While buying a house in Maharashtra, one has to pay the stamp duty and registration fee to register the property in the government records. This is over and above the cost of the property. A homebuyer has to pay stamp duty before execution of the document, the next day, or on the day when the document is executed.

If you are planning to buy a property in Maharashtra, this guide is for you. Mentioned below are details about the stamp duty and registration charges in Maharashtra including how to pay it online, offline and how you can opt for a stamp duty refund.

What is stamp duty in Maharashtra?

An indirect tax paid to legally register a property in Maharashtra (urban and rural) is known as the stamp duty and registration charges in Maharashtra. This has to be paid by residential, commercial, industrial, agricultural and non-agricultural land among others. Registration charges are paid to register the property.

This is charged under the Maharashtra Stamp Act and can be paid online and offline and is unchanged from 2022.

Under the Maharashtra Stamp Act also known as Bombay Stamp Act 1958, every property owner in the state has to pay the Maharashtra stamp duty and registration charges.

Recent amendments in the Act include a Maharashtra stamp duty revision in the following:

- gift deed stamp duty Mumbai

- inclusion of e-payment of stamp duty Maharashtra

- Maharashtra stamp duty revision of penalty clauses

- increase in stamp duty in Maharashtra under certain instrument clauses.

Stamp duty and registration charges in Maharashtra in 2025

The stamp duty is calculated based on the ready reckoner rate in Maharashtra. Thus, the stamp duty depends on the location of the property.

| Areas in Mumbai | Stamp duty in Mumbai for men | Stamp duty in Mumbai for women | Registration charges |

| Within the municipal limits of any urban area | 6% of property’s market value | 5% of property’s market value | 1% of the property value |

| Within the limits of any municipal council/ panchayat/ cantonment of any area within MMRDA | 4% of property’s market value | 3% of property’s market value | 1% of the property value |

| Within the limits of any gram panchayat | 3% of property’s market value | 2% of property’s market value | 1% of the property value |

See also: All about Maharashtra rent agreement stamp duty and registration laws

Stamp duty and registration charges in Mumbai

| Area | Stamp duty (male) | Stamp duty

(female) |

Registration charge |

| South Mumbai | 5% (+1% metro cess) | 4% (+1% metro cess) | 1% or Rs 30,000 for properties above Rs 30 lakh

|

| Central Mumbai | 5% (+1% metro cess) | 4% (+1% metro cess) | 1% or Rs 30,000 for properties above Rs 30 lakh

|

| Western Mumbai | 5% (+1% metro cess) | 4% (+1% metro cess) | 1% or Rs 30,000 for properties above Rs 30 lakh

|

| North Mumbai | 5% (+1% metro cess) | 4% (+1% metro cess) | 1% or Rs 30,000 for properties above Rs 30 lakh

|

Stamp duty and registration charges in different areas of Maharashtra in 2025

| City | Stamp duty rates applicable for men | Stamp duty rates applicable for women | Registration charges |

| Thane | 7% (includes 1% metro cess, local body tax and transport surcharge) | 6% (includes 1% metro cess, local body tax and transport surcharge) | Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh |

| Navi Mumbai | 7% (includes 1% metro cess, local body tax and transport surcharge) | 6% (includes 1% metro cess, local body tax and transport surcharge) | Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh |

| Pune | 7% (includes 1% metro cess, local body tax and transport surcharge) | 6% (includes 1% metro cess, local body tax and transport surcharge) | Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh |

| Pimpri-Chinchwad | 7% (includes 1% metro cess, local body tax and transport surcharge) | 6% (includes 1% metro cess, local body tax and transport surcharge)

|

Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh |

| Nagpur | 7% (includes 1% metro cess, local body tax and transport surcharge) | 6% (includes 1% metro cess, local body tax and transport surcharge) | Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh |

|

Nashik |

7% (includes 1% metro cess, local body tax and transport surcharge) | 6% (includes 1% metro cess, local body tax and transport surcharge) | Rs 30,000 for properties above Rs 30 lakh

