You would have heard the term immovable property often. An immovable property is something that cannot be moved from one place to another. It has rights of ownership attached to it. Here is a look at what constitutes an immovable property.

Also know all about release deed

Immovable property meaning

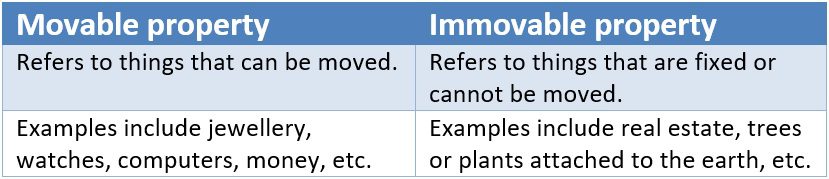

A movable property, as per many references and common understanding, refers to things like jewellery, watches, computers, money, etc. The term ‘movable property’ has been mentioned in Section 12(36) of the General Clause Act, 1847 and Transfer of Property Act, 1882. Section 22 of the Indian Penal Code (IPC) has provided the definition of movable property as any corporeal property except land and things permanently attached to the earth.

Immovable property commonly refers to real estate – a house, warehouse, manufacturing unit or a factory. Trees or plants attached to the earth are also immovable property. In case of realty, they remain liable to legal statutes and also taxation.

Difference between movable and immovable property

| Parameter | Movable property | Immovable property |

| Examples | Jewellery, watches, computers, money, etc. | Real estate such as house, factory, manufacturing plant, warehouse, land, hereditary allowances, etc. |

| Registration | Not required | Should be registered under the Registration Act, 1908, if its value exceeds Rs 100. |

| Taxation | Liable for value-added tax (VAT) | Attracts stamp duty under the Indian Stamp Act, 1899 |

| Inheritance | Can be partitioned easily | Is not breakable or divisible easily |

| Transfer | Can be transferred easily | Cannot be transferred without a will, gift deed or partition and simultaneous registration of the property in the beneficiary’s name. |

| When used as a security | Pledge | Mortgage/lien |

Also Read: Immovable property and property rights in India

Rights associated with immovable property

If a person owns an immovable property, he/she has certain rights. These include:

Right to collect rent: A property owner is legally eligible to collect rent by leasing out his property.

See also: Lease vs rent: Main differences

Right to collect dues: If the property has been leased out so that another person/party can cultivate on it or use it to earn through his/her service, the owner of the immovable property has the right to collect the dues.

Right of ferry: This refers to the authority’s right to maintain a vessel upon a body of water, in order to transport people and vehicles across it, in exchange for the payment of a reasonable toll. A ferry can also be the continuation of a highway from one side of a water body to the other.

Right of way: A particular land may be private or public and trespassing on it may be a legal offence.

Right of fishery or factory: There may be access rights to fish in a certain water body or access to a certain factory and this would be restricted to the owner of this immovable property.

Other rights on immovable property

Other rights include right to future rent and profits, hereditary offices of priests, equity of redemption, reversion in a property that is leased, interest of a mortgage and right to collect lac from trees.

Also read: Laws governing the inheritance of immovable property in India by NRIs

FAQs

What is immovable property called in Hindi?

An immovable property is called achal sampatti in Hindi.

What is an annual immovable property return form?

Rule 18(1) (ii) of the CCS (Conduct) Rules, 1964 mandates that every government servant holding Group 'A' & 'B' post, is required to submit an annual return to the government, giving complete particulars of their immovable property inherited by them or held by them on lease or mortgage, either in his/her own name or in the name of his/her immediate family.

What looks like immovable property but is not?

Standing timber, growing crops and grass are not immovable properties.