As Mumbai is one of the most expensive property markets in the world, buyers must factor in all the allied costs before moving ahead with a property purchase plan. Among these costs, stamp duty and registration charges add significantly to the home purchase amount. Buyers must know how much money is to be paid during property registration.

What is stamp duty?

Stamp duty is a tax imposed by states in India on various property transactions. A major source of state income, stamp duty is imposed at the time of the registration of legal instruments such as sale deed, gift deed, exchange deed, partition deed, lease deed, relinquishment deed, etc. Being a local levy, stamp duty differs from one state to another.

What is registration fee?

Buyers are also expected to pay a registration fee for the documentation work. Typically lower than the stamp duty, registration fee is around 1% of the stamp duty in most states.

Metros cess on property purchase in Mumbai

Starting from April 1, 2022, the Maharashtra government has imposed a 1% metro cess along with stamp duty on property purchase in Mumbai, Pune, Thane and Nagpur. The purpose of this new fee is to gather funds for the development of transportation infrastructure projects. As a result of this metro cess, stamp duty and registration charges in Mumbai have increased to 7%. In Pune and Nagpur, the stamp duty has gone up from 7% due to the introduction of the metro cess.

Stamp duty and registration fee in Mumbai in 2024

| Area | Stamp duty for men | Stamp duty for women | Registration fee |

| Within the municipal limits of any urban area | 6% | 5% | 1% |

| Within the limits of a municipal council/ panchayat/ cantonment of any area within MMRDA | 4% | 3% | 1% |

| Within the limits of a gram panchayat | 3% | 2% | 1% |

Area-wise stamp duty in Mumbai in 2024

| Area | Stamp duty | Registration fee |

| South Mumbai | 5%+1% metro cess | 1% |

| Central Mumbai | 5%+1% metro cess | 1% |

| Western Mumbai | 5%+1% metro cess | 1% |

| Harbour | 5%+1% metro cess | 1% |

| Thane | 5%+1% metro cess | 1% |

| Navi Mumbai | 5%+1% metro cess | 1% |

Registration charges in Mumbai in 2024

| Buyer | Registration fee |

| Male | Property value below Rs 30 lakh: 1%

Property above Rs 30 lakh=Rs 30,000 |

| Female | |

| Joint |

While buyers have to pay 1% of the property cost as the registration charge on properties worth over Rs 30 lakh, the registration amount is capped at Rs 30,000 for properties worth less than that.

Unlike many states, where women buyers are offered a lower rate, women buyers have to pay the same rate as men, for Mumbai stamp duty and registration charges. This is because Maharashtra uses a uniform rate, irrespective of the gender of the person on whose name the property is being registered.

Stamp duty of resale flat in Mumbai 2024

| Areas in Mumbai | Stamp duty in Mumbai for men | Stamp duty in Mumbai for women | Registration charges |

| Within the municipal limits of any urban area | 6% of property’s market value | 5% of property’s market value | 1 % of the property value |

| Within the limits of any municipal council/ panchayat/ cantonment of any area within MMRDA | 4% of property’s market value |

3% of property’s market value |

1 % of the property value |

| Within the limits of any gram panchayat | 3% of property’s market value | 2% of property’s market value | 1 % of the property value |

Stamp duty on key deed in Mumbai in 2024

| Name of deed | Stamp duty rate |

| Gift deed stamp duty Mumbai and other parts of Maharashtra | 3% |

| Gift deed stamp duty for residential/agricultural property passed on to family members | Rs 200 |

| Lease deed | 5% |

| Power of attorney | 5% for property located in municipal areas, 3% for property located in gram panchayat areas. |

How is stamp duty calculated in Mumbai?

Buyers have to pay the stamp duty based on the transaction value as specified in the sale agreement. Note here, that a property cannot be bought or sold below the government-prescribed ready reckoner (RR) rates in Mumbai. This means, the property value must be calculated based on the current RR rates and the stamp duty must be calculated accordingly. In case the house is being registered at a value higher than the RR rate, the buyer will have to pay the stamp duty on the higher amount. If the property is being registered at a value less than the RR rates, the stamp duty will be calculated as per the ready reckoner rates.