1% of property value for properties below Rs 30 lakh |

Stamp duty Maharashtra 2025 on different conveyance deeds

| Conveyance deed | Stamp duty rate |

| Gift deed stamp duty Mumbai and other parts of Maharashtra | 3% |

| Gift deed stamp duty for residential/agricultural property passed on to family members | Rs 200 |

| Lease deed | 0.25% of total rent |

| Power of attorney | 5% for property located in municipal areas, 3% for property located in gram panchayat areas. |

See also: Everything about land survey maps online Maharashtra

Rebates on stamp duty in Maharashtra in 2025

Mentioned below are rebates on stamp duty in Maharashtra.

Stamp duty on Senior living housing

Under the Maharashtra Housing Policy 2025 that was announced in May 2025, the buyers of senior living housing in the state have to pay a flat fee of Rs 1,000 as stamp duty for the property. Before this rebate, the stamp duty was around 5% to 7% of the property’s value depending on the location of the property.

Stamp duty in Maharashtra for redeveloped housing projects

Under section 4 (1) of the Maharashtra Stamps Act, Rs 100 will be charged as stamp duty for all Permanent Alternative Accommodation Agreements (PAAAs) of redevelopment projects. Society members have to pay stamp duty as per free area for the additional carpet area they may ask for.

Maharashtra stamp duty revision for women

The Maharashtra government offers a stamp duty rebate of 1% for women homebuyers in the state. To substantiate that property is registered under a woman’s name and avail the rebate, one has to submit the sale deed.

Do slum rehabilitation projects have to pay stamp duty?

According to the Maharashtra Housing Policy 2025, to protect the rights of the slum dwellers in a slum rehabilitation authority (SRA) project, registration of an agreement between slum dweller and developer with minimum stamp duty is compulsory.

What is the stamp duty for registered will in Maharashtra?

In case of inheritance through a will, once the person who has written the will dies, no stamp duty has to be paid in any state in India.

What are the factors on which stamp duty Maharashtra 2025 is calculated?

| Age | Senior citizen may have a rebate in stamp duty |

| Gender | Stamp duty for women in Maharashtra is less than that for men |

| Property age | Old property – low stamp duty

New property- comparatively high stamp duty |

| Property type | Stamp duty for residential property is less than commercial property |

| Locality | Stamp duty in posh areas more than stamp duty of affordable area (based on RR rate) |

| Market value | More market value means more stamp duty to be paid |

How to calculate stamp duty and registration charges in Maharashtra?

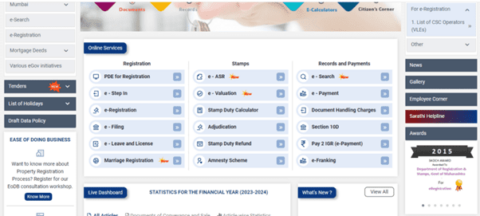

To know the approximate stamp duty to be paid, you can use the stamp duty calculator under stamps section on the IGR Maharashtra website and you will be led to the next page.

Choose from the options for which you need to calculate the stamp duty.

For instance, if you want to know stamp duty to be paid in Mumbai on sales deed, then click on sales deed and you will be led to the following page.

Click on municipal corporation, you will be led to the following page.

On clicking on Mumbai municipal corporation, you will reach.

Where you have to enter the consideration value and market value and click on submit and you will get the approximate stamp duty value to be paid.

Example

If the ready reckoner rate for the flats in the Bandra is Rs 85,000 per sqft, the minimum value of a 1,000 sqft flat in the Bandra will be around Rs 8,50,00,000. Thus, the total stamp duty in Mumbai including local taxes is Rs 42,50,000.

How to pay stamp duty and registration charges in Maharashtra online?

Stamp duty and registration charges in Maharashtra can be paid through e-stamping. Payment can be paid via RTGS or NEFT.

