For any property-related transactions in Madhya Pradesh, all parties concerned have to avail of the services provided by the Madhya Pradesh Inspector-General of Registration (MPIGR). This guide is meant to familiarise buyers, sellers and investors with the MPIGR and its services.

MPIGR services

- Document search

- Electricity bill

- E-registration and slot reservation

- Property valuation

- Duty calculation

- E stamp

- Attested copy

- Will deposit

- Application for service provider licence

- Water bill

- RERA registration details

- MP Stamp duty and registration fee

- Stamp duty calculation

- Mutation fee details

- Guideline value

- Agricultural land conversion check

- Khasra numbers check

- Bhu naksha MP fee details

- Complaint registration

See also: Everything about IGRMaharashtra

Can I register my property online in Madhya Pradesh?

You can register your newly purchased property online in Madhya Pradesh on the MPIGR official website – https://www.mpigr.gov.in/. Note that the MPIGR provides document registration-related services through its SAMPADA platform. SAMPADA is short for Stamps and Management of Property Document Application.

Difference between MPIGR and SAMPADA portal

Many first-time users get confused between MPIGR and SAMPADA. While they are closely linked, they serve different purposes:

- MPIGR (Madhya Pradesh Inspector-General of Registration and Stamps):

This is the state authority that oversees property registration, stamp duty collection, and record-keeping. It frames the rules, ensures compliance with the Registration Act, and supervises all 51 district registrar and 233 sub-registrar offices in Madhya Pradesh. - SAMPADA (Stamps and Management of Property Document Application):

This is the online platform launched by MPIGR to provide digital services. Through SAMPADA, users can calculate stamp duty, generate valuation IDs, upload property documents, pay fees, book slots, and track registration applications.

💡 Think of MPIGR as the regulator, and SAMPADA as the digital tool that implements its services for citizens.

Mandatory uploads for MPIGR e-Panjiyan system

- Mobile number

- Email ID

- Identity proof: Passport, driving licence, bank /post office passbook, PAN card, voter ID, Aadhaar card

- Bhoo adhikar evam rin pustika number (agricultural land)

- Khasra number (agricultural land)

- Number of diversion order (diverted land)

- Map and three photographs of the property, showing the front, the left and the right view

- Number and date of the order if the land was disputed

- PAN number in case of property value is Rs 5 lakhs or above

Note: If you claim any exemption in stamp duty or/and in the registration fee, mention the notification number with the date and text of the notification in the document and upload the same. If you want to avail of any kind of exemptions that do not figure in the list given in the e-panjiyan system, mention the notification number and upload the supporting document.

See also: How to do Khasra number check MP

Who can claim stamp duty exemptions in MP?

While uploading documents for online property registration via the MPIGR e-Panjiyan system, users may notice a provision to claim exemptions in stamp duty and registration fees. However, the article currently doesn’t explain who qualifies for these exemptions.

Here are the key categories eligible for stamp duty relief in Madhya Pradesh:

- Women property owners: In specific municipal areas or under certain state policies, female buyers may get a reduced stamp duty rate (up to 1%–2% lower) if the property is registered in their name alone. This aims to promote women’s property ownership.

- Agricultural inheritance transfers: When ancestral or agricultural land is passed down through succession (not through sale), the transaction may be exempted from stamp duty. Proper proof of inheritance and family relation is required.

- EWS and government schemes: Some government housing schemes for the Economically Weaker Section (EWS) or low-income groups come with stamp duty concessions. These are applicable if the property is registered under such notified schemes.

- Special orders / notifications: If buyers possess special exemption orders from the government or court, they must mention the notification number and upload it during registration.

Tip: When claiming any exemption not pre-listed in the e-Panjiyan system, buyers must manually input the notification reference and upload the supporting document for validation.

Who can claim stamp duty exemptions in MP?

In Madhya Pradesh, certain categories of buyers and transactions qualify for reduced or exempted stamp duty and registration charges. These exemptions go beyond women buyers and EWS beneficiaries and are defined by state notifications and government schemes:

- Women property owners: Female buyers registering property solely in their name can get a concession (typically 1%–2%) on stamp duty in designated areas.

- Agricultural inheritance transfers: Transfer of ancestral or agricultural land by succession (not sale) is exempt, provided family and inheritance proof is submitted.

- Economically Weaker Sections (EWS) / government housing schemes: Concessions apply when beneficiaries purchase under state-backed affordable housing or rehabilitation schemes.

- Senior citizens: In some notified areas, senior citizens registering residential property in their own name may be entitled to partial exemption, aimed at promoting housing security for the elderly.

- Family transfers / blood relation transfers: Property transferred within immediate family (parents to children, husband to wife, siblings) may attract concessional stamp duty, provided affidavits and family proof are furnished.

- Government housing beneficiaries: Purchases under state-run housing boards or schemes like PMAY (Pradhan Mantri Awas Yojana) may enjoy concessional registration rates.

- Agricultural land ceiling exemptions: In cases where land is transferred to comply with state-imposed ceiling laws, exemptions are allowed if supported by diversion/ceiling orders.

- Special government notifications: Exemptions may also apply under one-time state relief measures (for example, for rehabilitation of displaced persons, flood relief beneficiaries, or specific community welfare initiatives).

If your exemption does not appear in the pre-listed dropdown of the MPIGR e-Panjiyan system, manually enter the notification reference and upload the supporting document for approval.

Process for online registration of property on MPIGR

Step 1: MPIGR Login

Only registered users can register property online on the MPIGR portal. To register yourself, visit https://www.mpigr.gov.in:8080/IGRS/userreg.do?TRFS=NGI&. Fill in all the required details to register yourself.

Step 2: MPIGR registration initiation

Once you are registered, open the MPIGR portal, and enter your user name and password. Choose your preferred language (Hindi or English), and click on the login button.

On the new page, click on Registration process > Registration Initiation > Initiate registration application.

On the next screen, select the relevant deed category from the available drop-down menu.

Next, select the relevant instrument/document.

Fill in the consideration amount for the calculation of the duty. Also, check the boxes that may be applicable in your case.

If you have not done property valuation in the current financial year, click on ‘No’ to generate a valuation ID. If you already have a valuation ID, click on ‘Yes,’ enter the ID number, and click on the ‘Validate’ button to verify the ID.

If your valuation ID is validated, relevant property details will appear on the screen. Click on ‘Next’ to proceed.

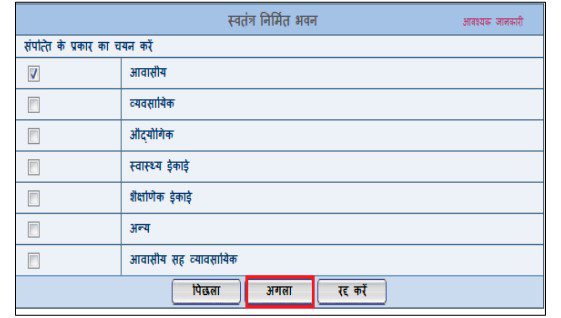

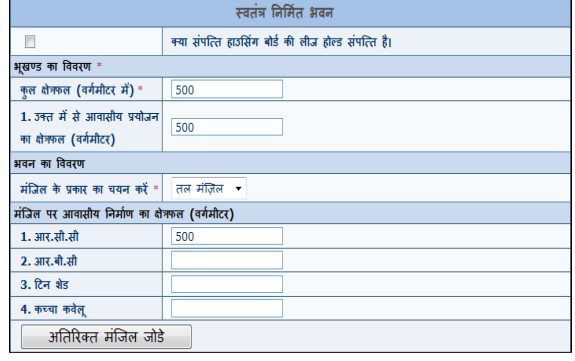

On the next page, select the relevant district, tehsil, area type (rural or urban), sub-area type, ward/patwari halka from the sub-area type of tehsil, village/colony under the ward, and property (plot, building or agriculture land).

Below we are using a sample flow for building transactions. Fill in all the details, and check the applicable boxes.

Once all the steps are complete, provide the buyer details.

Upload all the mandatory documents like ID proof, photograph, PAN card, etc. A similar process must be followed to fill in seller details and property details.

Following this, initiate the stamp duty payment process.

Also read all about IGRS Madhya Pradesh

MPIGR registration journey at a glance

To help first-time users navigate the online property registration process smoothly, here’s a quick visual flow of key steps on the MPIGR SAMPADA portal:

Step 1: User login: Create an account on the MPIGR portal or log in using your credentials.

Step 2: Property valuation: Generate or validate a valuation ID by providing basic property details. This will auto-fill key parameters for stamp duty calculation.

Step 3: Document upload: Upload all required documents including ID proof, property photographs, PAN card (if applicable), and khasra/diversion documents (for agricultural land).

Step 4: Stamp duty and fee payment: Use the payment gateway to pay the calculated stamp duty and registration fee online.

Step 5: Slot booking: Choose a convenient time slot to visit the sub-registrar office for biometric verification and final deed presentation.

Step 6: Physical visit: Visit the sub-registrar office on the booked date. Biometrics and photographs of the buyer/seller are taken, and the final deed is submitted for registration.

How to verify E-stamp on MPIGR website (MPIGRS)?

Step 1: Go to the official website, https://www.mpigr.gov.in/#/home.

Step 2: On the home page, the option of ई स्टाम्प सत्यापन will appear. Click on it.

Step 3: On the next page, fill E-stamp ID, captcha, choose language and hit Search to verify e-stamp on the MPIGR website.

MPIGR contact details

Helpdesk for e-registration

Toll-free number: 18002333842

Other numbers: 0755-2573849, 0755-2573846, 0755-2573852

See also: Bhopal Pin code

Stamp duty in Madhya Pradesh

| Property owner | Stamp duty rate (percentage of the property cost) | Registration charge (percentage of the property cost) |

| Male | 9.5% | 3% |

| Female | 9.5% | 3% |

| Male and Female | 9.5% | 3% |

| Male and male | 9.5% | 3% |

| Female and female | 9.5% | 3% |

Source: MPIGR

See also: All about land record terms

Must-know facts

What is MPIGR?

Every state in India has an Inspector-General of Registration and Stamps (IGRS), who is responsible for levying taxes on all property-related transactions. The IGRS is also responsible for keeping records of all the property transactions in the state.

The MPIGR is Madhya Pradesh’s state authority, which levies stamp duty and registration charges on all property-related transactions. The MPIGR also acts as the single biggest repository of land and property record-keeping in Madhya Pradesh.

See also: All you need to know about Dharitree

Registration and stamps department Madhya Pradesh

The MPIGR comes under the Madhya Pradesh Registration and Stamps department. The MPIGR oversees property registrations throughout Madhya Pradesh through its 233 sub-registrar offices.

Check out: Gwalior

MPIGR responsibilities

In the sub-registrar offices under the MPIGR, you can get your property-related documents registered, search for any registered documents, and apply for copies of such documents.

See also: All you need to know about Punjab land records

Sub-registrar office under MPIGR

There are 51 district registrar offices and 233 sub-registrar offices in Madhya Pradesh. All these offices work under the control of Bhopal-headquartered MPIGR.

See also: All about CG Bhuiyan

MPIGR SAMPADA

SAMPADA is the web-enabled digital project by MPIGR for registration of documents in Madhya Pradesh.

MPIGR service provider

The MPIGR gives licenses to service providers, mainly authorised collection centres (ACCs), banks and financial institutions, to sell e-stamps for online registration of property. The MPIGR service provider application can be submitted on the SAMPADA platform.

Know about: Jabalpur, Madhya Pradesh

FAQs

What is the full form of MPIGR?

MPIGR is the short form for the Madhya Pradesh Inspector-General of Registration.

What is the stamp duty rate in Madhya Pradesh?

Buyers in Madhya Pradesh have to pay 9.5% stamp duty on property registrations.

What is e-Stamp?

E-stamp or electronic stamp means an electronically generated impression on paper, issued from the electronic stamping system, to denote the payment of stamp duty or any such amount that would have otherwise been paid as an impressed or adhesive or franked stamp.

How many reginal offices are there under the Deputy Inspector-Generals of Registration in Madhya Pradesh?

The department has four regional offices located in Bhopal, Gwalior, Jabalpur and Indore working under the Deputy Inspector-Generals of Registration.

How many district registrar offices and sub-registrar offices are there in Madhya Pradesh?

There are 51 District Registrar offices and 233 Sub-Registrar offices in the state.

Do I have to visit sub-registrar’s office in Madhya Pradesh after paying online stamp duty for property registration?

Yes, while any registered user can start online presentation of documents for registration, they have to visit the sub-registrar’s office at an appointed time where photographs of the parties concerned are captured by web-camera and thumb impressions are taken by bio-metric device.

What facilities are available on the SAMPADA portal?

On the SAMPADA portal, facilities such as valuation of property, calculation of stamp duty and registration fee chargeable on different types of documents and slot booking in the office of the sub-Registrars are available.