Mumbai stamp duty calculation example

Suppose you are buying a property of carpet area of 800 sq ft in an area where the RR rate is Rs 5,000 per sq ft. The RR-based value of the property would be 800 x 5000 = Rs 40 lakh.

If the property is being registered at Rs 40 lakh, the buyer will pay 2% of this amount as stamp duty, i.e., Rs 80,000.

If the property is being registered at an amount lower than that, the buyer will still have to pay 2% of Rs 40 lakh as stamp duty, as the property cannot be registered below the RR rate.

If the property is being registered at Rs 50 lakh, the buyer will have to pay 2% of Rs 50 lakh as stamp duty, i.e., Rs 1 lakh.

Documents for property registration in Mumbai

- Agreement to sale

- Sale deed

- Encumbrance certificate

- Property tax receipts

- No-objection certificate

- Power of Attorney, if applicable

- Stamp duty and registration fees payment proof

- Occupancy certificate for new buildings

- Completion certificate for under-construction buildings

- TDS deduction certificate (applicable on properties worth over Rs 50 lakh)

- PAN Card of buyer

- PAN Card of seller

- Aadhaar card of seller

- Aadhaar card of buyer

- Passport size photos of buyer and seller

- ID proof of buyer

- ID proof of seller

- ID proof of witnesses

- Address proof of buyer

- Address proof of seller

- Address proof of witnesses

Factors affecting stamp duty and registration in Mumbai

In Mumbai, several factors can influence the stamp duty and registration charges applicable to a property transaction:

Property type: The stamp duty and registration charges may vary based on the type of property involved. Residential properties, for instance, might attract different stamp duty rates compared to commercial properties.

Property location: The location of the property plays a significant role in determining stamp duty and registration charges. Different regions within Maharashtra may have distinct stamp duty rates and regulations.

Property value: The charges for stamp duty and registration may be calculated based on the property’s value. Typically, the stamp duty on a property sale is a percentage of the property’s selling price.

Ownership type: The type of ownership can also impact the stamp duty and registration charges. For example, properties owned by companies may incur higher stamp duty compared to those owned by individuals.

How to pay stamp duty online in Mumbai?

Home buyers can pay stamp duty and registration charges for property registration online in Mumbai, as the state allows e-payment of stamp duty.

The payment of stamp duty and registration fee can be done through the Maharashtra stamp and registration departments, Government Receipt Accounting System (GRAS).

Users can log on to the website, https://gras.mahakosh.gov.in, provide all the property and personal details and make the online payment using various channels.

Here is a step-by-step process to do that:

Step 1: Select the ‘Pay Without Registration’ option, if you are not a registered user. A registered user can key in the login details to proceed.

Step 2: If you choose the ‘Pay Without Registration’ option, a new page will appear where you have to select ‘Citizen’ and select the type of transaction.

Step 3: Select ‘Make Payment to Register your Document’. You have the option to pay stamp duty and registration charges together or separately.

Step 4: Key in all the required fields to proceed. This would require filling in of the district, the sub-registrar’s office, property details, transaction details, etc.

Step 5: After selecting the payment option, proceed with the payment. After this, an online receipt will be generated. This document must be presented at the sub-registrar’s office at the time of the property registration.

See also: Price trends in Mumbai

How to pay stamp duty offline in Mumbai?

To pay Mumbai stamp duty offline, you can follow these methods:

Obtain stamp papers from authorised vendors

In this payment method, you need to buy stamp papers of the necessary value from a licenced stamp vendor for your transaction. This is applicable when the value of the stamps is below Rs 50,000.

Franking

Authorised banks in India offer franking services where they affix a denomination or stamp on property purchase documents. This serves as evidence that the stamp duty for the transaction has been duly paid.

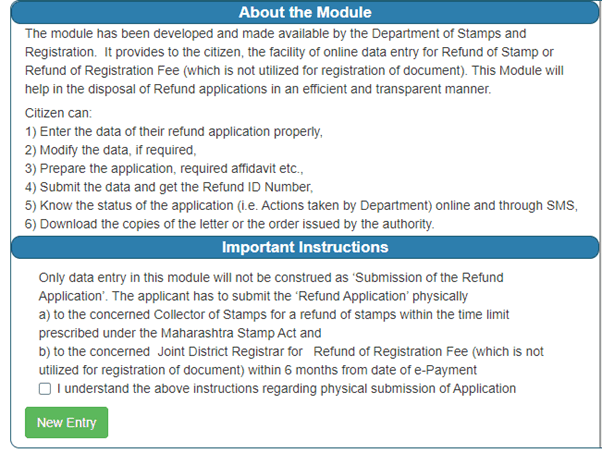

How to apply for stamp duty refund in Maharashtra online?