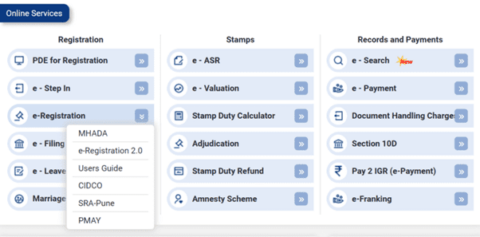

Step 1: Visit the Maharashtra Stamp Duty online payment portal.

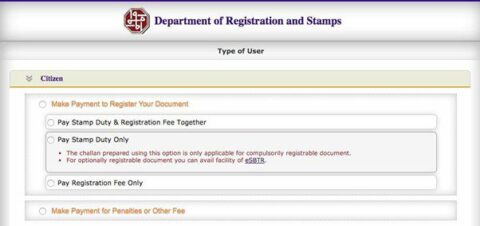

Step 2: Click ‘Pay Without Registration’ if you are not registered with the Maharashtra stamp duty portal. If you are a registered user, fill in the login details on the Maharashtra stamp duty portal.

Step 3: If you have selected the ‘Pay Without Registration’ option, you will be redirected to another page on the stamp duty in Maharashtra portal, where you have to choose ‘Citizen’ and select the type of transaction you want to do.

Step 4: Choose ‘Make Payment to Register your Document’. Now, you can opt for paying the stamp duty and registration charges together, or stamp duty only, or registration charges only.

See also: All about Vasai virar property tax

Step 5: Fill in the details as required such as district, sub-registrar’s office, payment details, party details, property details and property value details in the stamp duty and registration charge website.

Step 6: Choose the payment option for stamp duty

Step 7: Choose the payment option for stamp duty and registration charges payment and proceed once done, generate the challan from the stamp duty and registration charge website, which has to be presented at the time of execution of the deed.

If you are stuck at any step or you want to generate your challan again, you can drop a mail to vtodat.mum-mh@gov.in.

Home registration charges in Maharashtra

The property or home registration charges in Maharashtra is 1% of the total cost for the properties priced below Rs 30 lakh and capped at Rs 30,000 for properties priced above Rs 30 lakh.

Example

If an apartment in Maharashtra is being sold for Rs 60 lakh, the home registration charges will be Rs 30,000 as the land value is above Rs 30 lakh. However, if the value of a property is Rs 20 lakh, the registry charges will be 1% of Rs 20 lakh that is Rs 20,000.

Maharashtra launches e-registration for property agreements

Inspector General of Registration (IGR), Maharashtra has officially launched the online e-registration of property agreements. With this, there is no need to make physical visits to sub-registrar offices (SROs) for registration. Under the new system, all key steps such as agreement drafting, Aadhaar-based e-KYC, biometric verification, payment of stamp duty and registration charges and final agreement registration are executed securely through a digital platform.

The digital workflow significantly speeds up approvals and provides immediate access to digitally signed agreements, reducing paperwork and administrative delays. Built-in security features, including Aadhaar-based identity verification, biometric authentication, and encrypted data handling, maintain the integrity of every transaction. Importantly, the system supports sustainability goals by eliminating the need for paper-based documentation, thereby minimising environmental impact.

How to register your Mhada property?

If you have won a housing unit through Mhada lottery then, once you accept and pay for the property, you need to register it with the Maharashtra state government so that it is present in legal records.

- To register Mhada property, log on to https://igrmaharashtra.gov.in/Home

- Click on Mhada

- You will reach iSarita 2.0 page.

- Login as a citizen and proceed.

How to register your Cidco property?

If you have won a housing unit through Cidco lottery then once you accept and pay for the property, you need to register it with the Maharashtra state government so that it is present in legal records.

- To register Cidco property, log on to https://igrmaharashtra.gov.in/Home

- Click on Cidco

- You will reach iSarita 2.0 page.

- Login as citizen and proceed.

