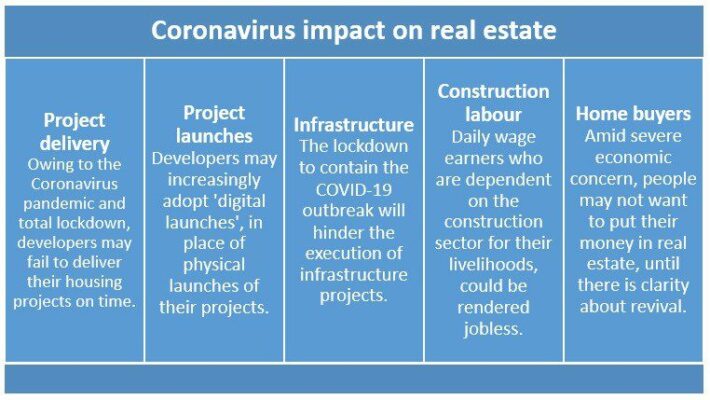

The Coronavirus pandemic, which is likely to erode trillions of dollars of wealth, as it exacts huge human loss upon the world, is likely to reshape property markets as we know them. While India’s economy is headed towards a contraction for the first time in more than four decades, 12.2 crore young Indians lost their employment in April 2020, because of the COVID-19-induced lockdown. What else is set to change, as the pandemic runs its course? What can we can expect from India’s real estate sector, in a post-COVID-19 world?

We try to find some answers.

Site visits to fall

Prospective buyers would carry out a large part of their searches and research online. Once they shortlist a few properties, they may undertake a physical visit of the sites, to take the final call. If anything, sellers and developers have a reason to be happy about this likely change, as those visiting the property are likely to be genuine buyers, who are in the last leg of making a decision. This also saves a lot of time and energy for all parties concerned.

See also: Brokers’ corner: How to handle virtual property transactions

Will property prices rise?

In case you expect housing prices to crash in the backdrop of the Coronavirus scare, you may be disappointed. Building and development may become costlier for builders, amid likely delays in supplies and government approvals. This would reflect in pricing, as well.

For a variety of others reasons — primarily springing from the fact that even the top-rated developers in the country are already under tremendous monetary pressure, because of an ongoing slowdown in the housing market — chances of property prices dropping will be slim.

Home buying to be affordable

In order to push demand, amid the economy staring at a 2.5% growth in 2020, the government has launched several measures to make property buying affordable for consumers. Low interest rates and likely corrections in guidance values, could make purchases more affordable for the middle class. As it is, the tax deduction limit for first-time home buyers has been increased to 3.50 lakhs per annum, under Section 80EEA.

See also: What will home buyers expect in a post-Coronavirus world?

Interest rates to fall

The RBI has already brought the repo rate, at which it lends to banks and the rate which ultimately decides how much interest borrowers pay on home loan, to a record low of 4%. This was done by the banking regulator, to cushion the possible blow caused by the spread of the virus on demand in general and the economy in particular. This reduction in repo rate would make home loans more affordable for buyers. No hike in interest rate is likely, at least in the short to medium term.

See also: Home loan tax benefits

Project launches to decline

Amid drying sources of funding, developers have been showing utmost caution in launching projects. Data available with PropTiger.com show that new launches fell 44% in the period between October-December 2019. With the RBI infusing $5.5 billion in the banking system, builders will shift their entire focus on completing their stuck projects, which are looking at longer delays because of a complete halt of construction work amid the Coronavirus lockdown.

Project delays may increase

Home buyers may have to wait for longer for the delivery of housing projects that were scheduled to be completed in the coming months. While construction activity has come to a halt for now, it is also not likely to pick up much speed even after the country is able to afford some normalcy. This situation has also forced the government to allow the Force Majeure clause on delays.