Step 1: Log on to https://appl2igr.maharashtra.gov.in/refund/

Step 2: Agree to the terms and conditions by clicking on check box. Next, click on New Entry.

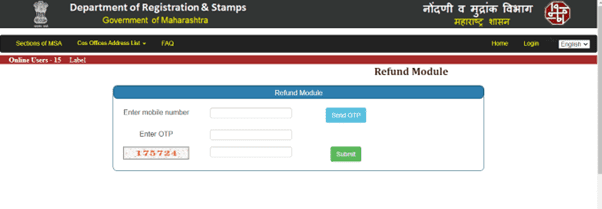

Step 3: Enter mobile number, OTP, captcha and click on submit.

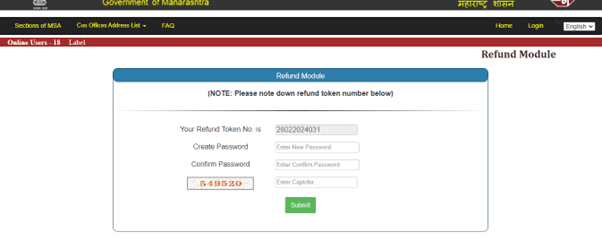

Step 4: You will see refund token number. Create password, confirm password, enter captcha and click on submit.

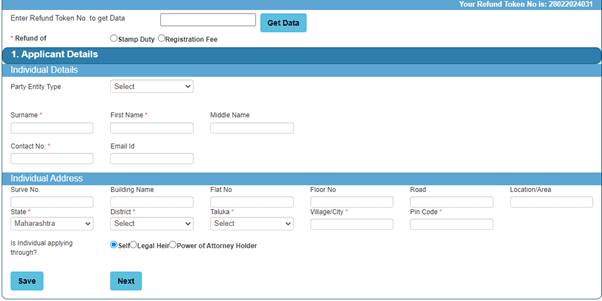

Step 5: Next click on whether you want to get old data or no.

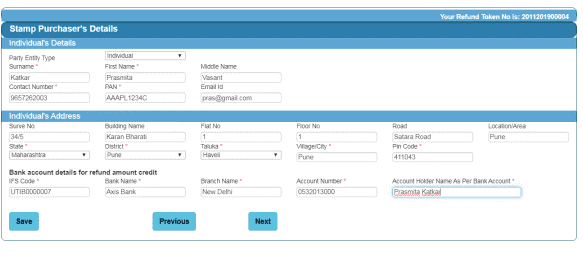

Step 6: Enter refund token number, select on refund as stamp duty and fill all individual details and address and proceed.

Step 7: Next enter stamp purchaser’s details including bank account details where the amount will be refunded.

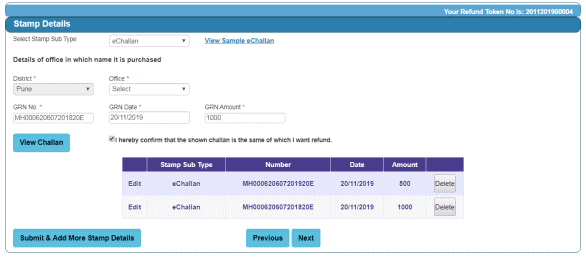

Step 8: This should be followed by stamp details.

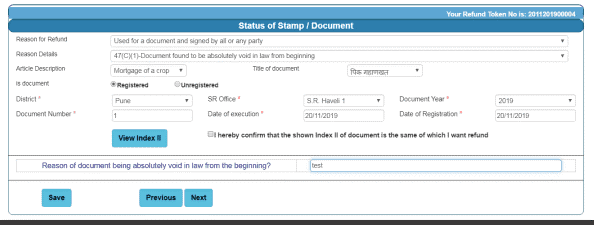

Step 9: Enter the reason for the stamp duty refund and select if the document is registered or not registered.