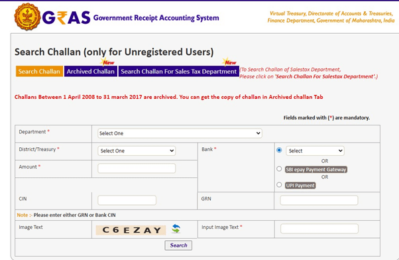

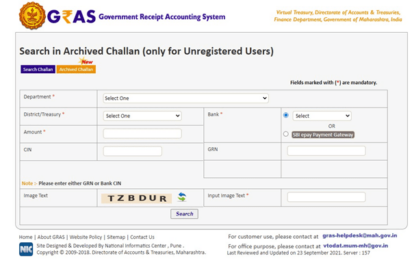

How to search challan on Mahakosh portal?

A challan is a digital receipt that confirms stamp duty payment. You can search a challan on the Mahakosh portal.

- Login to https://gras.mahakosh.gov.in/echallan/ and click on ‘Search Challan’ on the homepage.

- A new page will open where you have to enter department, district/ treasury, amount, bank, CIN, GRN, payment gateway captcha and click on search.

- Note that challans between April, 1 2008 to March 31, 2017 are archived. You can get the copy of challan by clicking on the archived challan tab.

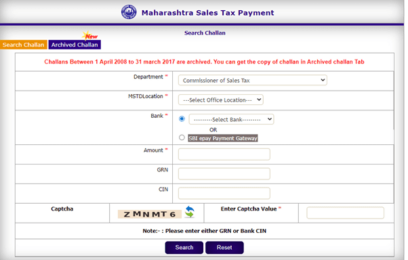

- Click on Search Challan for sales tax department if you want challan for the sales tax department.

Enter details like department, MSTD Location, Bank, Amount, GRN, CIN, Captcha and click on Search.

What are the common errors while paying stamp duty Maharashtra online?

- Wrong entry of the SRO code

- Session timeout before the challan download

- Payment failure (NEFT/RTGS delay)

Maharashtra to provide e-stamp certificates online

In a bid to streamline stamp duty and registration processes, the Maharashtra government on March 24, 2025 announced the provision of citizens obtaining e-stamp certificates online from the convenience of their homes. Maharashtra revenue minister Chandrashekhar Bawankule tabled the Maharashtra Stamp (Amendment) Bill in the legislative council and this was approved.

This will solve the biggest pain points of citizens who had to visit licensed vendors to purchase physical stamp papers since 2004. Also, the state has franking services that are only available at specific centers. As there was no seamless digital support available, people had to submit printed slips in SROs even after paying e-challans during registration. The processing fee for this service is Rs 500 and there will be no added costs. Previously to determine the stamp duty to be paid, submissions were made on plain paper.

With the digital system submissions will be made on Rs 1,000 stamp paper. In case, a person pays more than the required stamp duty, he will get a refund within 45 days. Also, in case someone has paid insufficient stamp duty, he will have to pay the outstanding promptly.

People should note that in addition to availability of this service, citizens are free to purchase traditional physical stamp papers.

How to pay stamp duty and registration charges in Maharashtra offline?

Stamp paper

Stamp duty can be paid using Stamp paper where details of the agreement are written on a paper that is signed by the authorised person once checked. After this the stamp paper is registered at the sub-registrar office after a period of four months.

Franking

In this, the stamp duty Maharashtra is paid where in the agreement is printed on a paper that is then submitted to an authorised bank. Once submitted, the documents for stamp duty payment are processed with the help of franking machine.

e-SBTR

To get an Electronic Secured Bank and Treasury Receipt (e-SBTR), visit the bank that has been approved. Once the transaction details are sent, make payment in cash, cheque or demand draft. The property document that has to be registered should be attached to the issued e-SBTR. Check out ePayment Rules.

What is the penalty for not paying stamp duty Maharashtra?

If the stamp duty in Maharashtra is not paid on time or insufficiently paid, the buyer has to pay a penalty of 1% per month on the stamp duty deficit amount. It was reduced from 2% to 1% in Maharashtra’s Interim Budget 2024-25 and a bill has been passed to this effect. The maximum penalty for delaying or not paying stamp duty will be up to 200%.

Tax benefits for paying stamp duty in Maharashtra

Under section 80C of the Income Tax Act, one can avail income tax deductions for payments against stamp duty and registration charges and cess charges. However, note that the total IT deduction under Section 80C should not be more than Rs 1.5 lakh.

Document handling fees for property registration increased by Maha govt

The Maharashtra government increased the document handling fee with immediate effect from Rs 20 to Rs 40 per page. This document handling fee has to be paid addition to the stamp duty and registration fee that a buyer has to pay at the Sub-Registrar Office (SRO) while he is registering the newly bought or acquired property.

While the stamp duty and registration fee is collected by the state government, the document handling fee is collected by the private company that operates the Maharashtra online registration system.

Important points related to stamp paper before paying Maharashtra Stamp Duty

Here are a few essential points you need to consider before paying stamp duty in Maharashtra:

- Date of the issued stamp paper must not be more than six months from the property transaction date.

- The stamp duty for all assets that are applicable should be stamped before registration or in the next working day

- The stamp paper should include individual’s name who are involved in the property transaction.

- There is an adhesive stamp on the stamp paper that has to be removed at the time of execution. This is not available for reuse.

Maharashtra government’s stamp duty amnesty scheme

The Maharashtra government in the interest of the public had extended its stamp duty amnesty scheme for the fifth time until August 20, 2025. Believed to be the last phase that started from July 21, 2025 and go on till August 20, 2025, this scheme was designed to give over 13,566 applicants a last chance to legalise their property documents.

Named the Mudrank Shulakh Abhay Yojana, the scheme was introduced in December 2023 to encourage homebuyers to settle outstanding stamp duty dues. The scheme is applicable for the First Allotment Letter or Agreement or Share Certificate issued or executed on unstamped paper or on letter head regarding residential or non-residential units by the registered co-operative housing society situated on the Mhada, Cidco or MIDC land.

Under the scheme, the Maharashtra government will exempt the entire stamp duty fee and penalty imposed on property documents registered or not registered between January 1, 1980, and December 31, 2020. This includes properties under Mhada, Cidco or even the SRA.

The scheme was launched in a phased manner: first from December 1, 2023, to January 2024, and second from February 1, 2024, to March 31, 2024 that was then extended till June 30, 2024.

For the uninitiated, stamp duty is a one-time tax that homebuyers have to pay to the state government during registration of property. If the stamp duty is not paid, it will attract penalties. In Maharashtra, for instance, a property owner has to pay a penalty on the dues at 2% per month and may total to more than 400% of the stamp duty.

Stamp duty and registration charges Maharashtra 2025: List of available banks for E-challan

|

See also: All about Satara (Maharashtra)

When can the stamp duty in Maharashtra be refunded?

- If the stamp duty paid exceeds the amount that has to be paid, the home buyer can ask for a refund. This refund can be claimed within one year from the previous timeline of 6 months from the day of payment.

- The stamp duty paper is not fit for use due to writing mistakes.

- The stamp paper is unsigned and either complete or partially filled but is intended not to be used.

- The stamp paper is signed but the transaction is found to be illegal by the party as per Section 31 of Specific Relief Act.

- The court finds the transaction to be entirely illegal since the beginning (Void/ab/initio) as per Section 31 of Specific Relief Act.

- The person whose signature is essential refuses to sign or has died before signing.

- Any party to the stamp paper document declines signing it.

- Any party to the stamp paper document does not comply with the terms and conditions.

- The value of the stamp for the document is insufficient and the transaction has been completed by using another stamp paper with the correct value.

- The stamp duty paper is spoiled and both parties have executed another stamp paper document for the same purpose.

How to get refund of stamp duty in Maharashtra?

To initiate stamp duty Maharashtra refund, it is compulsory to enter information through the online system. Once the information is fed online and a token is allotted, you have to submit the application offline. Mentioned below is the procedure in detail.

