Property tax has to be paid by all property owners to the local municipal body irrespective of the type of property owned. A key revenue source for the municipal body, this is used to develop areas under its jurisdiction. Failure to pay property tax on time may result in penalties or even property attachment.

What is MCGM Property Tax 2025?

Properties that fall under the Municipal Corporation of Greater Mumbai (MCGM) i.e, the Mumbai Metropolitan Region (MMR) have to pay their property tax to the MCGM every year under the Municipal Corporation Act of 1888. Also known as the Brihanmumbai Municipal Corporation (BMC) Property Tax, this is one of the major contributors to the infrastructural development in the city.

The MCGM Property Tax comprises different components with major aspect being the ready reckoner rate. The remaining include factors such as the age and condition of the property, sewerage charges etc.

Surge in MCGM Property Tax in FY2025-26

After over 10 years, the property rates in Mumbai saw a hike. According to news reports, the hike has reflected in the ad hoc MCGM Property Tax bills that the municipal body raised for FY2025-26. Note that effective April 1, 2025, the Maharashtra government revised the ready reckoner rates in the state by an average rate of 3.89%. On the basis of this, the property tax rates have fluctuated in Mumbai ranging between 8% and 20%. This move has impacted over 9 lakh property owners in the city.

As different locations pay different percentages of tax rate, the BMC Property Tax is calculated by the Maharashtra government based on the property’s annual rental value (ARV). According to the Mumbai Municipal Corporation Act, property tax gets revised once every five years. The last revision was done in 2015. The revision that was to be done in 2020 was not executed owing to the pandemic. Reports mention that there has not been any change in the collection of Rs 5,200 crore that the MCGM has set as property tax targets for FY2025-26.

MCGM Property Tax 2025: Key details

| Authority name | Municipal Corporation of Greater Mumbai (MCGM)/ BMC |

| Property tax to be paid | Property owners of residential, commercial and industrial properties |

| Jurisdiction | Places under the jurisdiction of BMC |

| Payment mode | Online and offline |

| Last date | June 30 |

| Official website | https://ptaxportal.mcgm.gov.in/ |

| Property tax base | Annual Rateable Value (ARV) |

| Property tax Rate | Depends on ARV and the type of property |

See also: All about Thane property tax payment

How is the MCGM Property Tax calculated?

There MCGM was previously calculated on the basis of the annual rent collected that the property collected. This was known as the Rate Value Method (RVM).

Rate Value Method (RVM)

The RVM is applicable for all properties that are constructed before 2016. Under the RVM, property tax is calculated on the basis of annual rental value or deemed rent, which depends on factors like the location of the property, usage and construction type. This property tax is calculated by using the ready reckoner rate, that is determined by the location of the property, property’s age, usage, tenancy status and type.

However, this impacted the revenue generated by the BMC negatively. Hence they started evaluating the property based on the Ready Reckoner rate. The assigned Ready Reckoner (RR) rate is allowed to be revised annually to provide an accurate value

The MCGM Property Tax is calculated on the basis of:

- Ready reckoner rate: The minimum rate below which a property cannot be sold in a place. This is set by the state government

- Sewerage and water tax: The supplementary taxes are included while calculating the tax

- Age and property condition: The property tax depends on if the property is new or cold

- Location of property: The property tax depends on the location of the property

- Area of property

- Types of property: These can be residential, commercial, industrial, institutional

- Type of construction: Kutcha or Pucca construction

How to calculate MCGM Property Tax online?

The BMC Property Tax is calculated using two methods.

Capital Value System (CVS)

The BMC Property Tax is calculated using the Capital Value System (CVS). This CVS is based on the market value of the property and is applicable for all properties constructed after 2016.

