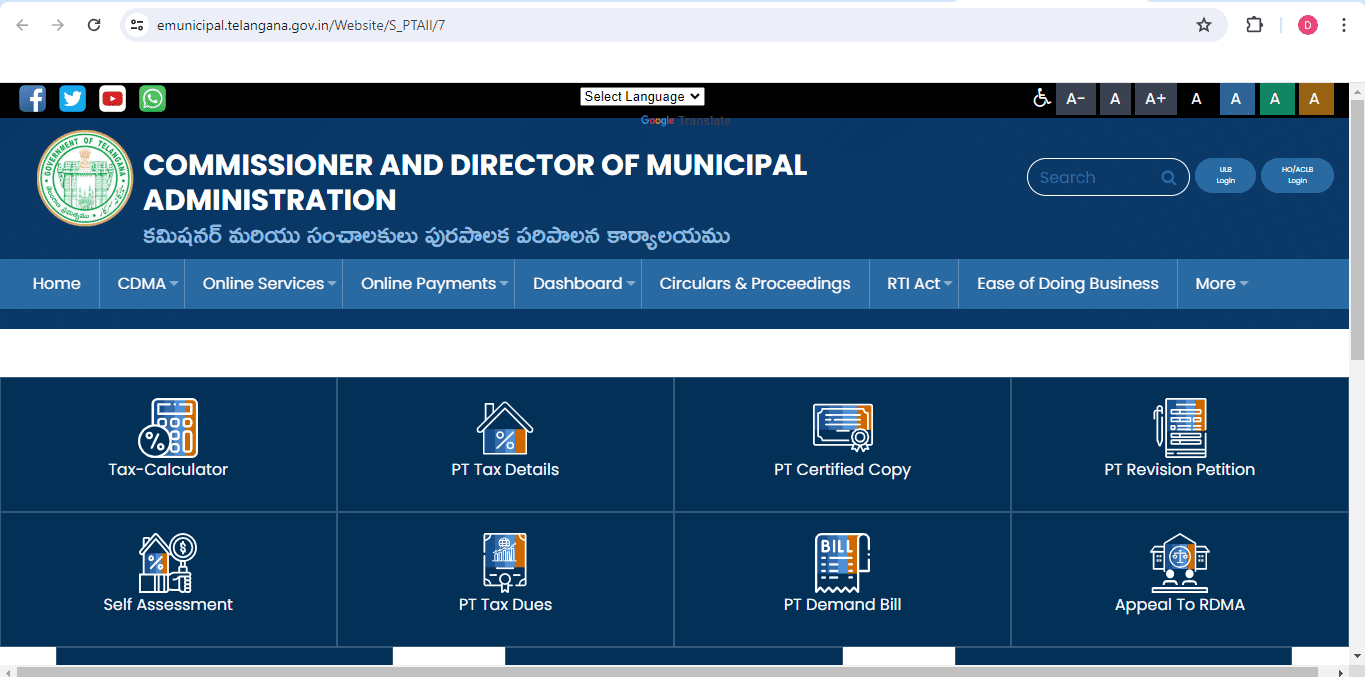

- You will be redirected to the CDMA website.

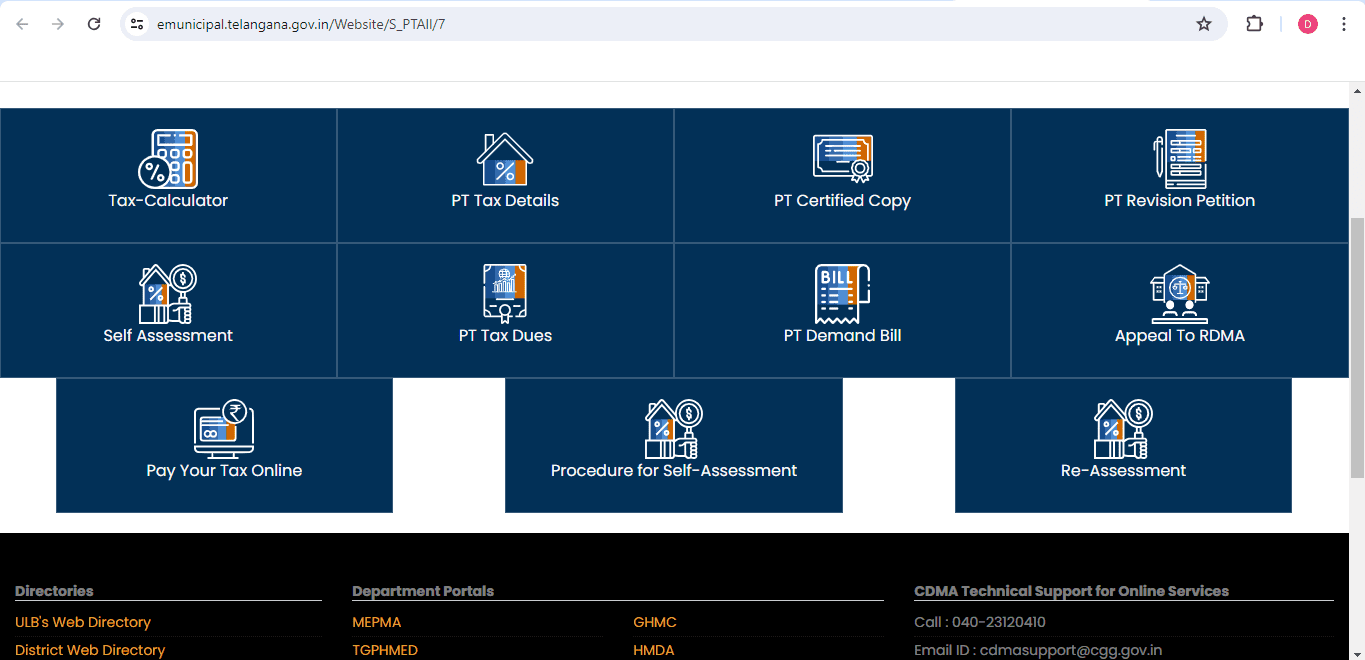

- Click on ‘Pay your Tax Online’.

- If you choose to pay tax via PTIN number, enter the PTIN or ASMT and click on ‘Know Property Tax Dues’.

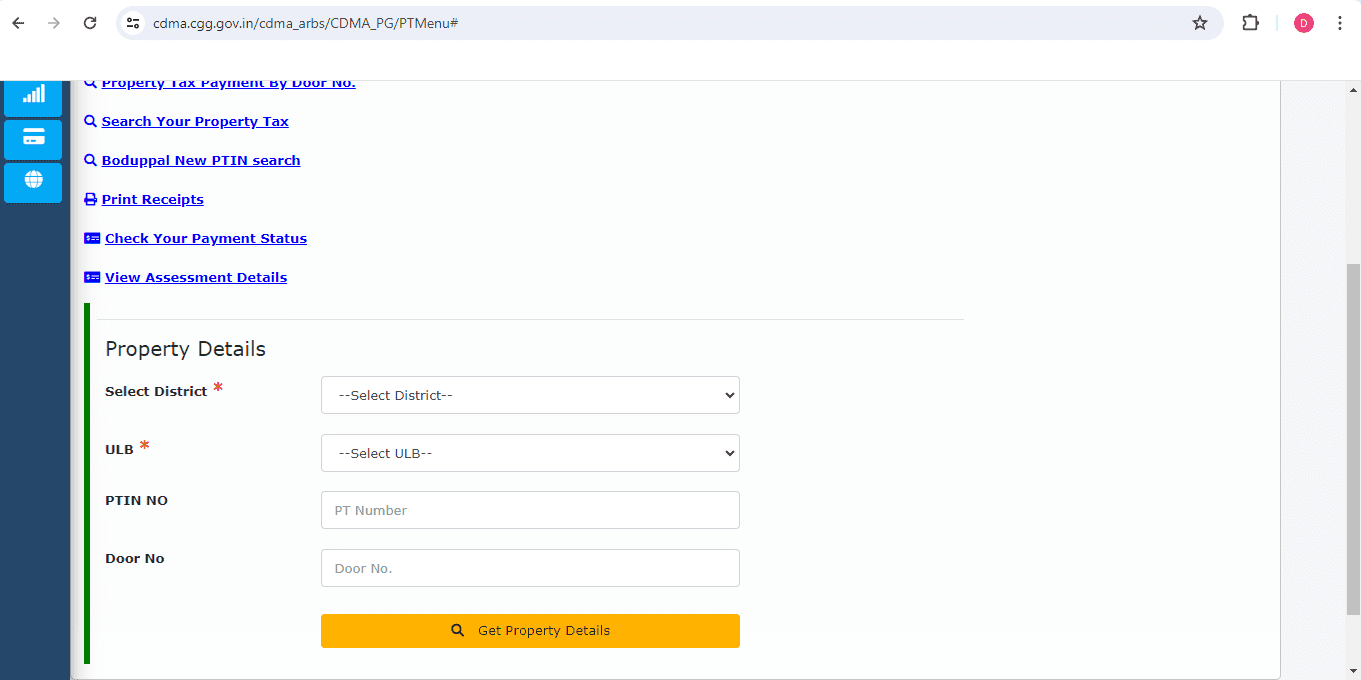

- If you plan to pay tax via door number, enter the district, ULB, PTIN number and door numberand click on ‘Get Property Details’.

How to pay Khammam property tax offline?

Taxpayers can pay their property tax offline by visiting the nearest Telangana Municipal office. Below are the contact details of the Commissioner and Director of Municipal Administration (CDMA), Telangana:

- Email: [email protected]

- Technical support: 040 2312 0410 (available from 10 AM to 5 PM on working days)

When to pay Khammam property tax?

The deadline for paying property tax in Khammam is April 30th of each financial year. Residents who miss this deadline will be subject to a penalty.

Khammam property tax rebate

Individuals who pay their property tax within the deadline qualify for a rebate of 5% of the amount due.

How to change the name on the Khammam property tax bill?

- Visit the official Khammam Municipal Corporation (KMC) website.

- Click on ‘Mutations’ under ‘Online Services’.

- You will be redirected to the CDMA website, emunicipal.telangana.gov.in.

- Click on ‘Mutation Click Here’.

- Enter a valid mobile OTP to access the mutation form.

- Fill out the mutation form with the required details and upload all the required documents in the prescribed format. Click on ‘Submit’.

- The application ID will appear on the screen and an SMS will be sent to the applicant for further reference. The application will be sent to the revenue inspector (RI) for inspection.

- The RI will verify and approve the application. The application will be forwarded to the Revenue Officer (RO) for verification and approval.

- After receiving approval, the application will be forwarded to the municipal commissioner (MC).

- Once approval is received, the applicant will receive the payment link via SMS.

- After paying the mutation fees, the mutation application process will be

Taxpayers must upload one of the following documents when applying online for the mutation of the Khammam property tax:

- Will deed

- Sale deed

- Court deed

- Gift deed

- Partition deed

- Released deed

- Revocation deed

- Legal heir document

- Settlement deed

- Cancel deed

- Rectification deed

Housing.com POV

Managing property tax obligations in Khammam, Telangana, is now convenient, thanks to the efforts of the Khammam Municipal Corporation (KMC). Through their user-friendly portal, property owners can calculate and settle their taxes, ensuring timely payments with rebates and discounts. Whether online or offline, the process has been streamlined for the benefit of the residents. With clear guidelines on tax calculation, payment methods, deadlines and procedures for updating property details, the KMC aims to provide efficient and accessible services to all taxpayers. By following the outlined steps, individuals can fulfil their property tax responsibilities while availing incentives and ensuring compliance with regulations.

FAQs

How can I calculate my property tax Khammam?

Property tax in Khammam is calculated based on various factors, such as building permission status, plot area and construction details. You can use the property tax calculator to accurately determine your tax liability.

What are the payment options available for Khammam property tax?

Property owners in Khammam can pay their taxes online and offline. Online payment can be made through the official Khammam Municipal Corporation website using the Property Tax Identification Number (PTIN) or door number. Offline payments can be made at the nearest Telangana Municipal office.

What is the deadline for paying Khammam property tax?

The deadline for paying property tax in Khammam is April 30th of each financial year. Failure to pay before the deadline may result in penalties.

Can I get a rebate on my Khammam property tax?

Yes, individuals who pay their property tax within the deadline are eligible for a rebate of 5% of the amount due.

How can I update the name on my Khammam property tax bill?

To update the name on your Khammam property tax bill, follow the mutation process. This can be done online through the official Khammam Municipal Corporation website by filling out the mutation form and submitting the required documents.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at Jhumur Ghosh |

Dhwani is a content management expert with over five years of professional experience. She has authored articles spanning diverse domains, including real estate, finance, business, health, taxation, education and more. Holding a Bachelor’s degree in Journalism and Mass Communication, Dhwani’s interests encompass reading and travelling. She is dedicated to staying updated on the latest real estate advancements in India.

Email: [email protected]