See also: All about token money, GST and stamp duty refund when a property deal is cancelled

First you have to log on to the website of IGR Maharashtra and select online services. Here, you have to click on the stamp duty Maharashtra refund application link. Alternatively, you can go to https://appl2igr.maharashtra.gov.in/refund/

Here, click on the check box on understanding the terms and conditions and click on New Entry. Enter mobile number, OTP and captcha.

Then, you will get the stamp duty Maharashtra refund token number. Now create password, confirm password, enter captcha and press ‘Submit’.

For a stamp duty Maharashtra refund, firstly one has to enter all their personal details, their bank account number and the reason for the refund. One has to enter all information about the document like if it is executed or not, registered or not etc. in the particulars of the document.

If the document is registered, and you want a stamp duty refund in Maharashtra , you have to enter the document number, date and SRO details. Likewise, cancellation deed if registered, then registration number and SRO details should be entered.

Next you have to enter particulars of the stamp including the type- whether it is e-payment, e-SBTR or franking, name of the stamp vendor along with his address, name and details of purchaser of stamp, value of stamp etc. On entering all stamp related details, an ‘Image Code’ in red will appear. You will have to mention that code in the blank frame and press on the ‘register’ button. Post this, your stamp duty in Mumbai/ stamp duty Maharashtra refund information is submitted and you will see the ‘acknowledgement‘ tab . Enter your stamp duty in Mumbai/ stamp duty Maharashtra refund token number in the application that has to be submitted to the office of collector of stamps for initiation of stamp duty refund Maharashtra.

Can you get stamp duty refund if gift deed is revoked?

Mostly, stamp duty paid on a gift deed in Maharashtra is not refundable, even if the deed is revoked later. You can apply for a stamp duty refund if the gift deed is not executed and the transaction is cancelled. This can be done within 6 months.

To know more, visit the local Sub-Registrar Office (SRO) where the gift deed was intended to be registered. If you were eligible for the refund, fill the appropriate form and affidavit and submit along with original stamp paper and proof of gift deed cancellation.

What is the notice of intimation charges in Maharashtra?

| Notice of intimation filed | Charges |

| Online | Rs 1,000 ( whatever the loan amount be) |

| Offline | Rs 300 ( by going to the SRO office) |

Stamp duty and registration charges on past property documents

- While the Maharashtra Stamp Act empowers the collector of a district, to call for documents within a period of 10 years from the registration date of such documents, to verify if the appropriate duty has been paid on the deed, the Bombay High Court has held that stamp duty cannot be collected for inadequately stamped past documents, at the time of its subsequent sale.

- Moreover, according to stamps and registration charges in Maharashtra, if the historical documents are liable to be stamped, the stamp duty shall be recovered only at the market rate prevalent when the transaction took place. Thus stamp duty and registration charge cannot be applied on a retrospective basis.

Also read all about IGR Maharashtra document search

Stamp duty and registration charges in Maharashtra 2025: Adjudication

According to Section 31 of Maharashtra Stamp Act, any person who is party in the instrument can apply to Collector of Stamps along with the instrument for his opinion about Stamp Duty applicable

Click on Adjudication under stamps on the IGRS Maharashtra page. You will reach

Here, enter username, password, captcha and login. If you don’t have username and password, click on Sign up and register first.

After login in, in this, page a person can

- Enter the data relating to his application.

- Upload the copy of instrument as well as the other proofs.

- Know the status of his application.

- Know the query / requirement and to comply it.

- To get the copies of notices and orders (if any).

Amendment in Maharashtra stamp duty and registration charges (October 2024)

The Maharashtra Stamp Act, 1958 underwent some amendments that has been effective from October 14, 2024. Mentioned below are amendments.

- Under article 4 of Maharashtra Stamp Act, the registration fee of the stamp duty document has been increased from Rs 500 to Rs 1,000.

- Stamp duty charge of Rs 200 that was collected previously under articles 52 and 58 has been revised to Rs 500.