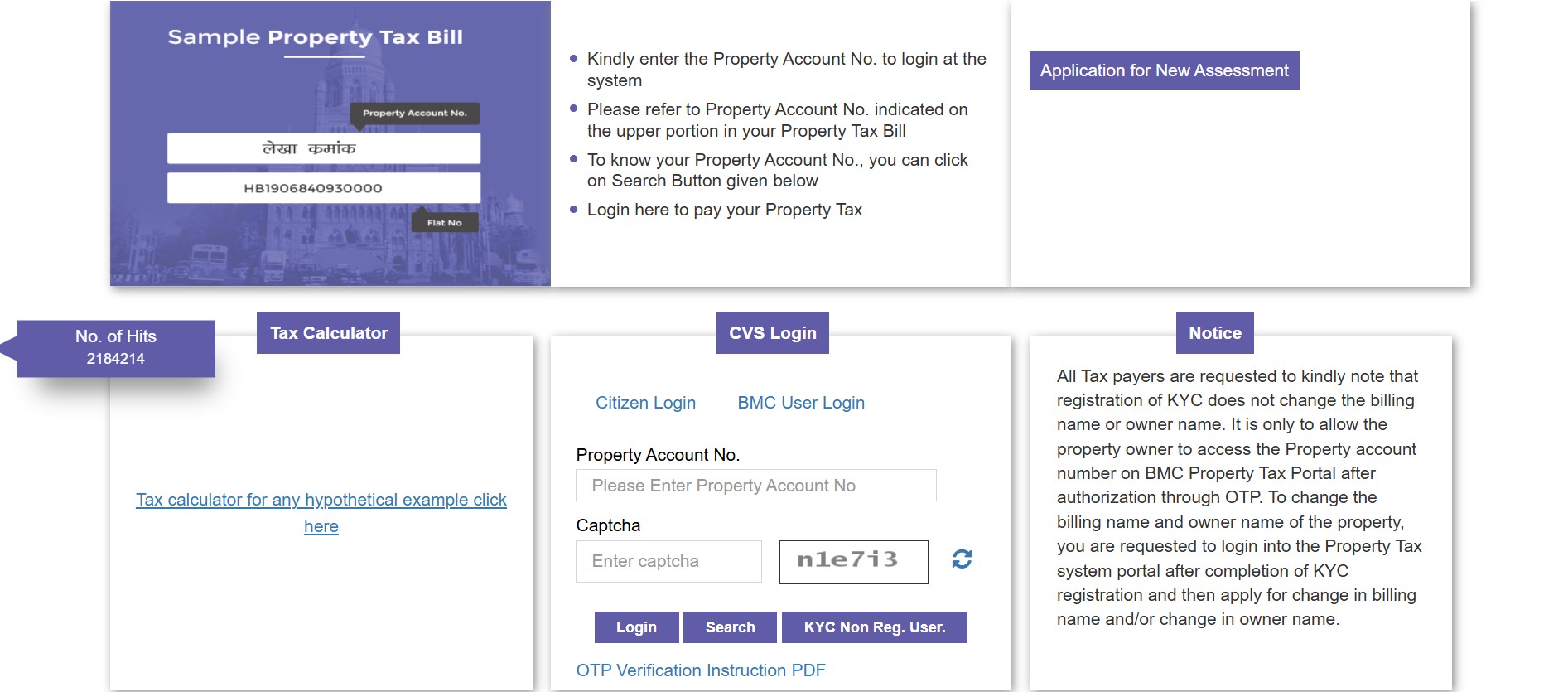

Step 1: Go to property tax calculator Mumbai on MCGM website.

Step 2: Fill the required details on MCGM portal’s property tax calculator Mumbai such as ward number, floor, nature and type of building, carpet area, zone, user category, year of construction, FSI factor, tax code, sub zone, user sub-category and other details.

Step 3: Click ‘Calculate’ on property tax calculator and get the detailed BMC property tax bill. MCGM property tax formula

See also: Property Tax Guide: Importance, Calculation and Online Payment

After you have ascertained the capital value, Mumbai Property Tax is calculated as follows:

Capital value of property x Current property tax rate (%) x Weight for user category

Weights for ‘user category’, in units:

- Hotels and like businesses – 4 units.

- Commercial properties (shops, offices) – 3 units.

- Industries and factories – 2 units.

- Residential and charitable institutions – 1 unit.

How to view MCGM Property Tax 2025 bill online?

For paying the BMC property tax online in Mumbai, you can use the MCGM website for property tax, BMC mobile app or BMC website. To view your outstanding dues and property tax bill online in Mumbai, follow the steps given below:

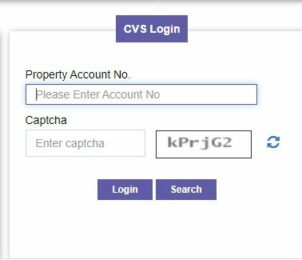

Step 1: To pay the property tax Mumbai, visit the MCGM portal at portal.mcgm.gov.in property tax and enter your property/account number.

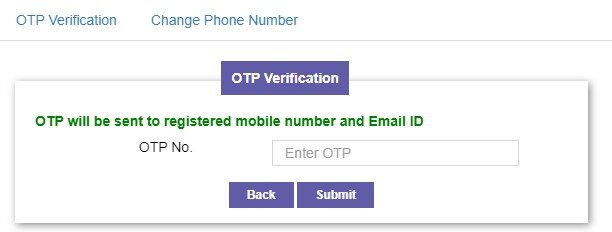

Step 2: Enter the captcha. You will get OTP on your registered mobile number which you have to enter to move to the next step for paying your property tax Mumbai.

