While real estate developers in India were betting on firming up of property prices in India, following an improvement in home sales in 2021, the chances of that happening have slimmed significantly, with the springing up of the Omicron variant of the Coronavirus in 2022.

Sector experts were predicting that the wobbly housing market in India might find its footing in the year 2022. Their projections were based on the fact that there was a marked recovery from the pandemic, even as home loan interest rates have been hovering at 10-year-low levels.

However, the emergence of Omicron variant of the Coronavirus has thrown a spanner in the works. As on January 20, 2021, India reported 8,209 cases of the Omicron variant of the Coronavirus, as states tightened security measures and stepped up the vaccination programme, to curb its spread. First reported in South Africa on November 24, 2021, the Omicron variant of the Coronavirus has been termed a ‘variant of concern’ by the World Health Organization.

As a result of this, property prices in India are likely to remain under stress till the third wave of the pandemic is over.

On the other hand, 60% developers who participated foresee a price rise of up to 20% in 2022, due to an increase in prices of building materials, according to a survey conducted by realtors body CREDAI. Nearly 35% respondents expected prices to rise by 10%-20% while 25% predicted up to 10% hike in rates. Another 21% participants felt that prices would increase in the range of 20%-30%.

***

Covid-19 impact on property prices in India

Even though rates of property remained under stress after the outbreak of the pandemic in early 2019, till the second outbreak in 2021, property prices in India started to show appreciation towards the latter part of 2021. The increase in property prices was driven by renewed buyer interest in residential real estate and increased material cost.

Property prices in India’s big cities

Rates of properties in most Indian cities have increased during the July-September period of 2021, after the second wave of the Coronavirus pandemic. According to Real Insight: Q3CY21, a quarterly report by PropTiger.com, Ahmedabad recorded the highest growth of 8% during the quarter on a year-on-year basis.

Price growth: City-wise break-up

| City | Average price range as on September 30, 2021 (in Rs per sq ft)* | Annual growth in % |

| Ahmedabad | 3,300 – 3,500 | 8 |

| Bangalore | 5,400 – 5,600 | 4 |

| Chennai | 5,300 – 5,500 | 3 |

| Hyderabad | 5,800 – 6,000 | 6 |

| Kolkata | 4,100 – 4,300 | 2 |

| MMR | 9,600 – 9,800 | 3 |

| NCR | 4,300 – 4,500 | 5 |

| Pune | 5,000 -5,200 | 4 |

| National average | 6,200 – 6,400 | 5 |

Source: Real Insight (Residential) – July-September (Q3)2021

*All prices are weighted average prices as per new supply and inventory.

Sector experts are already hinting at how property prices are bound to see upwards correction after the discount-laced festive season comes to a closure. This belief is based on the facts that prices of construction materials have appreciated significantly in the past two years even as housing sales remained dismal for a large part of this period, putting intense monetary pressure on the developer community.

However, there is no denying that housing affordability in India has improved remarkably since the onset of the pandemic in March 2o20. Experts are of the view that properties in India are at its most affordable currently, considering that housing loans are available for interest rates as low as 6.50%, while buyers also have a narrow window to avail of the benefits of the government’s PMAY credit-linked subsidy scheme. Moreover, several authorities have effectuated reductions in circle rates (the minimum rate below which a property cannot be purchased) and stamp duty charges (the tax that buyers have to pay to the state, to get the property title registered in their names). With the ongoing festive season, builders are also likely to offer discounts on property purchases in India, making it the perfect time for investment in real estate in 2021.

Put together, these factors have increased housing affordability in India, in spite of the minimal appreciation in values of new properties, primarily fueled by a hike in rates of construction materials and labour shortage.

Will property prices fall further in 2021?

While further depreciation in property prices cannot be ruled out, sector experts are of the view that rates might start firming up, once the dull economic situation caused by the second wave of the COVID-19 pandemic improves, signs of which are already visible. Even though economic growth is likely to remain subdued in the first half of 2021, it might bounce back in the second half, provided the impact of any third wave of the pandemic is mild.