- There are changes in instrument of partnership introduced under article 47 with minimum stamp duty of Rs 500 and maximum stamp duty of Rs 50,000.

Legal tips for home buyers before paying stamp duty Maharashtra

Paying stamp duty means getting the property legally registered in your name in the government records. But if you have been scammed and the said property is under litigation, what will you do? This can result in a heavy loss, so some basic steps should be followed.

- Check if the developer’s project is registered under Maharashtra RERA.

- Ensure that the property’s title is legally verified by checking it on the IGR Maharashtra website.

- In case of legal proofs that may be asked, keep digital receipts and challans across formats — PDF and print-ready.

- Evaluate all options of ownership of the property as Maharashtra has gender-based rebate available.

IGR Maharashtra, Aaple Sarkar and DigiLocker linked

In Maharashtra, the process of data sharing integration between many municipal corporations and IGR Maharashtra, DigiLocker and Aaple Sarkar portals is underway. Some, such as the Pimpri Chinchwad Municipal Corporation (PCMC), has completed this task. This helps in the quick and automatic updating of property records once registration is completed. This also enables the property to be transferred online. The name transfer process will now be completed within one day. Similarly, any change in a property’s use from residential to commercial will be automatically updated in the municipal corporation’s records.

Maharashtra stamp duty and registration charges: Contact information

Office of the Inspector General of Registration and Controller of Stamps,

Ground Floor,

Opposite Vidhan Bhavan (Council Hall),

New Administrative Building,

Pune 411001, Maharashtra, India

Housing.com POV

Stamp duty and registration charges have to be paid compulsorily in Maharashtra to register the property in government records. Not paying this will result in absence of ownership to the property. This will pose as a problem if the property runs into litigation as you won’t have any documents to prove ownership. To make things easy, Maharashtra offers a stamp duty rebate of 1% for women homebuyers. However, this is not applicable in case of joint registration. Also, you should know how much stamp duty you are expected to pay in case your property goes for redevelopment.

FAQs

According to the Maharashtra Stamp Act, all instruments should be stamped before or at the time of execution, or on the next working day following the date of execution. However, if the deed is executed out of the territory, it can be stamped within three months after it is first received in India.

The stamp duty Maharashtra papers must be in the name of one of the parties to the transaction and not in the name of the chartered accountant or lawyer of the parties. Also, the date of issue of the stamp paper in Maharashtra for stamp duty must not be more than six months older than the date of the transaction.

Maharashtra stamp duty can be paid by way of adhesive or impressed stamps on the deed. Additionally, the adhesive stamps used on the deed is cancelled at the time of execution so that it is not available for reuse.

For property sale documents, Stamp Duty Maharashtra is payable on whichever is higher- the consideration value of the property that is mentioned in the document or the ready reckoner rates /circle rates that are decided by the government.

Currently no such announcement has been made by the Maharashtra government. A 50% stamp duty concession for developers of integrated township projects in Thane, Navi Mumbai and Pune was announced by the Maharashtra government in 2023. However, this won’t be applicable to projects in Mumbai and Lonavala.

You can register the property in a women’s name, register under-construction property at lower undivided share and avail of tax benefits on stamp duty.

The application of refund of stamp duty can be made within two years from the date of cancellation of the sale deed.

To initiate stamp duty refund in Maharashtra, you have to enter the information online and get a token. With this token, you have to submit the stamp duty refund form offline. When should the stamp duty on gift deed in Maharashtra be stamped?

Whose name should be on the stamp duty Maharashtra papers?

How can stamp duty be paid?

What is stamp duty Maharashtra based on- ready reckoner rate or consideration value of property?

Will stamp duty be reduced in 2024 in Maharashtra for developers of integrated townships?

How can I lower stamp duty in India?

How can I get stamp duty refund stamp in Maharashtra?

How to initiate stamp duty refund?

The last date for registering properties under Maharashtra Stamp Duty Amnesty Scheme was August 20, 2025 When was the last date for registering properties under Maharashtra Stamp Duty Amnesty Scheme?

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |