On July 8, 2020, the Ministry of Housing and Urban Affairs confirmed that the Affordable Rental Housing Complexes (ARHC) scheme had received the nod from the union cabinet and would continue as a sub-scheme of the Pradhan Mantri Awas Yojana (Urban), meant to provide a decent living standard to the urban poor.

The much-awaited Budget 2021-22 did give a boost to affordable rental housing in India. Finance minister (FM) Nirmala Sitharaman proposed to allow tax exemption for notified affordable rental housing projects. As of now, the government allows 50% additional FAR/FSI, tax reliefs at par with affordable housing, concessional loan at priority sector lending rate, etc., to private developers to develop ARHCs on their own vacant land for 25 years.

In August 2020, the Central Board of Direct Taxes added ‘affordable rental housing complex’ to the list of infrastructure projects that can get foreign investment, via debt or equity. Income from dividends, interest and long-term capital gains from investments in rental housing for low-income groups were also made exempt from tax. ‘Affordable Rental Housing Complex; was also included in the Harmonized Master List of Infrastructure Sub-sectors by adding it in the category of ‘Social and Commercial Infrastructure’, with a footnote that said Affordable Rental Housing Complex. Foreign investors could also directly, or through vehicles like AIFs or alternate investment funds or infrastructure investment trusts (InvITS), invest in rental housing projects. This was meant to boost ARHC in India.

While more details about the new announcement made in the finance minister’s budget speech are awaited, the tax exemption seems to be headed in the right direction.

ARHC in India

Amid the slump witnessed by the Indian real estate over the last few years, rental housing was an oft-discussed topic among industry leaders, developers and analysts alike. The United States and Singapore are examples of developed countries, where the rental housing market has evolved successfully over the years with a bulk of the population willingly opting for it. What made it difficult for India to resort to a rental housing model earlier, which at a time looked more profitable for stakeholders, in the face of stabilising housing demand? In this article, we look at the evolution of the PMAY and rental housing scheme in India (henceforth referred to as the ARHC or Affordable Rental Housing Complexes), its components and scope.

Evolution of rental housing in India

While the ARHC formally came into existence in July 2020, the National Urban Housing Rental Policy (Draft) 2015 had gathered some interest in the past. The need to address the housing needs of the urban poor was on the anvil but failed to take off due to various reasons. The National Urban Housing Rental Policy too can be traced back 32 years to the National Housing Policy, 1988, when the need for rental housing was first discussed. Over the next three decades, the proposal failed to get traction.

Types of rental housing in India

There are different types of rental housing. Do note that while dharamshalas, hotels and lodges do not count as rental housing, there are some others and you would have seen such formats functioning in India.

| Type of rental housing | How it works |

| Formal rental housing | Registered rental agreement between the owner and the tenant. |

| Informal rental housing | No rental agreement between the owner and the tenant. |

| Market-driven rental housing | Individually-owned and managed, with no assistance from the government. |

| Professional or need-based rental housing | Tenants may or may not be able to afford the rent but they have a source of income and their occupation demands them to stay close to work. For example, construction workers. |

| Public rental housing | A government body or an authority is the owner. |

| Social rental housing | The owner, which may be an NGO, public or private company, rents out properties at rates lesser than the market. |

Affordable rental housing scheme

In May 2020, it was proposed that an Affordable Rental Housing Complexes (ARHCs) scheme, would be launched through the public-private partnership (PPP) model. The scheme would be targeted towards migrant workers, students and the urban poor, providing them with adequate living conditions and security through government-funded housing. The scheme would be under the PPP mode and industries, manufacturing units and institutions would be incentivised, to develop ARHCs on their unutilised land. Such properties, it was hoped, would deter migrant workers from undertaking long voyages to their native places, when faced with a calamity or a pandemic such as COVID-19. The ministry has now crystallised guidelines to this effect.

Taking to Twitter, Durga Shankar Mishra, secretary, Ministry of Housing and Urban Affairs (MoHUA), confirmed that the ARHCs scheme had been approved by the union cabinet on July 8, 2020. For this purpose, vacant government-funded housing complexes will be put to use and converted into ARHCs, after a concession agreement for 25 years is signed. The MoHUA claims it is a step towards an Atmanirbhar Bharat. The Ministry hopes to curtail the proliferation of slum dwellings and provide a decent environment for living close to workplaces, for those who cannot afford it by themselves.

Delighted to share that in a significant move to create an urban ecosystem to make housing available at affordable rent to urban migrants/poor, Union Cabinet, under visionary leadership of Hon’bl PM Sh @narendramodi Ji, approved Affordable Rental Housing Complexes scheme today. pic.twitter.com/6xHkIYCplf

— Durga Shanker Mishra (@Secretary_MoHUA) July 8, 2020

Where will ARHCs be implemented?

ARHCs is a sub-scheme under the PMAY and the MoHUA has confirmed that it will be implemented in the following areas:

- Statutory towns

- Planning areas that are notified

- Development authorities

- Special area development authorities

- Any other area that may be notified by the state or UT government

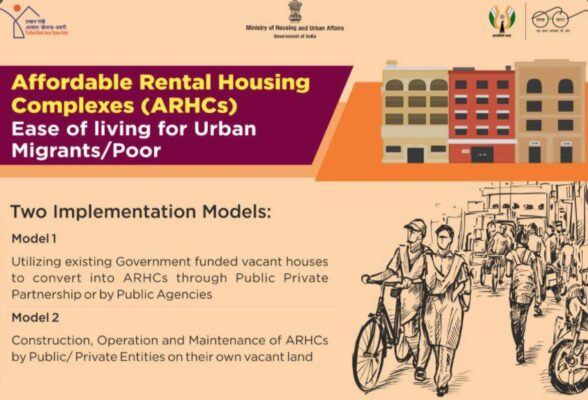

Implementation model of ARHCs

There are two models. First, government-funded land that is vacant can be converted to ARHCs, either by public agencies or on a PPP model. The second model is that in which the construction, operation, as well as the maintenance of ARHCs, will be by the public or private entity, on their own vacant land.

List of beneficiaries under ARHCs

ARHCs are meant for urban migrants from the EWS and LIG sections and the following will be beneficiaries:

- Labourers

- Urban poor, such as street vendors and hawkers

- Market or trade associations

- Industrial workers

- Manufacturing units

- Long-term tourists

- Hospitality sector

- Educational institutions

- Students

- Health institutions

Latest developments regarding ARHC

As government guidelines and policy regarding the ARHC crystalise, we list below some of the recent updates.

Time period

Projects under the ARHC will be used for rental housing for a minimum period of 25 years.

Size of units

Units with single bedrooms will be up to 30 sq metres and double-bedroom units will be up to 60 sq metres. Beds in dormitories will be up to 10 sq metre carpet area each.

Initial rent

The initial rent will be fixed by the local authorities, as per the guidelines of the MoHUA. The guidelines also state that while the rent can be Rs 3,000 for government-funded flats in the outskirts of Delhi, the same amount can be fixed for units in Agra, Ernakulam, Faridabad and Ludhiana. So far 1.08 lakh homes have been completed and ready to be rented out. We are awaiting more details.

FDI in affordable rental housing

Union housing minister Hardeep Singh Puri has said that 100% FDI in rental housing will be announced soon.

Priority rental housing

The economically and socially backward sections of the society, widows, specially-abled and working women, will be given priority allotment.

Important notes on the ARHC scheme

- The ARHC scheme is applicable only till March 2022, which is also the PMAY Urban mission period. All related funding and consideration will be applicable only till then.

- Projects under the ARHC will be used for a minimum period of 25 years, for only rental housing purposes.

PMAY subsidy scheme extension

One of the pertinent questions so far remained whether the centre will announce a PMAY subsidy scheme extension and extend the last date for the PMAY Credit-Linked Subsidy Scheme (CLSS) for the Middle-Income Groups I & II. The last day to avail of the subsidy, for this segment, was March 31, 2020 while those in the Economically Weaker Section (EWS) and the Lower- Income Group (LIG) have time till March 31, 2022. Finance Minister Nirmala Sitharaman on May 14 announced that the scheme will be extended by a year to FY21. This is aimed towards a Rs 70,000 crore investment in housing projects for the mid-income group.

Given that the objective of Housing for All by 2022 is the main driver behind the PMAY scheme, experts had already pointed out that the centre will be keen to extend it. Now, the extension will benefit an added 2.5 lakh beneficiaries.

In short, those with income between Rs 6 lakh and Rs 12 , that is MIG-I and will get an interest subsidy of 4 per cent on a loan amount up to Rs.9 lakh. Those with income between Rs 12 lakh and Rs 18 lakh, that is MIG-II will get an interest subsidy of 3 per cent on a loan amount up to Rs.9 lakh, as has been the guidelines so far. The PMAY CLSS subsidy amount comes to Rs 2,35,068 and Rs 2,30,156 for the MIG-I and MIG-II scheme respectively and beneficiaries will continue to enjoy it.

See also: How does the PMAY interest subsidy scheme for EWS and LIG work?

Scope and challenges of ARHC

The government’s initiative to provide a decent lifestyle to the poor, has gone down well with the real estate fraternity. Ankush Kaul, president (sales and marketing), Ambience Group, noted, “The cabinet’s approval of ARHCs is a kind of move that will strengthen the government’s commitment to ‘Housing for All’. This, if implemented, will create affordable housing for many who are not in a position to buy. Moreover, it will solve the problem of affordable housing shortage in cities.” However, Kaul also said that availability of land and necessary infrastructure to create such a supply, may pose a challenge.

Another challenge that most experts are talking about, is the fact that ARHCs may get only lukewarm enthusiasm from private participants, since the yields are likely to be low. It may not be viable for developers who have land parcels within city limits. Only time can tell whether the government’s incentives and concessions that include, 50% additional FAR/FSI, tax reliefs at par with affordable housing, concessional loan at priority sector lending rate, etc., to develop ARHCs on their own available vacant land for 25 years, is enough to win over private developers.

See also: All you need to know about PMAY-Gramin

COVID-19 public grievances about housing

The Nodal Officer for COVID-19 public grievances for the Ministry of Housing & Urban Affairs is:

Name:- Shri Manish Thakur, Joint Secretary,

E-mail:- [email protected]

Phone Number:- 9599085666

FAQs

What is HUDCO’s contact number?

You can contact HUDCO on their toll free number: 1800-11-6163

Will the Housing for All be extended post 2022?

No official communication has been made regarding extension of the Housing for All mission.

What is the rent under the affordable rental housing scheme?

The local authorities will fix the rental amount for units in the Affordable Rental Housing Complexes scheme, as per the guidelines of the Ministry of Housing.

Sneha takes her head and heart to work. A passionate writer, she loves to pen observations about real estate, policies, business, infrastructure, lifestyle, luxury, marketplace and people. She is a gold-medalist and majored in English Literature and Communications. Off work, she is interested in theatre.