You will be redirected to your account on the MCGM website, where you will be able to view all your outstanding and paid property tax Mumbai bills.

See also: Everything about water bill MCGM

How to pay MCGM Property Tax online?

Visit the MCGM Property Tax Portal on https://ptaxportal.mcgm.gov.in/CitizenPortal/#/login

- Enter account number on the MCGM website and captcha and login.

- Check outstanding MCGM Property Tax bills. Review the bill to make the correct payment.

- Enter the amount that you wish to pay

- Click on online payment and choose preferred method ( credit card, UPI, debit card, net banking)

- Once you make the MCGM Property Tax payment online, keep your MCGM Property Tax payment receipt. This is important, not only as a proof of payment of MCGM Property Tax but also for proof of ownership of your property.

- Ensure that the MCGM portal updates your record and no outstanding amounts are shown against your account. If there are any errors, have them corrected immediately.

How to pay the MCGM Property Tax online using Paytm?

- Log on to https://paytm.com/municipal-payments/mcgm-property-tax

- Select the type of tax under ULB Code/ Local Body as Property Tax

- Enter Property Account Number and click on Get Tax Amount

- Next opt for the online mode of payment like credit card, debit card, net banking etc. and proceed to make the MCGM Property Tax.

- Note that the Paytm service provider will take a day to update the payment to their records.

How to check the MCGM Property Tax payment status online?

The property owners can check the MCGM Property Tax payment status by following the mentioned steps.

- Visit the official website of the Municipal Corporation of Greater Mumbai.

- Under the “Popular” section and click on “Property Tax (New)”.

- You will be redirected to a new page where you need to log in to your account.

- Next add property details such as property type, zone, year of construction etc., preview and submit.

- The payment status of your MCGM Property Tax will be visible now.

How to download the MCGM Property Tax Bill?

To download the MCGM Property Tax bill, follow these steps:

- Visit the official website of the Municipal Corporation of Greater Mumbai.

- Under the “Popular” section and click on “Property Tax (New)”.

- You will be redirected to a new page where you need to log in to your account.

- Next add property details such as property type, zone, year of construction etc., and click on view bill and try to download the bill.

- In case you are unable to download the bill, take a screenshot of it and print it.

How to get MCGM Property Tax 2025 bill by e-mail?

The property tax Mumbai payers can get their BMC Property Tax bill in their inbox, if they fill the Know Your Customer (KYC) form online on MCGM portal. All notifications, alerts and tax bills will be sent to the registered email ID, once the KYC formalities are completed by the citizens. The civic body has requested all tax payers to finish the KYC as soon as possible and to avert penalties on delayed payment of MCGM Property Tax 2025.

Here’s how to do the KYC on the MCGM Property Tax 2025 portal for getting Mumbai property tax bill:

Step 1: Visit MCGM Citizen Portal and enter your property account number.

Step 2: Enter the captcha and click on ‘login’ on the MCGM website.

Step 3: Upload the requisite documents on MCGM website and submit the attested copy.

Step 4: Enter the email ID and contact details for receiving MCGM property tax alerts through email and SMS.

Step 5: Once approved, you will get the confirmation on your email.

What are the benefits of paying MCGM Property Tax online?

- Accessible 24×7

- Secure and User-friendly interface

- No need to go physically to ward office to pay the MCGM property tax and thus saves time and effort

- Timely reminders are sent as notifications to pay the MCGM Property Tax on time.

- Can access property tax history

- Can verify the MCGM Property Tax bill

- Can get instant receipts after payment of MCGM Property Tax

What to do if MCGM Property Tax payment fails?

In case of failure of the MCGM Property Tax Payment, you can follow one of the three options:

- Contact the service provider or bank and give them the transaction details and let them solve your problem.

- Raise a grievance request on MCGM Property Tax page on failure of payment and the MCGM will revert to you. Go to transaction history and check the failure status and accordingly submit information as proof.

- Contact MCGM Property Tax customer care.

Documents required to pay MCGM Property Tax offline

If you are paying MCGM Property Tax online, you don’t need to attach any document.

If you are paying MCGM Property Tax offline, you have to verify the following details and for this official supporting documents may be required.

-

Name and contact details of the property owner

-

Address of the property, blue print of the property

-

Property identification number (PID)

-

Property’s assessed value

-

Tax rate applicable to the property

-

Property tax due before and after due date

Once property tax is paid offline, you will get a receipt that acknowledges MCGM Property Tax Payment.