See also: Government announces major relief for realty sector in Coronavirus stimulus package 2.0

Construction to slow down

Amid a nation-wide lockdown to slow down the Coronavirus spread, thousands of migrant workers, mostly daily-wage workers, resorted to mass exodus. Since the construction industry in India largely depends on this unorganised labour force, activity is going to be slow, even when things gradually come back to normal.

See also: What is force majeure and how it works in real estate?

Demand for property to increase

Among the many realisations the current crisis has dawned upon us, is the importance of homes as a majority of us are forced to work from home. A home owner today is in a much better position than a tenant. The government has already announced support measures to offer relaxation to home loan borrowers. Those who have been living on rent, could realise that if they are not able to pay their rents because of loss of income, they would not have anything concrete to fall back on.

Rentals to fall

Amid home ownership becoming more popular, the demand for rental homes could decrease. As a result of this, some correction in rents could be expected in India’s major cities. In the past year, rents in several key markets saw some correction. They are likely to fall further in 2020.

Defaults, insolvencies to rise

With demand likely to touch a new low and construction activity coming to a complete halt, the monetary stress of a large number of players is likely to be immense. In a situation like this, one can expect more developers joining the defaulters’ list or filing for bankruptcy. The demand slowdown has already pushed builders like Amrapali, Jaypee, Unitech and 3C Company towards insolvency.

Consolidation may increase

The novel Coronavirus-induced crisis will further reduce the number of real estate developers in the housing segment— the arrival of the real estate law in 2017 has already ushered in consolidation. Amid short-term shocks, only the fittest would survive. From a buyer’s point of view, this would be a positive change.

Projects to offer better amenities

Home buyers are likely to demand amenities that promote healthier living, in housing projects. Going ahead, buyers are more likely to invest in projects that offer a greener environment, ventilated spaces and medical facilities, even if they have to pay more for such a home.

NRI interest in Indian realty to rise

The Indian rupee may see further erosion in its value and touch Rs 78 per dollar in the near term. While this is a reason to worry for the government and the domestic investors, NRI investors would find it more affordable to make purchases in India, because of their higher purchasing power. With the top nine markets in India having considerable luxury housing stock, they would find it lucrative to invest here. Moreover with stock prices falling, the value of immovable property as an investment option is set to increase now.

Demand for large apartments to rise

In markets such as Mumbai, small apartments formed a considerable part of the sales every year. While money will remain the most important factor in home purchase decisions, buyers may prefer to wait longer and save more, to opt for bigger homes. Size and space will be important factors that will shape home-buying decisions in future.

Cost of land to increase

Those living in independent homes have a comparatively lower chance of contacting an infected person, than one who is living in a housing society. In the long run, this would make independent homes more desirable, pushing up land prices in city suburbs, where land is still available.

See also: How to register property and land online in India?

Buyers to make conscious choices

If home-buying was simply a monetary transaction for most buyers, it is not likely to be so in the times to come. Acutely conscious of their health and well-being, buyers are likely to demand more than just a roof over their heads.

Online brokers to gain prominence

With buyers undertaking most of their home purchase journey online, property brokers would become their top choice to carry out the transaction. Agents with an online presence, are likely to witness an increase in traffic on their sites. They should be ready to cater to customers in the best manner possible.

See also: 30 technical terms that real estate agents should know

Property buying to get easier

Amid a slowdown in demand, buyers would have a more advantageous position in property transaction negotiations. The same is true for borrowing. Apart from offering transparent home loans at cheaper interest, banks would also be more willing to lend without too many additional charges on the home loan.

Selling to get more challenging

With buyers getting more conscious about their purchase decisions, selling will become a more challenging task than it was before. Buyers would have more questions to ask than just pertaining to pricing, before they take a final call. Sellers will have to learn and adopt technology, as the online medium becomes mainstream in property transactions.

See also: How to get leads on your property amid the COVID-19 pandemic?

FAQs

Will property rates drop after COVID-19?

Property prices are unlikely to drop after COVID19.

Will demand for property drop after Coronavirus?

Demand for property might drop in the short term.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

sunita.mishra@proptiger.com