As mentioned earlier, housing loan affordability in India continues to be robust, considering the country’s banking regulator, the RBI, has maintained key lending rates at record low levels. Since the RBI-determined repo rate, at which it lends money to commercial banks in India, is currently at 4%, most banks in the country are offering home loans at 6.5% annual interest. They are also attracting borrowers by way of offering additional discounts like home loan processing fee waivers. India’s largest bank SBI, for example, is among the lenders currently offering a complete waiver on home loan processing fee.

Housing affordability in India might improve further, if states start reducing stamp duty, something that the centre has been urging them to do for a long time.

***

Even though the impact of the Coronavirus-induced economic troubles on property values in India’s mega cities may have been limited, the second wave of COVID-19 pandemic is likely to cause a much deeper overall impact, the positive outlook by industry bodies notwithstanding.

According to a Reuters poll unveiled on May 21, 2021, the devastating impact of the second COVID-19 wave in Asia’s third-largest economy, will stagnate price growth by crushing demand and offsetting the benefits to real estate developers offered by the government in the form of subsidies and incentives. During a poll in January 2021, analysts predicted a 1.3% average growth in property prices.

A recent research report by QuantEco Research also showed that the second wave would hit the Indian economy, by prompting people to save, rather than spend. Considering that housing purchases require big-ticket investments, the demand for homes would be subdued in the period that follows the second and third waves in India. Rates of properties might, thus, be adversely affected, because of the stress on demand.

Unlike the first wave that made bare the importance of housing ownership, as against other assets in the event of a pandemic and thus, acted as a propeller of demand for the housing sector, the Coronavirus second wave may in fact disrupt the demand momentum caused by the first wave.

India is second among the most-affected countries by active cases in the world. On May 30, 2021, the country added 1,65,553 cases to take its total caseload to 2,78,94,800. With 3,460 deaths on the same date, India’s total death toll due to the pandemic has now reached 3,25,972.

Nonetheless, housing affordability in India has improved significantly since 2015. In a report issued on May 24, 2021, JM Financial Institutional Securities Ltd said that housing affordability in India had improved over the years, in view of the fact that annual incomes have been on an upward trajectory while property cost has been fairly stable since 2015.

Increase in rates of raw material may boost property prices

Meanwhile, the pandemic-induced spike in prices of essential raw materials, like steel bars, cement, plastic, man-made polymers and resins, etc., are putting pressure on builders to hike prices of new projects. Supply shortage is only making matters worse.

“In the last three months iron prices have increased by Rs 20,000 per tonne, which is almost a 50% increase in prices. Apart from this, copper and aluminium prices have also increased, which has impacted construction costs. At a time when the real estate industry is already feeling the pressure of the second wave and the lockdown restrictions, the rise in prices of raw materials will put the brakes on the recovery of the real estate sector,” said Ashok Mohanani, president, NAREDCO-Maharashtra.

“Once the lockdown restrictions are lifted, we might notice a gradual rise in property prices in the coming months, where the change in percentage may vary as per different markets. In some parts of the country, we may witness minor hikes in property prices by the end of the next quarter, whereas we may see more significant corrections in prices by the end of 2021. All of this will be contingent on the successful stabilisation of the ongoing healthcare crisis in the country by the relevant authorities,” said Jayesh Rathod, executive director, The Guardians Real Estate Advisory.

***

Amid a slight pick-up in home sales during the January-March period of 2021, India’s eight prime housing markets have shown almost flat price growth, data available with PropTiger.com show. However, housing markets of Ahmedabad and Hyderabad remained exceptions, with both cities seeing a 5% annual appreciation in prices. This growth, especially in Ahmedabad, could, however, be attributed to the fact that average rates of properties in this market are already on the lower side when compared to other cities.

Annual property price growth: City-wise break-up

| City | Average price as on March 31, 2021 (in Rs per sq ft) | Annual growth in % |

| Ahmedabad | 3,234 | 5 |

| Bangalore | 5,450 | 3 |

| Chennai | 5,275 | 3 |

| Hyderabad | 5,713 | 5 |

| Kolkata | 4,208 | 1 |

| MMR | 9,474 | No change |

| NCR | 4,327 | 1% |

| Pune | 5,76 | 3 |

| National average | 6,234 | 3 |

Source: Real Insight: Q1 2021

According to a Reuters poll of property analysts earlier this year, house prices in India’s prime cities will barely rise in 2021, despite an economic recovery and supportive policies. The January 2021 poll of 13 analysts showed that average house prices in the country would rise by 1.3% this year, while a rise of 4.5% could be expected in 2022. The poll also showed that property values in 2021 would hold steady in Mumbai, Delhi and the National Capital Region, compared to contractions of 3.25%, 3.0% and 2.5%, respectively, predicted in September 2020.

The forecasts in the poll, were based on the assumption that the risk of a COVID-19 resurgence derailing activity was low. Much has changed since then. On May 10, 2021, 3,66,161 new Coronavirus infections and 3,754 deaths were reported in the country, with numbers standing close to record daily highs, amid claims that the peak of the second wave of COVID-19 is on the decline. With this, India currently has a total tally of virus infections at 22.66 million, with 2,46,116 deaths due to the pandemic.

***

Even though the stress caused by the Coronavirus pandemic has impacted India’s key residential markets, the average rates of new projects continue to stick to their previous levels, data available with PropTiger.com show. According to a report by the property brokerage firm, the weighted average prices of properties, in leading markets like NCR and Mumbai showed flat growth in the October-December period of 2020, when compared to the levels seen in the same period in 2019.

Price growth in Q4 2020: City-wise break-up

| City | Average price as on December 31, 2020 (in Rs per sq ft) | Annual growth in % |

| Ahmedabad | 3,213 | 7 |

| Bangalore | 5,342 | 2 |

| Chennai | 5,228 | 2 |

| Hyderabad | 5,602 | 5 |

| Kolkata | 4,202 | 2 |

| MMR | 9,448 | No change |

| NCR | 4,268 | No change |

| Pune | 5,077 | 4 |

| National average | 6,042 | No change |

Source: Real Insight: Residential Annual Roundup 2020

Interestingly, no prime market showed any downward movement in prices during the one-year period, in spite of the severe pressure caused on growth, because of the pandemic. In what could be termed as significant at this point of time, the average rate of new housing projects in Ahmedabad and Hyderabad, in fact, registered positive growth of 7% and 5%, respectively. Pune, too, recorded a positive price growth of 4% in the past one-year period.

In the coming quarters too, price growth is expected to remain range-bound amid global agencies predicting a long-drawn recovery process for India’s economy. “A combination of supply-side scarring and demand-side constraints – such as the weak state of the financial sector – will keep the level of GDP well below its pre-pandemic path,” Fitch Rating said in a statement, on January 14, 2021.

Terming India’s Coronavirus-induced recession as among the most severe globally, the rating agency said it expected the country’s gross domestic product (GDP) to expand by 11% in FY22 (April 2021 to March 2022) after falling by 9.4% in FY21 (April 2020 to March 2021). “Supply-side potential growth will be reduced by a slowdown in the rate of capital accumulation – investment has recently fallen sharply and is likely to see only a subdued recovery,” it said further.

While the muted price growth, along with several other factors, has increased housing affordability in India to a great extent, low yields might be detrimental to the investor spirit and impact the foreign investment volume in the country, especially from the NRI segment.

Housing affordability is also getting a boost through actions by state governments. The Delhi government, for example, on February 5, 2021, announced a 20% reduction in the circle rates for all types of properties. This temporary reduction, which will stay effective till September 30, 2021, would significantly lower the cost of property purchase for home buyers in the national capital, especially in the luxury housing segment.

See also: Delhi cuts circle rates by 20% across categories

To tap the only segment that has managed to show some growth, despite the general slowdown, banks have also entered into a heated competition to lower home loan interest rates. While public lender SBI is offering home loans at 6.7% interest, private lender Kotak Mahindra Bank is currently charging the lowest rate on home loans, at 6.65%. At HDFC, home buyers can secure a loan of any amount for an annual interest of 6.75%, while ICICI Bank is charging 6.80% interest on its home loans.

Analyzing the COVID-19 impact on property prices in India

The developer community in India has been in a tizzy after union minister of commerce and industry Piyush Goyal on June 3, 2020, said builders needed to sell housing projects at reduced prices and let go of the high-priced unsold stock. Will prices fall?

If a demand slowdown has been keeping price growth in India’s residential real estate market in check, the Coronavirus pandemic, which threatens to drastically impact global economic growth would wipe off any chances of value appreciation in the property market. In the near future, expecting price appreciation would be nothing but wishful thinking.

Sample this.

On Knight Frank’s global house price index, which tracks the movement in mainstream residential prices across 56 countries and territories worldwide, India slipped seven spots to rank 54th in the July-September period of 2020 against 47th rank in the same period last year, with a decline of 2.4% year-on-year in property prices. Compared to the previous quarter, however, the country’s the ranking remained unchanged, at 54th. The report points out that India was among the countries that saw the weakest price growth, year-on-year.

PropTiger.com numbers also indicate the nine major residential markets in India registered only negligible price growth in the past half a decade amid consumer sentiment hitting a new low.

Property prices in India’s eight prime residential markets

| City | Average rate per sq ft as on September 2020 | Annual change |

| Ahmedabad | Rs 3,151 | 6% |

| Bengaluru | Rs 5,310 | 2% |

| Chennai | Rs 5,240 | 2% |

| Hyderabad | Rs 5,593 | 6% |

| Kolkata | Rs 4,158 | 1% |

| MMR | Rs 9,465 | 1% |

| NCR | Rs 4,232 | -1% |

| Pune | Rs 4,970 | 2% |

| National average | Rs 6,066 | 1% |

Source: PropTiger DataLabs

While there has not been any significant upward or downward movement in terms of pricing, Ahmedabad and Hyderabad’s real estate markets have seen some appreciation over time. In the MMR, where property prices are already much higher than the national average, price growth has been quite slow. Only the housing markets in the National Capital Region have undergone some correction. Elsewhere, the growth has been largely insignificant.

According to a recently-unveiled report by international property consultancy Knight Frank, the top six housing markets in India underwent a price correction in the range of 2%-7% during the July-September period in 2020.

A poll conducted by Reuters also shows average house price is expected to fall 6% this year and 3% in 2021. The poll, in which 15 analysts participated between September 16-28,2020, a region-wise house prices decline of 7.5%, 7.0%, 5.0% and 3.5%was also predicted for Mumbai, Delhi, Chennai and Bengaluru, respectively.

As for the future, the effects of the pandemic, say some experts, would result in property prices dropping by at least 10%.

“Prices in most markets have held steady, despite the lending and shadow banking crises. They may come down by 10%-20% across geographies, while land prices could see an even higher reduction of 30%,” Pankaj Kapoor, chief executive of real estate consultancy firm Liases Foras was quoted as saying.

According to HDFC chairman Deepak Parekh, developers should be prepared for up to a 20% fall in housing prices.

Some, however, beg to differ from the likes of Kapoor and Parekh. This segment is of the opinion that those expecting any reduction in property prices, in the medium to long term, might be disappointed as property values, if anything, are likely to show an upward movement in the post-Coronavirus world, based on several factors.

[poll id=”2″]

Why property prices in India might not drop after COVID-19?

The developer community in India has been in a tizzy after union minister of commerce and industry Piyush Goyal on June 3, 2020, said builders needed to sell housing projects at reduced prices and let go of the high-priced unsold stock. In a terse message to the community, the minister said the government might offer some concession in circle rates, to lower their burden but they must be more forthcoming in reducing prices.

“If any one of you feel that government will be able to finance in such a way that you can hold longer and wait for the market to improve — because market is not improving in a hurry — your best bet is to sell,” Goyal said during a video conference meeting organised by industry body National Real Estate Development Council (NAREDCO).

“You can choose to be stuck with your material (inventory), then default with the banks. Or, you can choose to sell it even if you have bought it at high prices and move forward,” he added.

The statement came as a rude shock to the NAREDCO, which has sought USD 200 billion in relief, to deal with the aftermath of the Coronavirus crisis. Before things went bad, because of the pandemic, the sector was already grappling with a USD 120 billion-bad debt situation with banks.

Coming down heavily on the community, currently saddled with bad loans and huge inventory, the minister added, “You have to complete your projects before you sell, because buyers will not buy under-construction projects. In my life, I will not buy an under-construction flat from anybody.”

The next day, newly elected CII president Uday Kotak said he was in agreement with Goyal.

The Economic Survey 2019-20 also pointed out that builders should allow prices to drop, by taking a haircut as a remedy to reduce their inventory burden. Similar views were aired by the HDFC chairman when he said builders should sell their inventory at whatever prices they get to generate liquidity. However, a number of issues are at play, which makes accepting such suggestions difficult.

When asked whether his company plans to reduce prices to boost sales in the prevailing circumstances, Godrej Properties’ managing director Mohit Malhotra replied in the negative. “We do not have any plans of cutting prices. The industry has been reeling under a slowdown for the past eight years. There is limited scope to cut prices,” Malhotra was quoted by the media as saying. Many of his peers in the industry feel the same way. Why so?

Developers are under tremendous pressure

As on September 30, 2020, developers were sitting on an unsold stock consisting of over 7.23 lakh units worth over Rs 6 lakh crore in the top nine residential markets. With buyers becoming fence-sitters, almost-completely making any chances of profit-making for a large number of builders out of question; sources of liquidity are also fast drying up with the ongoing non-banking finance companies (NBFC) crisis.

As it is, several big developers in the country have been dragged to the insolvency court by banks over non-payment of large-scale dues. If the demand slowdown problem persists for a longer period, more builders might have to face the same fate — a highly likely scenario in the backdrop of the contagion.

Recall here that the total outstanding loans of real estate developers from commercial banks, NBFCs and HFCs are estimated to be around Rs 4.5 lakh crore as of March 2020.

While the government has already decided to set up an Rs 25,000-crore stress fund to help builders complete their pending projects and infuse more liquidity into the system through a COVID-19-focused stimulus package, an overall economic downturn would limit its capacity to focus on real estate and offer substantial relief. In a complex scenario like this, earning by way of home sales remains a builder’s only option.

“Residential real estate in India is likely to see a further slowdown in the coming months, given that attendant activities are at a standstill. With construction already coming to a grinding halt, project completions are slated to be postponed. If this situation prolongs, the deployment of funds, including the Rs 25,000-crore alternative investment fund (AIF), will remain on hold,” says Anurag Mathur, CEO, Savills India, had said earlier.

“Housing sales may see a sharp dip for at least the next one quarter as consumers’ biggest priority currently is health/safety and income preservation,” Mathur adds.

Data available with Housing.com show home sales in India’s eight key residential markets fell by 57% during the July-September period in 2020 as compared to the same period in 2019. A total of 35,132 units were sold during the period between July and September 2020, data show.

While the recent RBI move to lower the repo rate to 4% and offer a moratorium on loan EMIs would provide developers some cushion against the overall shock, reducing property prices does not seem to be a possibility, especially as buyers remain elusive from the market. In the meantime, project launches could drop significantly. In the September 2020 quarter, in fact, only 19,865 new units were launched across the eight markets, data show. This is a decline of 66% year-on-year.

Cost of supply materials has increased

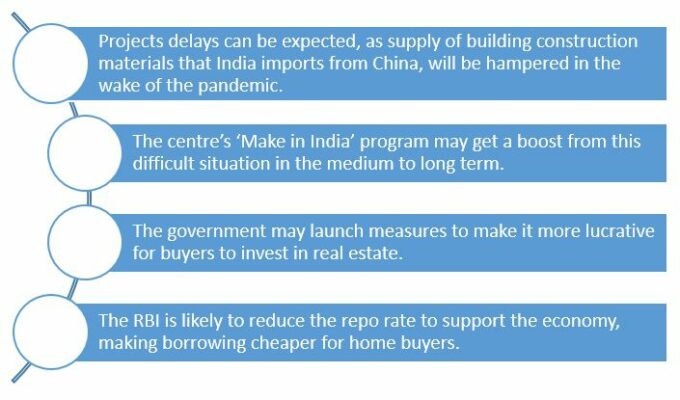

Projects delays are on cards as supply of building construction materials that India imports from China is hampered in the wake of the pandemic and amid rising tension between the two countries. The impact of the situation would be more prominent on premium-luxury housing projects which rely heavily on supplies of fixtures and furnishings from China, the country where the source of the contagion has been tracked down to. The time gap will not only delay housing projects but also ultimately increase the overall cost of project building since builders here will have to rely on alternative sources to meet their building requirements.

The centre’s ‘Make in India’ program might get a boost from this difficult situation in the medium to long term, but short-term pains for developers are inevitable. Dropping prices in a scenario like this is hardly the answer. However, the government might launch measures that might make it more lucrative for buyers to invest in property. It is also expected to support real estate, the second-largest employment generator in the country, by waiving off tax on unsold inventory.

“Depending upon the duration and depth of the current crisis, prices may or may not see a downward movement as the holding cost of the developers will go up while the pressure to liquidate unsold inventory will increase. It would be too early to predict the extent of price change in the near-to-medium term,” opined Mathur.

Interest rates at record low, home-buying to become affordable

The RBI has reduced the repo rate to 4%, making borrowing cheaper for home buyers. Consequently, home loan interest rates are already as low as 6.95%. This would act as a booster for buyers to invest in property at a cost advantage, once clarity on the impact of COVID-19 on the job market is known.

“It is important for (banks) to immediately transmit the (repo) rate cut (by the RBI) to the home buyer, which will boost consumer sentiment,” says Ramesh Nair, CEO and country head of JLL India.

While the government has already extended the benefits offered under Section 80EEA till March 2021, it might also consider extending it further, in order to give a boost to first-time home buyers. Experts are of the view that anxiety over impending job loss among consumers is likely to persist, even after the worst is over and normalcy returns. The government will have to continue extending support till that period.

However, some correction would still be expected from developers’ side, as cheap home loans alone would not to the trick in a weak job market. Property investments might, in fact, rise if developers were to offer some reduction.

According to a survey conducted by Housing.com in collaboration with NAREDCO, 47% tenants would like to invest in a ‘rightly-priced’ property. Moderation of prices would also attract tenants, who have so far been favouring renting over buying, primarily because of price benefits. Those renters who are not in a position to buy a house currently, because of price issues or the nature of their jobs, have also opined that they would buy a property within two years.

Stamp duty correction

With an aim to further boost buyer sentiment and reduce the overall cost of purchase for buyers, some states have also announced reductions in stamp duty—the tax that buyers have to pay to the state government as the percentage of the transaction value—in the aftermath of the Coronavirus pandemic. For example, Maharashtra has announced a temporary reduction in rates for a period of six months. Buyers in that state, which is home to the most expensive property market in India (Mumbai), can currently register a property by paying 2% of the property value as stamp duty. Karnataka has also reduced the stamp duty to 3% on properties worth up to Rs 30 lakhs. On September 7, 2020, the Madhya Pradesh government also announced a reduction in the cess on stamp duty charged for registration of properties by 2%.

What should an investor do?

Housing prices in some of the mega cities of India have witnessed significant correction. While expecting appreciation in the near future would not be a wise idea, this present scenario does provide investors with an opportunity to put their money in residential real estate at a low price point. Since prices are unlikely to undergo any further correction, this could prove be an ideal opportunity for buyers, if they are able to arrange the funds. Since home loan interest rates are also at record low levels currently, housing finance is also available to buyers and investors at comparatively affordable prices.

FAQs

Will property prices fall due to Coronavirus impact?

While any sharp increase is unlikely, property prices might continue to maintain the same level, because of a demand slowdown.

What will be the impact of COVID-19 on housing market?

Demand for housing is likely to be hit in the short term due to the Coronavirus outbreak.