Step 10: Next upload documents and proceed. Once you follow these steps, you will get an acknowledgment receipt.

How to view status of stamp duty refund in Mumbai?

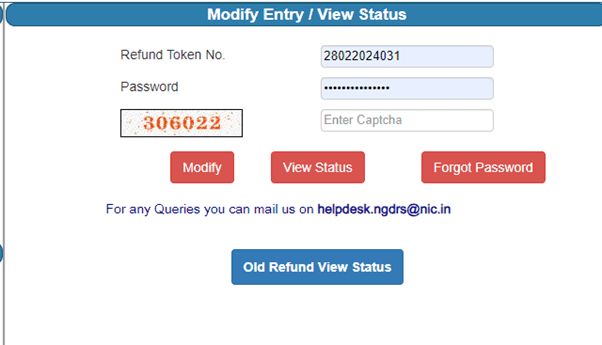

Step 1: Log on to https://appl2igr.maharashtra.gov.in/refund/

Step 2: Enter the refund token number, the password, the captcha and click on view status. If you want to modify something, click on the modify option.

Step 3: Click on View Status.

News update

Maharashtra govt extends stamp duty amnesty scheme till June 30, 2024

In a move to increase revenue generation, the Maharashtra government has decided to extend its stamp duty amnesty scheme for the third time until June 30, 2024. Named the Mudrank Shulakh Abhay Yojana, the scheme was introduced in December 2023 to encourage homebuyers to settle outstanding stamp duty dues.

Under the scheme, the state government will exempt the entire stamp duty fee and penalty imposed on property documents registered or not registered between January 1, 1980, and December 31, 2020. This includes properties under Mhada, Cidco or even the SRA.

According to the Inspector-General of Revenue, Maharashtra, a full waiver is granted for all properties with stamp duty and penalty amount up to Rs 1 lakh. For all properties with stamp duty and penalty above Rs 1 lakh, a 50% waiver on stamp duty and a 100% waiver on penalty is granted.

Conclusion

Maharashtra has been a front-runner state when it comes to stamp duty reforms. Over the past decades, the state government has been launching several schemes from time to time to make property purchases in the state, especially the capital city Mumbai, easier by way of reducing stamp duty rates, correcting registration fee and announcing amnesty schemes. This is one reason why stamp duty earned on property registration in Mumbai is one of the highest seen by any metropolitan city in India. The process of property registration has also been simplified to offer better standards of ease of doing business. However, for the final verification of documents, the buyer and the seller along with two witnesses must witness the sub-registrar’s office on a pre-booked slot. That way, property registration in Mumbai has yet to become entirely online.

FAQs

What is the rate of stamp duty in Mumbai?

The stamp duty rate in Mumbai is 6%.

How is stamp duty calculated on flats in Mumbai?

Stamp duty is calculated, based on the property value as mentioned in the sale agreement. However, note that a property cannot be registered below the RR rates in the city.

How can I pay stamp duty and registration fees online in Mumbai?

Users can visit the Maharashtra government’s Government Receipt Accounting System (GRAS) website, to make the online payment.

When is the stamp duty payable in Mumbai?

The stamp duty on property in Mumbai is payable before execution of the document or on the day of execution of document or on the next working day of executing such a document. Execution of the document means putting signature on the instrument by the person’s party to the document.

Whose name should property stamp papers bear, the buyer, the seller or the lawyer?

The stamp should be purchased in the name of any of the parties who are printing the document. The stamp should not be purchased in the name of the lawyer or the third party.

Who pays stamp duty on property registration in Mumbai, buyer or seller?

The buyer is responsible for paying the stamp duty and registration fee on registration of sale deed.

Who pays the stamp duty on gift deed registration in Mumbai, the doner or the donnee?

The donor pays the stamp duty on gift deed registration in Mumbai.

What address for the property details be given when paying stamp duty?

It must be the address of the property for which the stamp duty is being paid.

What if the Sub-Registrar Officer is not able to view the details of payment?

When the Government Receipt No (GRN) and Challan Identification No (CIN) are generated, the transaction is complete from bank. The SROs are provided with Help Line Numbers to take technical support from their IT department, under such circumstances.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]