After a strong comeback in 2022, the growth momentum in India’s retail sector continues to stay strong in 2023, shows JLL India’s latest report India Retail: Evolving to a new dawn.

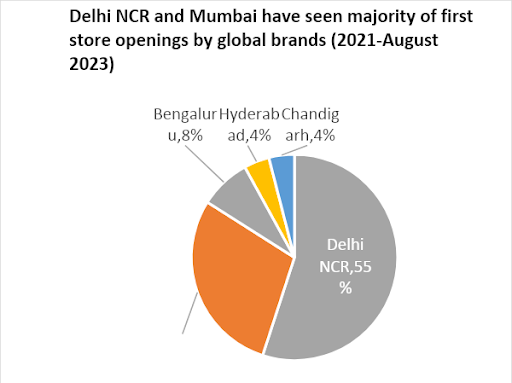

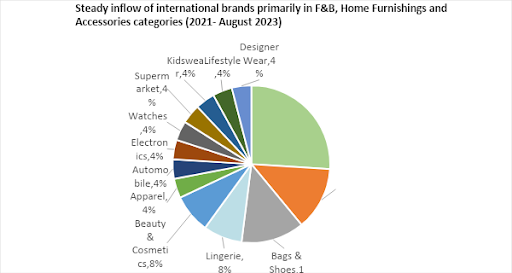

According to the report, increased consumption, rising institutional participation, strategic partnerships of Indian retail chains and a supportive regulatory environment are making India a lucrative destination for global brands— 24 new international brands have entered India since 2021, making a beeline for mall developments in the gateway cities of Delhi-NCR, Mumbai and Bangalore. Nearly a quarter of these new entrants were in the F&B category.

Source: JLL India

Source: JLL India

The report finds that while omnichannel retail is increasingly becoming important, physical stores still play a vital role in providing experiential shopping and social connect experiences to consumers. The operational retail stock as of H1 2023 in the top seven cities (Delhi NCR, Mumbai, Pune, Bangalore, Kolkata, Chennai and Hyderabad) stands at 89 million square foot (msf). More than 50% of the current operational mall stock lies in Delhi NCR (28 msf) and Mumbai (17 msf). Mall completions of around 1.1 msf were recorded in H1 2023, with additions in Hyderabad and Delhi NCR.

Rahul Arora, head of office leasing advisory and retail services, India, JLL, said, “India’s retail sector is on an elevated growth curve where the focus is on creating an innovative built environment, greater connections with the consumers and curating physical storefronts in untapped regions of the country including tier II and III cities. The shopping mall stock which stands at 89 msf as of H1 2023 is expected to increase by around 43% to reach 127 msf by the end of 2027. With India’s first retail REIT launched recently, the developers will focus on upgrading their retail assets by churning tenant mix, incorporating entertainment, leisure and F&B avenues. Investments into new-age technology and improved user interfaces to appeal to a more tech-savvy, millennial generation are also being undertaken as part of a refreshed brand experience.”

Gross leasing across the top seven cities (in shopping malls and leading high streets) stood at 3.16 msf in H1 2023, indicative of consumer confidence translating into expansion by retailers. Bangalore led with a 34% share followed by Delhi NCR (23%) and Hyderabad (19%). Fashion and Apparel and F&B brands have dominated the H1 leasing activity.

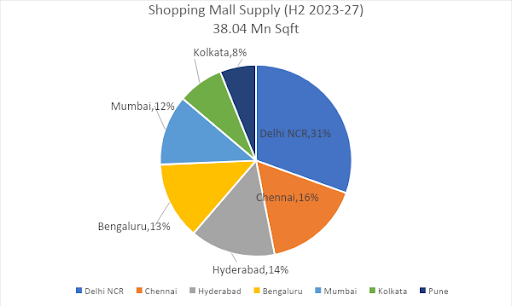

Dr Samantak Das, chief economist and head of research and REIS, India, JLL, said, “In a big boost to physical retail, prominent developers, global conglomerates and institutional investors have been at the forefront of announcing and launching quality retail developments. The physical retail space segment has an expected supply pipeline of over 38 msf of retail developments between H2 2023 and 2027, across the top seven cities. Delhi NCR is expected to lead in contribution towards upcoming mall supply with a 31% share, followed by Chennai (16%) and Hyderabad (14%). Around 18% of this upcoming supply (approximately 6.7 msf) has institutional participation.”

Source: JLL India

The maiden listing of India’s first Retail REIT has offered the opportunity for retail investors to own a stake in the retail asset class. Listing of real estate assets through REITs has infused greater transparency in transaction and management structures. The existing retail stock across the top seven Indian cities offers a potential of approximately 43-44 msf of REIT-worthy retail assets, of which more than half are in Mumbai and NCR-Delhi region.

With a quality supply pipeline and new malls announced by established developers, the Indian retail sector is expected to attract more institutional investment. The report states that tier I cities continue to attract the maximum investor interest, however, 30% of the institutionally held assets are in tier II and tier III cities such as Amritsar, Chandigarh, Ludhiana and Mohali in North, Mysore and Mangalore in South, Surat in West, Bhubaneswar in East and Indore and Nagpur in Central India.

Housing News Desk is the news desk of leading online real estate portal, Housing.com. Housing News Desk focuses on a variety of topics such as real estate laws, taxes, current news, property trends, home loans, rentals, décor, green homes, home improvement, etc. The main objective of the news desk, is to cover the real estate sector from the perspective of providing information that is useful to the end-user.

Facebook: https://www.facebook.com/housing.com/

Twitter: https://twitter.com/Housing

Email: [email protected]