How to pay the MCGM Property Tax offline?

- To pay the MCGM Property Tax offline, you have to visit the municipal corporation office that is near your property.

- Fill the property tax application form and attach supporting documents.

- Make payment and get acknowledgement.

What is the due date to pay MCGM Property Tax?

MCGM Property Tax must be paid every year by June 30. If you default on paying this tax, then a penalty will be raised against your property for the duration of time of default. If there is no response even then, the BMC has the right to send notices and attach the properties which will be later auctioned.

What is the rebate for paying property tax before time?

The MCGM offers tax rebates for people who pay their taxes before the due date. Taxpayers get around 2-5% discount on payment of property tax before the due date which is June 30, every year.

Also, media reports mention that the BMC is planning to offer a property tax rebate of 2% in case the housing societies and commercial establishments will install solar panel in their society. Under the ‘Clean Society Green Society’, societies are given a rebate of 5% for processing wet waste and recycling dry waste generated in the society complex.

What is the penalty for late payment or no-payment of BMC Property Tax?

Failure to pay the MCGM Property Tax will result in a penalty of 2% on the outstanding amount.

This year BMC has levied a fine of 200% MCGM Property Tax under Mumbai Municipal Corporation Act, 1888, Section 152 (A) on unauthorised properties in Mumbai totalling over 3,343 properties, mostly located in the western suburbs. This is part of BMC’s drive to curb illegal construction in the city. The municipal body levied a penalty of around Rs 392.28 crore for unauthorised construction in the city from April 2024 to March 2025.

MCGM Property Tax 2025: Properties exempted from paying tax

- Houses under the BMC jurisdiction that are up to 500 sqft are waived from paying BMC Property Tax.

- Properties used for worship or for charity.

- Residential units with carpet area between 501 sqft and 700 sqft, will get 60% reduction in the BMC Property Tax rate.

Why is necessary to follow mutation process?

By following the mutation process, the name of new owner comes into the records of the Bhrihanmumbai Municipal Corporation. This is important because the owner will be sent the bill for payment of property tax, utility services such as electricity, water etc.

How can you change name on the MCGM Property Tax records?

- Note that there is no need for a property card for change of name in MCGM property tax records as the change of name will be done on the basis of share certificate or the sale deed.

- No fees are charged by the MCGM property tax department for change of name in the records.

Once done, you can check the records on the https://ptaxportal.mcgm.gov.in/CitizenPortal/#/changeBillName by clicking on Detail under ‘View Detail’.

Challenges faced while paying MCGM Property Tax and how to overcome them

Incomplete documentation: Ensure that all documents required to pay the MCGM Property Tax are updated. If these are not timely, one can encounter a problem while paying the property tax.

Discrepancies in records: Check the MCGM Property Tax record details in advance so that there is no mismatch in the records.

Delay in verification: Check with the MCGM ward office on a regular basis so that verification is done on time, aiding in timely payment of MCGM Property Tax.

Ownership disputes: Settle all disputes before transfer of ownership of property so that all unpaid dues are handled by the previous owner or whatever the arrangement has been done.

Lack of awareness: It is recommended to be aware about all details about MCGM Property Tax. You can use experts like lawyers etc. for more clarity and then proceed to pay.

Housing.com POV

The MCGM Property Tax 2025 is an important source of revenue for the MCGM/BMC. The municipal body has also enabled an easy way of paying the property tax online. Moreover, with the BMC Property Tax not seeing a revision till now this year, it’s recommended that people pay their property tax on time so that they can avail of the rebates offered. This way they can save some money on the property tax to be paid.

FAQs

How do I check my MCGM Property Tax?

You can pay the MCGM property tax on the MCGM portal.

How much is the penalty for late MCGM property tax ?

A penalty of 2% has to be paid if the MCGM property tax is not paid on time

Who is exempted from property tax in Mumbai?

People with areas upto 500 sqft are exempted from paying property tax.

What is the property tax rebate of BMC?

Houses measuring between 500-700 sqft are eligible to get 60% concession on property tax as part of BMC rebate.

Is property tax same for tenanted as well as self-owned properties in Mumbai?

Yes, both tenanted and self-owned properties have to pay the same property tax.

Which properties are exempt from tax in Mumbai?

Residential properties up to 500 sq ft, within the Mumbai municipal area limits, are exempted from property tax.

I want to pay my property tax online in Mumbai. How can I do that?

You can pay the property tax online, on official websites by following the above procedure.

| Got any questions or point of view on our article? We would love to hear from you.Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |